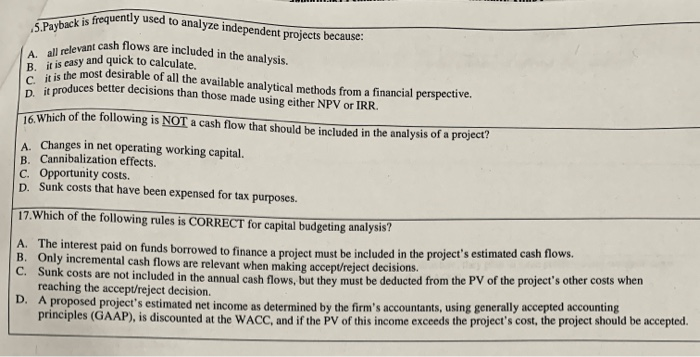

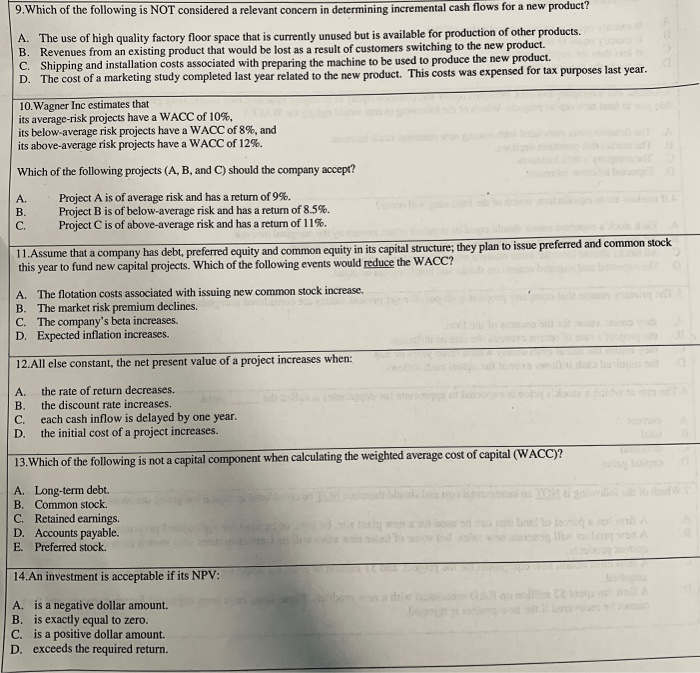

is frequently used to analyze independent projects because A. all relevant flows B. it is the most desirable of all the available analytical methods from a financial perspective tcash flows are included in the analysis. and quick to calculate. uces better decisions than those made using either NPV or IRR. 16.Which of the following is NOT a cash flow that should be included in the analysis of a project? A. Changes in net operating working capital. B. Cannibalization effects. C. Opportunity costs. D. Sunk costs that have been expensed for tax purposes. 17.Which of the following rules is CORRECT for capital budgeting analysis A. The interest B. Only incremental cash flows are relevant when making accept/reject decisions. C. Sunk costs are not included in the annual cash flows, but they must be deducted from reaching the accept/reject decision. A proposed project's estimated net income as determined by the firm's accountants, using generally accepted accounting principles (GAAP), is discounted at the WACC, and if the PV of this income exceeds the project's cost, the project should be accepted. paid on funds borrowed to finance a project must be included in the project's estimated cash flows. the PV of the project's other costs when 9.Which of the following is NOT considered a relevant concern in determining incremental cash flows for a new product? A. The use of high quality factory floor space that is currently unused but is available for production of other products. Revenues from an existing product that would be lost as a result of customers switching to the new product C. Shipping and installation costs associated with preparing the machine to be used to produce the new product. D. The cost of a marketing study completed last year related to the new product. This costs was expensed for tax purposes last year. 10.Wagner Inc estimates that its average-risk projects have a WACC of 10%, its below-average risk projects have a WACC of 8%, and its above-average risk projects have a WACC of 12%. Which of the following projects (A, B, and C) should the company accept? Project A is ofaverage risk and has a retum of9%. Project B is of below-average risk and has a return of 8.5%. Project C is of above-average risk and has a return of 1 1%. A. B. C. 11.Assume that a company has debt, preferred equity and common equity in its capital structure; they p this year to fund new capital projects. Which of the following events would reduce the WACC? and common equity A. The flotation costs associated with issuing new common stock increase. B. The market risk premium declines. C. The company's beta increases. D. Expected inflation increases. 12.All else constant, the net present value of a project increases when: the rate of return decreases. A, the discount rate increases. B. C. each cash inflow is delayed by one year. D. the initial cost of a project increases. 13.Which of the following is not a capital component when calculating the weighted average cost of capi A. Long-term debt. B. Common stock. C. Retained earnings. D. Accounts payable. E. Preferred stock 14.An investment is acceptable if its NPV: is a negative dollar amount. B. is exactly equal to zero. C. is a positive dollar amount. D. exceeds the required return. A