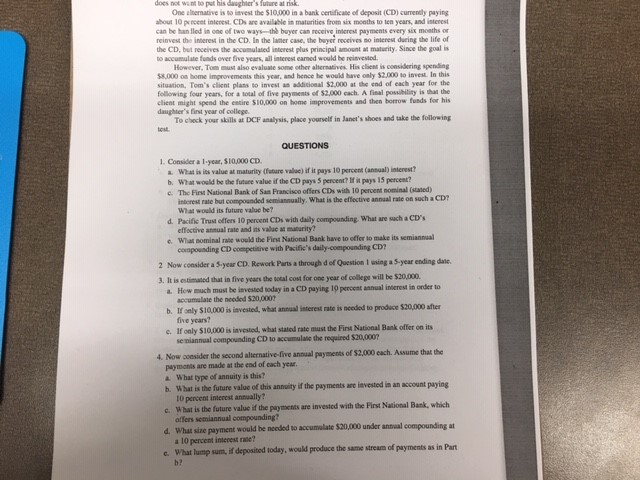

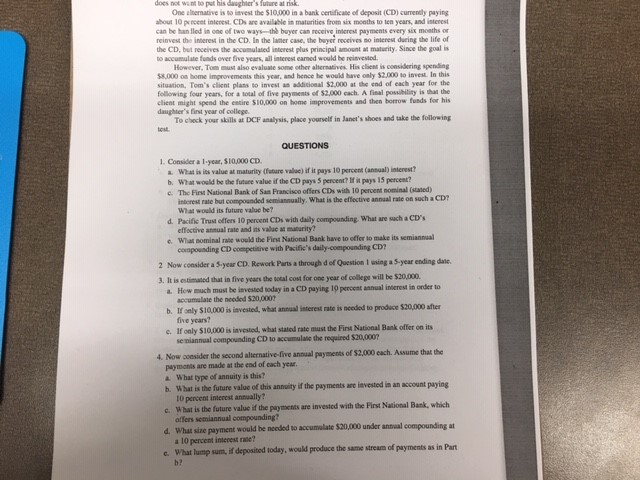

is hier's t eatrisk One m iesto svest the S10.000 in a bank certificate of deposit (CD) curelying wbout 10 et interest CDs are availae is maurities from six months to ten years, and interest can be hand is one of two ways buyer can receive interese payments every six months or vest them in the CD. In the case, the buyer receives so interest during the life of the CD, but the principal i ty. Since the goals ud over five years, and w e However, the evaluate the mat t is considering weig $8.000 home improvements this year, and hence he would have cely 52.000 iv In this situation, Tom's client plans to invest additional $2.000 the end of each year for the following four years, for a total of five payments of 52,000 each. A final pos ty is that the client might spend the entire S10,000 on home improvements and then borrow funds for his daughter's first year of college To check your DCF analysis, place yourself in Jan's shoes and take the following QUESTIONS 1. Considera l year, $10,000 CD. 2. What is its value at maturity future v e if it pays 10 percent annual interest b. What would be the future value of the CD pwys 5 percent of pays 15 percent? c. The First National Bank of San Francis offers CDs with 10 personal stated) este but compounded m y What is the effectivel e such a CD? What wo u ng wala be d. Pacific Trust offers 10 percent CDs with daily compounding. What we acha CD's effective s alate and its value w rity? c. Wat nominale would the National Bank have to offer to make its semiannual compounding CD competitive with Pacine's daily.compounding CD? 2 Now.consider a year CD Rework Parts a through of Question using a year ending date 3. Rise d that is five years the cost for one year of w e will be $20.000 How much must be invested today in a CD paying 10 percentual interest is onder to m ate the needed 5.20,000 b. Ialy $10.000 is invested, what an interest rate is needed to produce $20,000 five years? c. If only $10,000 is invested, what a re must the First National Bank offer on its seminal compounding CD the required $20,000 4. Now sider the second rative-five payments of 50.000 each. A m that the payments are made at the end of each year. What type of annuity is this? b. What is the future value of this annuity if the payments we invested in an account paying 10 percent interest annually? c. What is the future value of the payments are invested with the First National Bank, which olen pounding? 4. What sine payment would be needed to come $30,000 under compounding a 10 percent interest rate! e. What lumpsum, if deposited today, would produce the same stream of payments as in Part