Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is not exam. This is a past exam. QUESTION 3 - Total of 12 marks This question consists of 3 parts (Parts A, B, and

Is not exam.

This is a past exam.

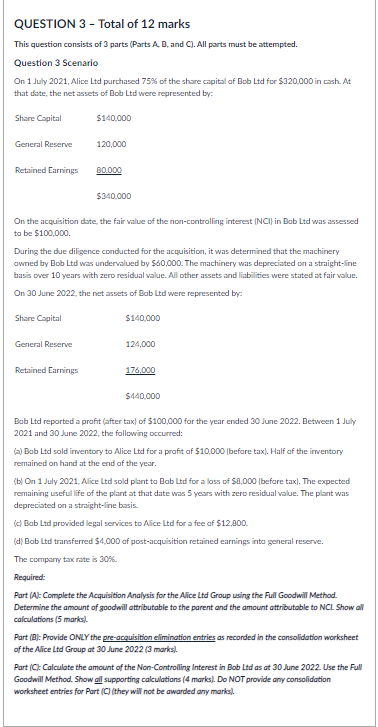

QUESTION 3 - Total of 12 marks This question consists of 3 parts (Parts A, B, and C). All parts must be attempted. Question 3 Scenario On 1 July 2021, Alice Ltd purchased 75% of the share capital of Bob Ltd for $320.000 in cash. At that date, the net assets of Bob Ltd were represented by: Share Capital $140.000 General Reserve 120,000 Retained Earnings 80,000 $340,000 On the acquisition date the fair value of the non-controlling interest INCI) in Bob Ltd was assessed to be $100,000. During the due diligence conducted for the acquisition, it was determined that the machinery owned by Bob Ltd was undervalued by $60,000. The machinery was depreciated on a straight-line basis over 10 years with zero residual value. All other assets and liabilities were stated at fair value. On 30 June 2022. the net assets of Bob Ltd were represented by: Share Capital $140,000 General Reserve 124,000 Retained Earnings 176,000 $440,000 Bab Ltd reported a profit (after tax) of $100,000 for the year ended 30 June 2022. Between 1 July 2021 and 30 June 2022, the following occurred: (a) Bob Ltd sold inventory to Alice Ltd for a profit of $10,000 (before tax). Half of the inventory remained on hand at the end of the year. (bOn 1 July 2021, Alice Ltd sold plant to Bob Ltd for a loss of $2,000 (before tax). The expected remaining useful life of the plant at that date was 5 years with zero residual value. The plant was depreciated on a straight-line basis. (d) Bob Ltd provided legal services to Alice Ltd for a fee of $12,000. (d) Bob Ltd transferred $4,000 af post-acquisition retained earnings into general reserve. The company tax rate is 30%. Required: Part (A): Complete the Acquisition Analysis for the Alice Ltd Group using the Full Goodwill Method Determine the amount of goodwill attributable to the parent and the amount attributable to NCL Show all calculations (5 marks! Part (B): Provide ONLY the pre-acquisition elimination entries as recorded in the consolidation worksheet of the Alice Ltd Group at 30 June 2022 [3 marks. Part (Ct Calculate the amount of the Non-Controlling Interest in Bob Ltd as at 30 June 2022 Use the Full Goodwill Method. Show all supporting calculations (4 marks). Do NOT provide any consolidation worksheet entries for Part (C) (they will not be awarded any marks) QUESTION 3 - Total of 12 marks This question consists of 3 parts (Parts A, B, and C). All parts must be attempted. Question 3 Scenario On 1 July 2021, Alice Ltd purchased 75% of the share capital of Bob Ltd for $320.000 in cash. At that date, the net assets of Bob Ltd were represented by: Share Capital $140.000 General Reserve 120,000 Retained Earnings 80,000 $340,000 On the acquisition date the fair value of the non-controlling interest INCI) in Bob Ltd was assessed to be $100,000. During the due diligence conducted for the acquisition, it was determined that the machinery owned by Bob Ltd was undervalued by $60,000. The machinery was depreciated on a straight-line basis over 10 years with zero residual value. All other assets and liabilities were stated at fair value. On 30 June 2022. the net assets of Bob Ltd were represented by: Share Capital $140,000 General Reserve 124,000 Retained Earnings 176,000 $440,000 Bab Ltd reported a profit (after tax) of $100,000 for the year ended 30 June 2022. Between 1 July 2021 and 30 June 2022, the following occurred: (a) Bob Ltd sold inventory to Alice Ltd for a profit of $10,000 (before tax). Half of the inventory remained on hand at the end of the year. (bOn 1 July 2021, Alice Ltd sold plant to Bob Ltd for a loss of $2,000 (before tax). The expected remaining useful life of the plant at that date was 5 years with zero residual value. The plant was depreciated on a straight-line basis. (d) Bob Ltd provided legal services to Alice Ltd for a fee of $12,000. (d) Bob Ltd transferred $4,000 af post-acquisition retained earnings into general reserve. The company tax rate is 30%. Required: Part (A): Complete the Acquisition Analysis for the Alice Ltd Group using the Full Goodwill Method Determine the amount of goodwill attributable to the parent and the amount attributable to NCL Show all calculations (5 marks! Part (B): Provide ONLY the pre-acquisition elimination entries as recorded in the consolidation worksheet of the Alice Ltd Group at 30 June 2022 [3 marks. Part (Ct Calculate the amount of the Non-Controlling Interest in Bob Ltd as at 30 June 2022 Use the Full Goodwill Method. Show all supporting calculations (4 marks). Do NOT provide any consolidation worksheet entries for Part (C) (they will not be awarded any marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started