Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an economy where aggregate output Y is produced using capital K and labour L according to the production function YKL, where is a

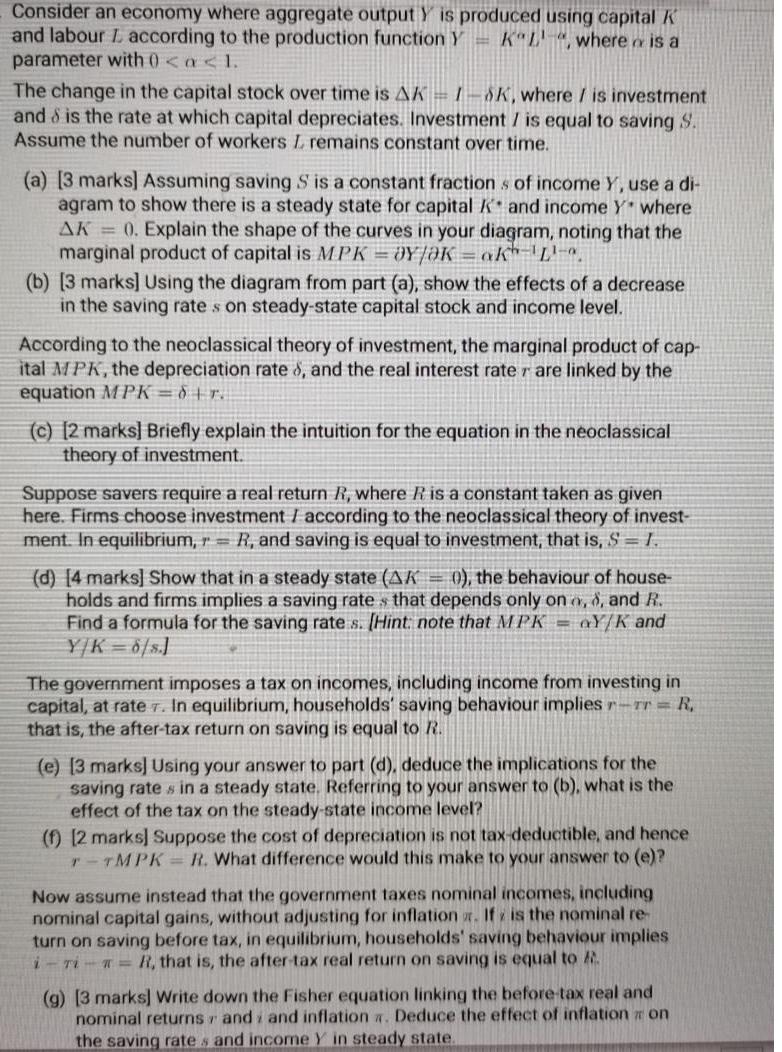

Consider an economy where aggregate output Y is produced using capital K and labour L according to the production function YK"L", where is a parameter with 0 < a < 1. The change in the capital stock over time is AKI-K, where / is investment and & is the rate at which capital depreciates. Investment / is equal to saving S. Assume the number of workers L remains constant over time. (a) [3 marks] Assuming saving S is a constant fractions of income Y, use a di- agram to show there is a steady state for capital and income Y* where AK = 0. Explain the shape of the curves in your diagram, noting that the marginal product of capital is MPK = Y/OK= ok-L-". (b) [3 marks] Using the diagram from part (a), show the effects of a decrease in the saving rate s on steady-state capital stock and income level. According to the neoclassical theory of investment, the marginal product of cap- ital MPK, the depreciation rate, and the real interest rater are linked by the equation MPK = 6 + r. (c) [2 marks] Briefly explain the intuition for the equation in the neoclassical theory of investment. Suppose savers require a real return R, where R is a constant taken as given here. Firms choose investment / according to the neoclassical theory of invest- ment. In equilibrium, r =R, and saving is equal to investment, that is, S = I. (d) [4 marks] Show that in a steady state (AK = 0), the behaviour of house- holds and firms implies a saving rate that depends only on o, , and R. Find a formula for the saving rate s. (Hint: note that MPK = Y/K and Y/K=6/s.] The government imposes a tax on incomes, including income from investing in capital, at rate . In equilibrium, households' saving behaviour implies r-rr = R that is, the after-tax return on saving is equal to R. (e) [3 marks] Using your answer to part (d), deduce the implications for the saving rates in a steady state. Referring to your answer to (b), what is the effect of the tax on the steady-state income level? (f) [2 marks] Suppose the cost of depreciation is not tax deductible, and hence T-TMPK = R. What difference would this make to your answer to (e)? Now assume instead that the government taxes nominal incomes, including nominal capital gains, without adjusting for inflation. If is the nominal re- turn on saving before tax, in equilibrium, households' saving behaviour implies i-ri-R, that is, the after-tax real return on saving is equal to (g) [3 marks] Write down the Fisher equation linking the before-tax real and nominal returns and and inflation . Deduce the effect of inflation on the saving rates and income Y in steady state.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Assuming saving S is a constant fraction of income Y use a diagram to show there is a steady state for capital K and income Y where AK 0 Explain the shape of the curves in your diagram noting that t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started