Answered step by step

Verified Expert Solution

Question

1 Approved Answer

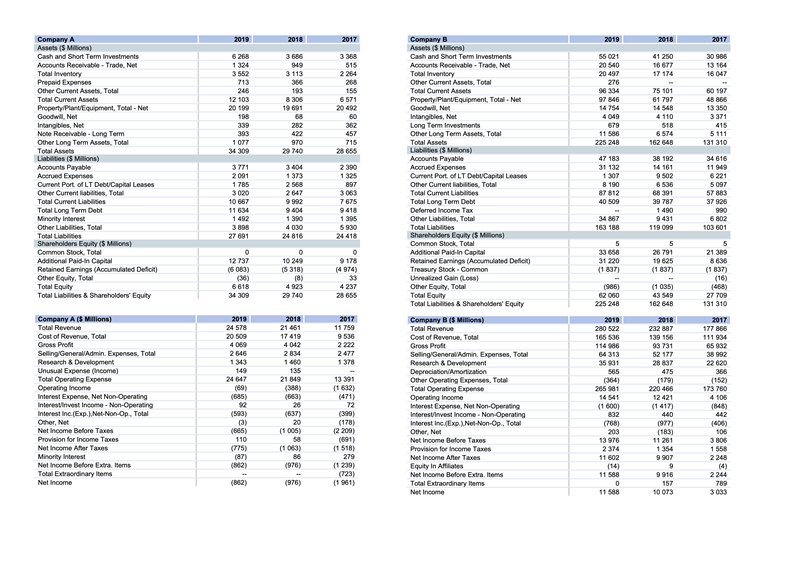

Is the A companys net investment in fixed assets negative or positive? Give evidence. How does it impact the capacity of the company? 2019 2018

Is the A companys net investment in fixed assets negative or positive? Give evidence. How does it impact the capacity of the company?

2019 2018 2017 2019 2018 2017 3 685 949 3113 41 250 16 677 17 174 30 966 13 164 16 047 3368 515 2 264 268 155 6571 626 1324 3552 713 246 12 103 20190 198 339 393 1 077 34309 8305 19 601 55021 20 540 20 497 276 96334 97 846 14 754 4049 679 11 506 225 248 75 101 61 797 14 548 4 110 518 6 574 162 648 60 362 457 715 28 655 60 197 48 866 13350 3371 415 5 111 131 310 282 422 970 29740 Company A Assets ( Millions) Cash and Short Term Investments Accounts Receivable - Trade. Net Total inventory Prepaid Expenses Other Current Assets, Total Total Current Assets Property Plant Equipment, Total - Net Goodwill, Net Intangibles, Net Note Receivable - Long Term Other Long Term Assets, Total Total Assets Liabilities (5 Millions) Accounts Payable Accrued Expenses Current Port of LT Debu Capital Leases Other Current liabilities. Total Total Current Liabi Total Long Term Debt Minority interest Other Liabilities, Total Total Liabides Shareholders Equity (5 Millions) Common Stock. Total Additional Paid in Capital Retained Earnings (Accumulated Deficit) Other Equity. Total Total Equity Total Liabilities & Shareholders' Equity 3404 3771 2001 1785 1 373 2568 2647 47 183 31 132 1 307 8 190 87 812 40 509 2390 1325 897 3063 7675 9418 1 395 5930 3090 38 192 14 161 9502 6 536 68391 39 787 1 490 9431 119 099 34 616 11949 6221 5097 57 883 37 925 10 667 11 634 1492 3898 27691 9404 1 390 4030 24 816 34 867 163 188 6802 103 601 O 12 737 (6063) 10249 (5318 Company Assets (5 Millions) Cash and Short Term Investments Accounts Receivable - Trade, Net Total Inventory Other Current Assets, Total Total Current Assets Property PlantEquipment, Total - Net Goodwill. Net Intangibles, Net Long Term Investments Other Long Term Assets, Total Total Assets Liabilities (Milions) Accounts Payable Accrued Expenses Current Port of LT Debt Capital Leasts Other Current liabilities. Total Total Current Liabilities Total Long Term Debt Deferred Income Tax Other Liabilities, Total Total Liabilities Shareholders Equity (5 Millions) Common Stock, Total Additional Paid in Capital Retained Earnings (Acumulated Deficit) Treasury Stock. Common Unrealized Gain (L03) Other Equity, Total Total Equity Total Liabilities & Shareholders' Equity Company B (5 Millions) Total Revenue Cost of Revenue, Total Gross Profit Selling General/Admin Expenses, Total Research & Development Depreciation/Amortization Other Operating Expenses. Total Total Operating Expense Operating Income Interest Expense, Net Non-Operating Interest invest income. Non Operating Interest Inc (Exp.Net-Non-Op. Total Other Net Net Income Before Taxes Provision for Income Taxes Net Income Ahler Taxes Equity In Affiliates Net Income Before Extra.Items Total Extraordinary Hems Net Income 9 178 (4 974) 4 237 28 655 5 33 658 31 220 (1 837) (986) 62 060 225 248 5 26 791 19 625 (1 837) 5 21 389 8 636 (1 837) (16) (468) 27709 131 310 6618 34 309 4923 29 740 (1 035) 162 648 2019 24 578 20 509 2017 11 750 9 536 2 222 2 477 1378 2018 232 887 139 156 93 731 52 177 28 837 475 2017 177 866 111 934 65 932 38 992 22 620 366 2646 Company A (5 Millions) Toual Revenue Cost of Revenue, Total Gross Profit Selling General Admin. Expenses. Total Research & Development Unusual Expense (Income) Total Operating Expense Operating income Interest Expense, Net Non-Operating Interestinvest Income Non-Operating Interest Inc. Exp.), Net-Non-Op. Total Other, Net Net Income Before Taxes Provision for Income Taxes Net Income After Taxes Minority interest Net Income Before Extra.Items Toul Extraordinary items Net Income 2015 21 461 17 419 4042 2834 1460 135 21 849 (388) (663) 20 (637) 20 (1006) 149 24 647 (60) (585) 220 466 12 421 13391 (1 632) (471) 72 (399) (178) 12 209) 2019 280 522 165 536 114 986 64 313 35 931 565 (364) 265 81 14 541 (1 600) 832 (768) 203 13 976 2 374 11 602 (14) 11 588 0 11 588 (593) (3) (665) 110 (775) (87) (662) 173 760 4 106 (848) 442 (406) 106 3 306 1558 2 248 (4) 2244 789 3033 88 (976) 440 1977) (183) 11 261 1354 9 907 9 9916 157 10 073 (1 518) 279 (1 230) (723) (862) (976)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started