Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is the acquisition of ABC Aluminum aligned with CBA's strategic plan? Explain your answer. Will there be an increase in value-added? By how much?

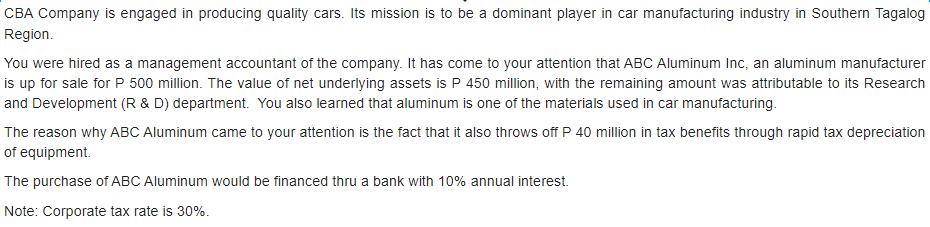

Is the acquisition of ABC Aluminum aligned with CBA's strategic plan? Explain your answer. Will there be an increase in value-added? By how much? Show your computation in good form. CBA Company is engaged in producing quality cars. Its mission is to be a dominant player in car manufacturing industry in Southern Tagalog Region. You were hired as a management accountant of the company. It has come to your attention that ABC Aluminum Inc, an aluminum manufacturer is up for sale for P 500 million. The value of net underlying assets is P 450 million, with the remaining amount was attributable to its Research and Development (R & D) department. You also learned that aluminum is one of the materials used in car manufacturing. The reason why ABC Aluminum came to your attention is the fact that it also throws off P 40 million in tax benefits through rapid tax depreciation of equipment. The purchase of ABC Aluminum would be financed thru a bank with 10% annual interest. Note: Corporate tax rate is 30%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine if the acquisition aligns with CBAs strategic plan we need to consider if acquiring ABC ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started