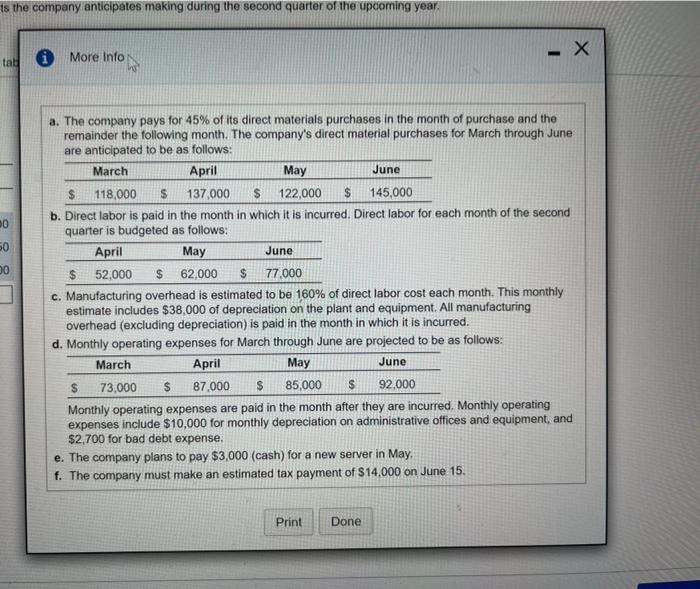

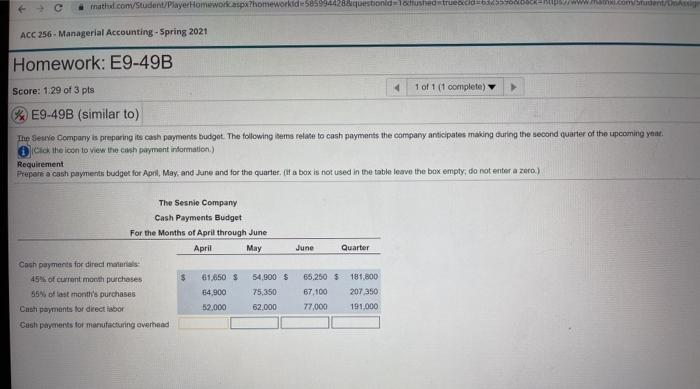

is the company anticipates making during the second quarter of the upcoming year. tal 0 More Info - X 0 50 00 a. The company pays for 45% of its direct materials purchases in the month of purchase and the remainder the following month. The company's direct material purchases for March through June are anticipated to be as follows: March April May June $ 118,000 $ 137,000 S 122,000 $ 145,000 b. Direct labor is paid in the month in which it is incurred. Direct labor for each month of the second quarter is budgeted as follows: April May June 52,000 62,000 $ 77,000 c. Manufacturing overhead is estimated to be 160% of direct labor cost each month. This monthly estimate includes $38,000 of depreciation on the plant and equipment. All manufacturing overhead (excluding depreciation) is paid in the month in which it is incurred. d. Monthly operating expenses for March through June are projected to be as follows: March April May June $ 73,000 $ 87,000 $ 85,000 $ 92.000 Monthly operating expenses are paid in the month after they are incurred. Monthly operating expenses include $10,000 for monthly depreciation on administrative offices and equipment, and $2,700 for bad debt expense, e. The company plans to pay $3,000 (cash) for a new server in May. f. The company must make an estimated tax payment of $14,000 on June 15. Print Done mathu.com/Student/Player Homeworkcaspx?homework estionidlodsheds true dd www.en ACC 256. Managerial Accounting - Spring 2021 Homework: E9-49B > Score: 1.29 of 3 pts 1 of 1 (1 complete) E9-49B (similar to) The Sesto Company is preparing its cash payments budget. The following terms relate to cash payments the company anticipates making during the second quarter of the upcoming yeat. Cick the icon to view the cash payment information) Requirement Prepare a cash payments budget for Apel, May and June and for the quartet (la box is not used in the table leave the box empty, do not enter a zero.) June Quarter The Sesnie Company Cash Payments Budget For the Months of April through June April May Cash payments for direct mais 45% of current month purchases $ 61,650 $ 54.900 $ 55% oftast month's purchases 64.900 75,350 Cash payments for direct isbor 52.000 62.000 Cash payments for manufacturing overhead 65.250 $ 181,800 67,100 207 350 77,000 191,000