Question

Is the following statement true or false? This analysis begins with a U.S. dollar-based risk-free rate, adds a country risk premium to it, and then

Is the following statement true or false?

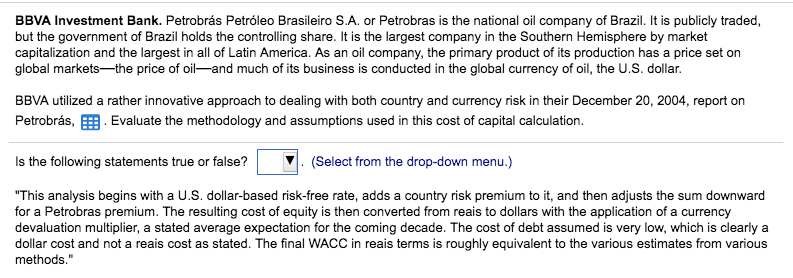

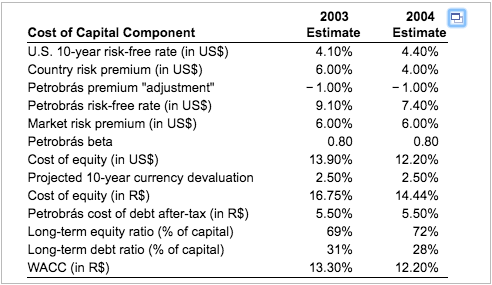

"This analysis begins with a U.S. dollar-based risk-free rate, adds a country risk premium to it, and then adjusts the sum downward for a Petrobras premium. The resulting cost of equity is then converted from reais to dollars with the application of a currency devaluation multiplier, a stated average expectation for the coming decade. The cost of debt assumed is very low, which is clearly a dollar cost and not a reais cost as stated. The final WACC in reais terms is roughly equivalent to the various estimates from various methods."

BBVA Investment Bank. Petrobrs Petrleo Brasileiro S.A. or Petrobras is the national oil company of Brazil. It is publicly traded, but the government of Brazil holds the controlling share. It is the largest company in the Southern Hemisphere by market capitalization and the largest in all of Latin America. As an oil company, the primary product of its production has a price set on global markets -the price of oil-and much of its business is conducted in the global currency of oil, the U.S. dollar BBVA utilized a rather innovative approach to dealing with both country and currency risk in their December 20, 2004, report on Petrobrs, E . Evaluate the methodology and assumptions used in this cost of capital calculation. Is the following statements true or false? . (Select from the drop-down menu.) "This analysis begins with a U.S. dollar-based risk-free rate, adds a country risk premium to it, and then adjusts the sum downward for a Petrobras premium. The resulting cost of equity is then converted from reais to dollars with the application of a currency devaluation multiplier, a stated average expectation for the coming decade. The cost of debt assumed is very low, which is clearly a dollar cost and not a reais cost as stated. The final WACC in reais terms is roughly equivalent to the various estimates from various methodsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started