Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is the math in the chart correct? Rhonda runs a six-week summer camp in the North Georgia Mountains (three weeks in June and three weeks

Is the math in the chart correct?

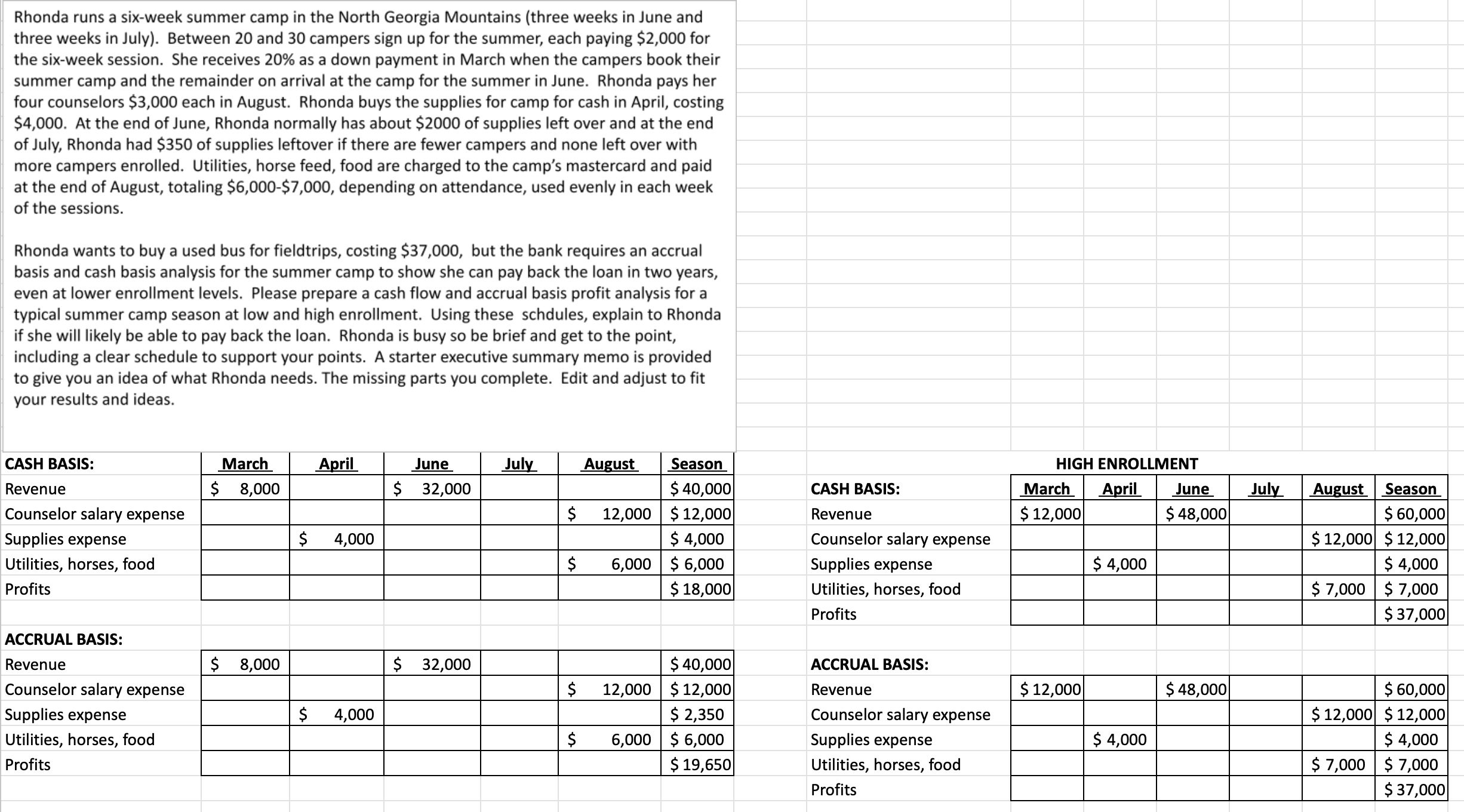

Rhonda runs a six-week summer camp in the North Georgia Mountains (three weeks in June and three weeks in July). Between 20 and 30 campers sign up for the summer, each paying $2,000 for the six-week session. She receives 20% as a down payment in March when the campers book their summer camp and the remainder on arrival at the camp for the summer in June. Rhonda pays her four counselors $3,000 each in August. Rhonda buys the supplies for camp for cash in April, costing $4,000. At the end of June, Rhonda normally has about $2000 of supplies left over and at the end of July, Rhonda had $350 of supplies leftover if there are fewer campers and none left over with more campers enrolled. Utilities, horse feed, food are charged to the camp's mastercard and paid at the end of August, totaling $6,000-$7,000, depending on attendance, used evenly in each week of the sessions. Rhonda wants to buy a used bus for fieldtrips, costing $37,000, but the bank requires an accrual basis and cash basis analysis for the summer camp to show she can pay back the loan in two years, even at lower enrollment levels. Please prepare a cash flow and accrual basis profit analysis for a typical summer camp season at low and high enrollment. Using these schdules, explain to Rhonda if she will likely be able to pay back the loan. Rhonda is busy so be brief and get to the point, including a clear schedule to support your points. A starter executive summary memo is provided to give you an idea of what Rhonda needs. The missing parts you complete. Edit and adjust to fit your results and ideas. CASH BASIS: Revenue Counselor salary expense Supplies expense Utilities, horses, food Profits ACCRUAL BASIS: Revenue Counselor salary expense Supplies expense Utilities, horses, food Profits March $ 8,000 April June $ 32,000 July August $ $ 4,000 Season $40,000 12,000 $12,000 $ 4,000 HIGH ENROLLMENT CASH BASIS: March April Revenue $12,000 June $ 48,000 July Counselor salary expense $ 6,000 $6,000 Supplies expense $ 4,000 $18,000 Utilities, horses, food Profits $ 8,000 $ 32,000 $40,000 ACCRUAL BASIS: $ $ 4,000 $ 12,000 $12,000 $2,350 6,000 $6,000 $19,650 Revenue $12,000 $48,000 Counselor salary expense Supplies expense $ 4,000 Utilities, horses, food Profits August Season $60,000 $12,000 $12,000| $ 4,000 $7,000 $7,000 $37,000 $60,000 $12,000 $12,000| $ 4,000 $7,000 $7,000 $37,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Executive Summary Based on the cash flow and accrual basis profit analysis for a typical summer camp season at low and high enrollment it appears that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e70d3abdbb_956141.pdf

180 KBs PDF File

663e70d3abdbb_956141.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started