Question

Is there a method to the madness in how far back accounting changes are reported? For example, the 2nd paragraph says the change on Retained

Is there a method to the madness in how far back accounting changes are reported?

For example, the 2nd paragraph says the change on Retained Earnings will start 1/1/2016. If the business opened in 2015, why wouldn't the change in Ret Earnings not also start in 2015?

Similarly, the text has an example about Target (no screen print provided). The inventory valuation method changed in 2017. The company provided comparative information for 2015 and 2016 based on the new method. Why did they go back to 2015 vs beginning of company, only one year, or five years?

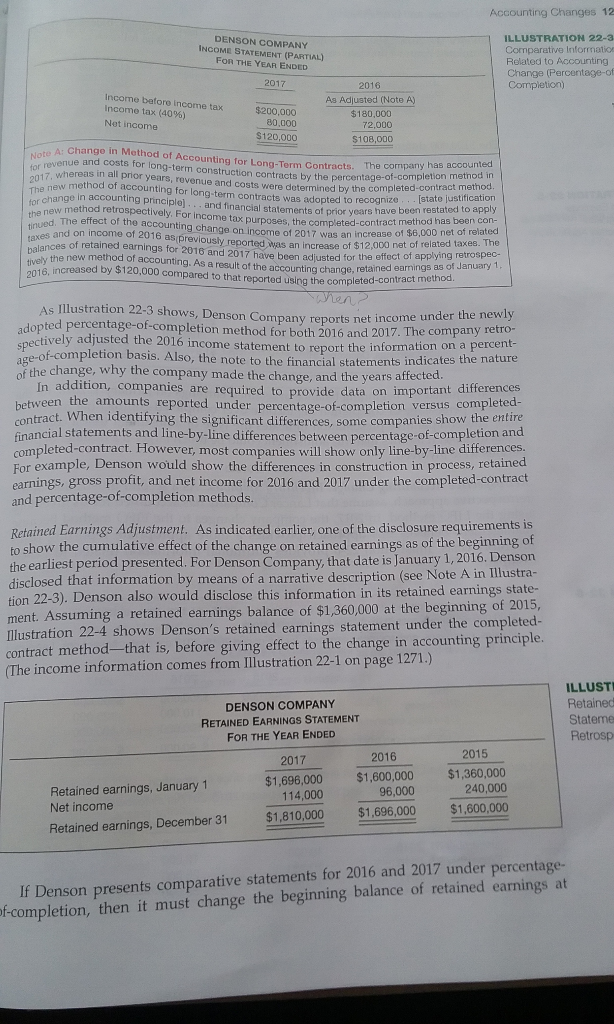

Accounting Changes 12 DENSON COMPANY INCOME STATEMENT (PARTIAL) FOR THE YEAR ENDED ILLUSTRATION 22-3 Information Related to Accounting Change (Percentage-of Income bafore income tax Income tax (40%) Net income As Adjusted (Note $200,000 0,000 $120,000 $108,000 Change in Method of Accounting for Long-Term Contracts te . e and costs for long-term construction contracts by the perc The company has accounted z whereas in all prior years, revenue and costs were determ 20 method of accounting for long-term contracts was adopted to r ined by the completed-contract method to recognize[state justification nd financial statements of prior vears have been restated to apply , the completed-contract method has been con- 7 was an increase of $6,000 net of related an increase of $12,000 net of related taxes. The of applying retrospec- retained earrnings as of January 1 The new for change in accounting principle).a method retrospectively. For income tax purposes The effect of the accounting change on income of 201 taxes and on income of 2016 as s of retained earnings for 2016 and 2017 have been adjusted for the effect ively the new method of accounting. As a result of the accounting change 016, increased by $120,000 compared to that reported using the complet As Illustration 22-3 shows, Denson Company reports net income under the newly completion method for both 2016 and 2017. The company retro- spectively adjusted the 2016 income statement to report the information on a percent of-completion basis. Also , the note to the financial statements indicates the nature the change, why the company made the change, and the years affected in addition, companies are required to provide data on important differences between the amounts reported under percentage-of-completion versus completed contract. When identifying the significant differences, some companies show the entir financial statements and line-by-line differences between percentage-of-completion and completed-contract. However, most companies will show only line-by-line differences. For example, Denson would show the differences in construction in process, retained earnings, gross profit, and net income for 2016 and 2017 under the completed-contradt and percentage-of-completion methods. Retained Earnings Adjustment. As indicated earlier, one of the disclosure requirements is to show the cumulative effect of the change on retained earnings as of the beginning of the earliest period presented. For Denson Company, that date is January 1, 2016. Denson disclosed that information by means of a narrative description (see Note A in Illustra tion 22-3). Denson also would disclose this information in its retained earnings state- ment. Assuming a retained earnings balance of $1,360,000 at the beginning of 2015 Illustration 22-4 sho ws Denson's retained earnings statement under the completed t is, before giving effect to the change in accounting principle (The income information comes from Illustration 22-1 on page 1271.) ILLUST Retained Stateme Retrosp DENSON COMPANY RETAINED EARNINGS STATEMENT FOR THE YEAR ENDED 2015 2016 2017 $1,360,000 $1,600,000 $1,696,000 Retained earnings, January 1 Net income 240,000 96,000 114,000 $1,810,000 $1,696,000 $1,600,000 Retained earnings, December 31 If Denson presents comparative statements for 2016 and 2017 under percenta f-completion, then it must change the beginning balance of retained earnings at ge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started