Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is there anything i can provide to make it more clear? 6. You are interested in investing in some corporate bonds from companies that have

Is there anything i can provide to make it more clear?

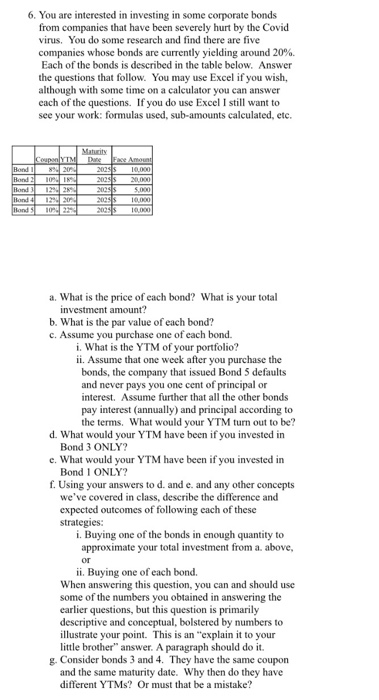

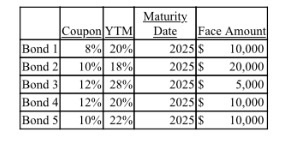

6. You are interested in investing in some corporate bonds from companies that have been severely hurt by the Covid virus. You do some research and find there are five companies whose bonds are currently yielding around 20% Each of the bonds is described in the table below. Answer the questions that follow. You may use Excel if you wish, although with some time on a calculator you can answer each of the questions. If you do use Excel I still want to see your work: formulas used, sub-amounts calculated, etc. ICY IMI Bond 1 920 Bond1091 Bond 1290 291 Rond 412002 Rond 10922- Dane 2005s 2025 $ 2005 2 003 $ 2005 $ 10,000 20,000 .000 10,000 10.000 a. What is the price of each bond? What is your total investment amount? b. What is the par value of each bond? c. Assume you purchase one of each bond. i. What is the YTM of your portfolio? ii. Assume that one week after you purchase the bonds, the company that issued Bond 5 defaults and never pays you one cent of principal or interest. Assume further that all the other bonds pay interest (annually) and principal according to the terms. What would your YTM turn out to be? d. What would your YTM have been if you invested in Bond 3 ONLY? e. What would your YTM have been if you invested in Bond 1 ONLY? f. Using your answers to d. and e. and any other concepts we've covered in class, describe the difference and expected outcomes of following each of these strategies: i. Buying one of the bonds in enough quantity to approximate your total investment from a. above, or ii. Buying one of each bond. When answering this question, you can and should use some of the numbers you obtained in answering the carlier questions, but this question is primarily descriptive and conceptual, bolstered by numbers to illustrate your point. This is an explain it to your little brother" answer. A paragraph should do it. g. Consider bonds 3 and 4. They have the same coupon and the same maturity date. Why then do they have different YTMs? Or must that be a mistake? Coupon YTM Bond 1 8 % 20% Bond 2 10% 18% Bond 31 129 28% Bond 4 12% 20% Bond 10% 22% Maturity Date Face Amount 2025$ 10.000 2025$ 20,000 2025$ 5,000 2025 $ 10,000 2025 $ 10,000 6. You are interested in investing in some corporate bonds from companies that have been severely hurt by the Covid virus. You do some research and find there are five companies whose bonds are currently yielding around 20% Each of the bonds is described in the table below. Answer the questions that follow. You may use Excel if you wish, although with some time on a calculator you can answer each of the questions. If you do use Excel I still want to see your work: formulas used, sub-amounts calculated, etc. ICY IMI Bond 1 920 Bond1091 Bond 1290 291 Rond 412002 Rond 10922- Dane 2005s 2025 $ 2005 2 003 $ 2005 $ 10,000 20,000 .000 10,000 10.000 a. What is the price of each bond? What is your total investment amount? b. What is the par value of each bond? c. Assume you purchase one of each bond. i. What is the YTM of your portfolio? ii. Assume that one week after you purchase the bonds, the company that issued Bond 5 defaults and never pays you one cent of principal or interest. Assume further that all the other bonds pay interest (annually) and principal according to the terms. What would your YTM turn out to be? d. What would your YTM have been if you invested in Bond 3 ONLY? e. What would your YTM have been if you invested in Bond 1 ONLY? f. Using your answers to d. and e. and any other concepts we've covered in class, describe the difference and expected outcomes of following each of these strategies: i. Buying one of the bonds in enough quantity to approximate your total investment from a. above, or ii. Buying one of each bond. When answering this question, you can and should use some of the numbers you obtained in answering the carlier questions, but this question is primarily descriptive and conceptual, bolstered by numbers to illustrate your point. This is an explain it to your little brother" answer. A paragraph should do it. g. Consider bonds 3 and 4. They have the same coupon and the same maturity date. Why then do they have different YTMs? Or must that be a mistake? Coupon YTM Bond 1 8 % 20% Bond 2 10% 18% Bond 31 129 28% Bond 4 12% 20% Bond 10% 22% Maturity Date Face Amount 2025$ 10.000 2025$ 20,000 2025$ 5,000 2025 $ 10,000 2025 $ 10,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started