Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is this correct? Martinez Corporation issues 2,000, 10-year, 8%, $1,000 bonds dated January 1, 2017, at 98. The journal entry to record the issuance will

Is this correct?

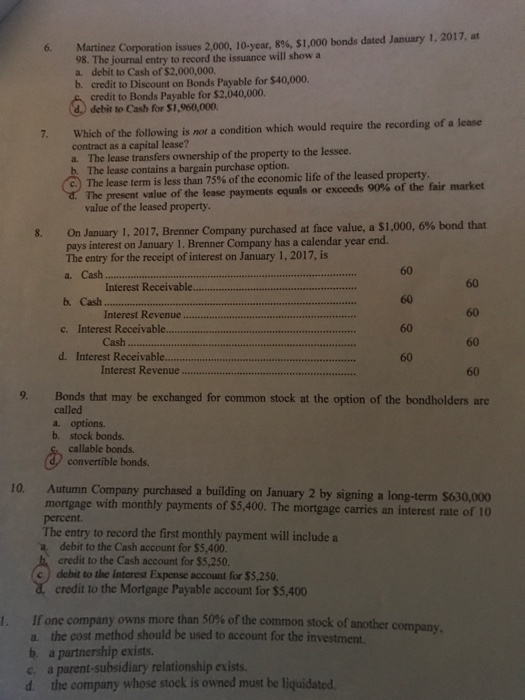

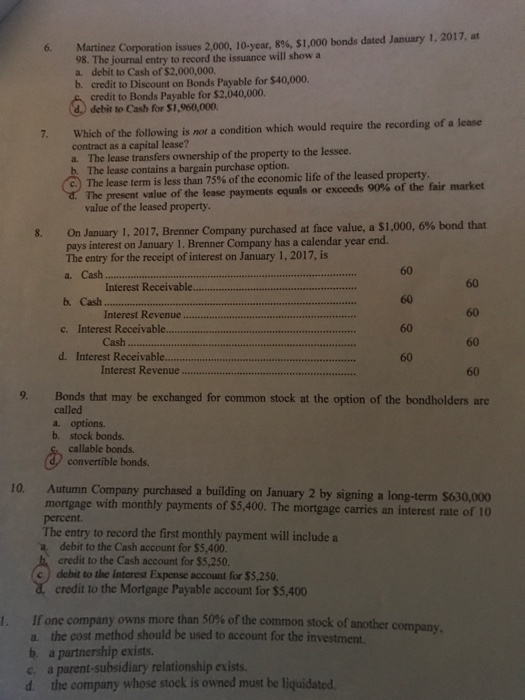

Martinez Corporation issues 2,000, 10-year, 8%, $1,000 bonds dated January 1, 2017, at 98. The journal entry to record the issuance will show a debit to Cash of $2,000,000. credit to Discount on Bonds Payable for $40,000. credit to Bonds Payable for $2, 040,000. debit to Cash for $1, 960,000. Which of the following is not a condition which would require the recording of a lease contract as a capital lease? The lease transfers ownership of the property to the lessee. The lease contains a bargain purchase option. The lease term is less than 75% of the economic life of the leased property. The present value of the lease payments equals or exceeds 90% of the fair market value of the leased property. On January 1, 2017, Brenner Company purchased at face value, a $1,000, 6% bond that pays interest on January 1. Brenner Company has a calendar year end. The entry for the receipt of interest on January 1, 2017, is Cash 60 Interest Receivable 60 Cash 60 Interest Revenue 60 Interest Receivable 60 Cash 60 Interest Receivable 60 Interest Revenue 60 Bomb that may be exchanged for common stock at the option of the bondholders are called options. stock bonds. callable bonds. convertible bonds. Autumn Company purchased a building on January 2 by signing a long-term $630,000 mortgage with monthly payments of $5, 400. The mortgage carries an interest rate of 10 percent. The entry to record the first monthly payment will include a debit to the Cash account for $5, 400. credit to the Cash account for $5, 250. debit to the interest Expense account for $5, 250. credit to the Mortgage Payable account for $5, 400 If one company owns more than 50% of the common stock of another company. the cost method should be used to account for the investment. a partnership exists. a parent-subsidiary relationship exists. the company whose stock is owned must be liquidated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started