Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020 ? A Married Filing Separate taxpayer paid $3,000

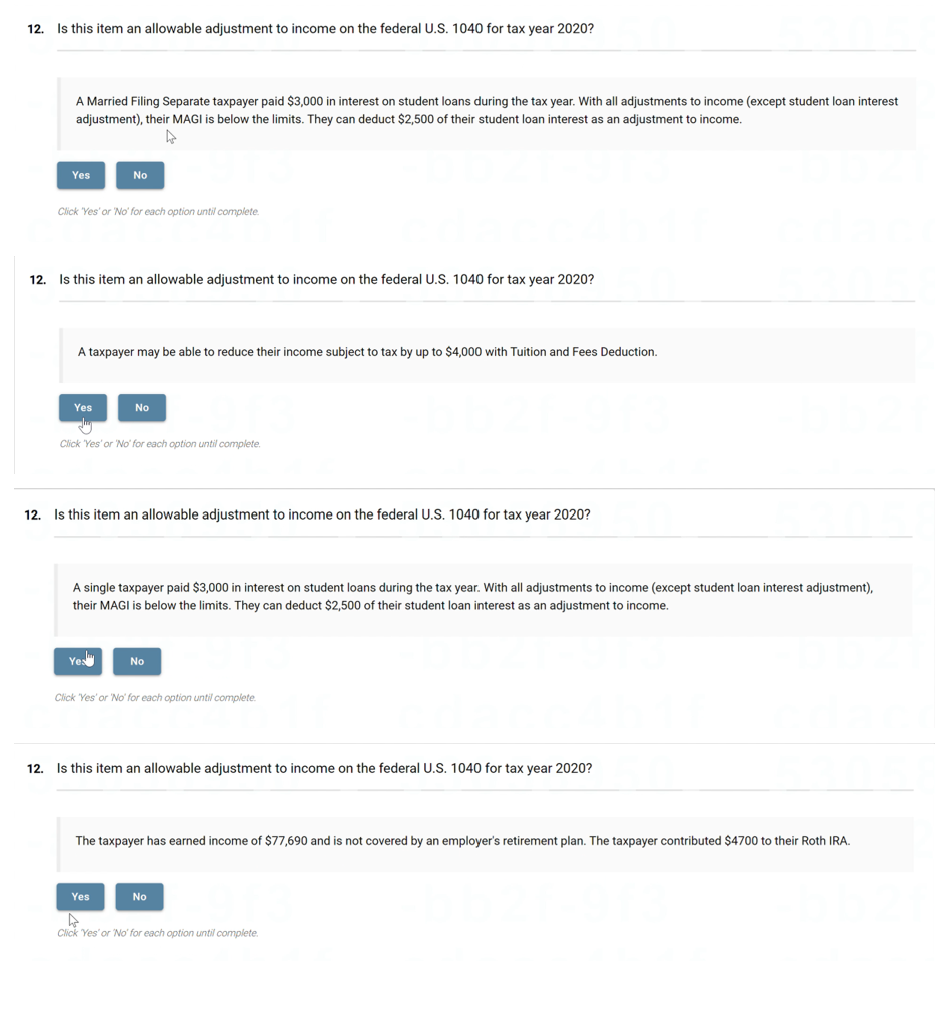

Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020 ? A Married Filing Separate taxpayer paid $3,000 in interest on student loans during the tax year. With all adjustments to income (except student loan interest adjustment), their MAGI is below the limits. They can deduct $2,500 of their student loan interest as an adjustment to income. Click 'Yes' or 'No' for each option until complete. 2. Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020 ? A taxpayer may be able to reduce their income subject to tax by up to $4,000 with Tuition and Fees Deduction. Click 'Yes' or 'No' for each option until complete. Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020? A single taxpayer paid $3,000 in interest on student loans during the tax year. With all adjustments to income (except student loan interest adjustment), their MAGI is below the limits. They can deduct $2,500 of their student loan interest as an adjustment to income. Click 'Yes' or 'No' for each option until complete. Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020 ? The taxpayer has earned income of $77,690 and is not covered by an employer's retirement plan. The taxpayer contributed $4700 to their Roth IRA. Click Yes' or 'No' for each option until complete

Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020 ? A Married Filing Separate taxpayer paid $3,000 in interest on student loans during the tax year. With all adjustments to income (except student loan interest adjustment), their MAGI is below the limits. They can deduct $2,500 of their student loan interest as an adjustment to income. Click 'Yes' or 'No' for each option until complete. 2. Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020 ? A taxpayer may be able to reduce their income subject to tax by up to $4,000 with Tuition and Fees Deduction. Click 'Yes' or 'No' for each option until complete. Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020? A single taxpayer paid $3,000 in interest on student loans during the tax year. With all adjustments to income (except student loan interest adjustment), their MAGI is below the limits. They can deduct $2,500 of their student loan interest as an adjustment to income. Click 'Yes' or 'No' for each option until complete. Is this item an allowable adjustment to income on the federal U.S. 1040 for tax year 2020 ? The taxpayer has earned income of $77,690 and is not covered by an employer's retirement plan. The taxpayer contributed $4700 to their Roth IRA. Click Yes' or 'No' for each option until complete Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started