is this right

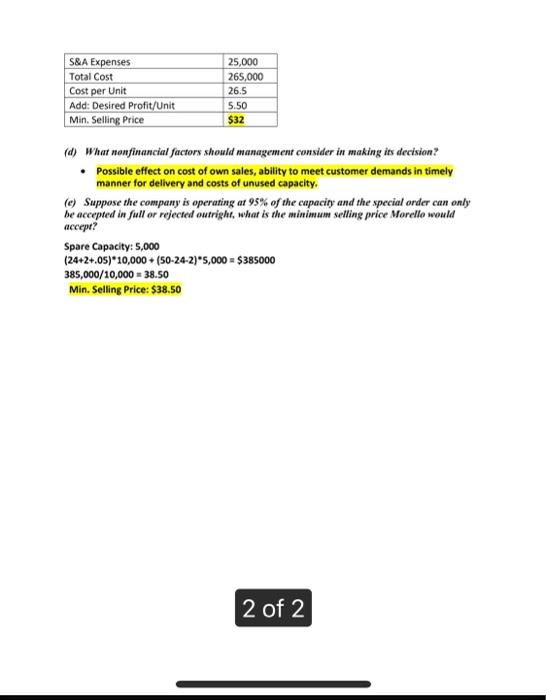

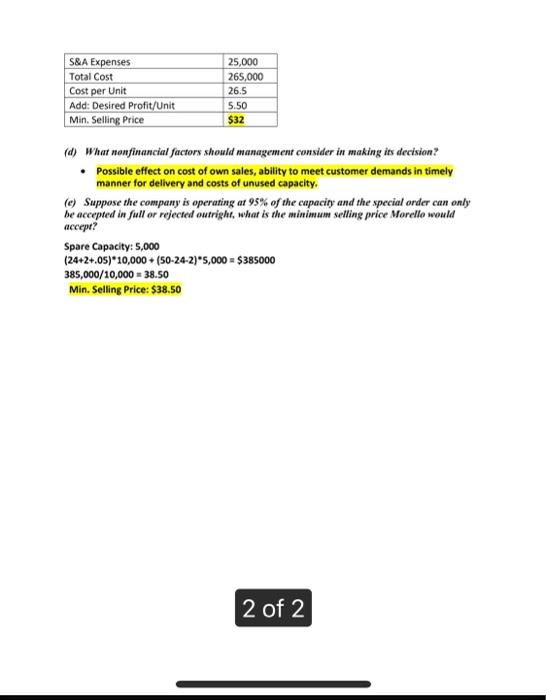

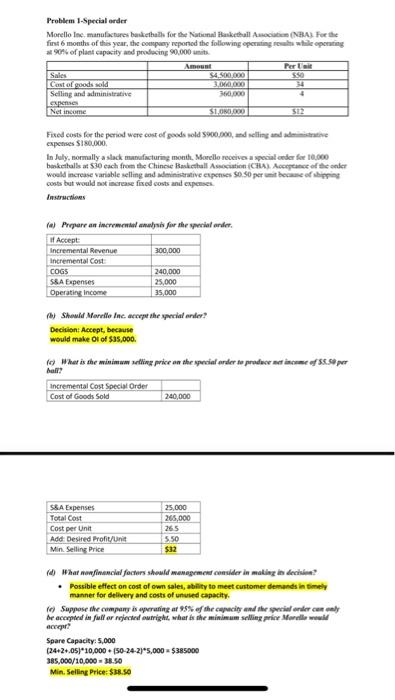

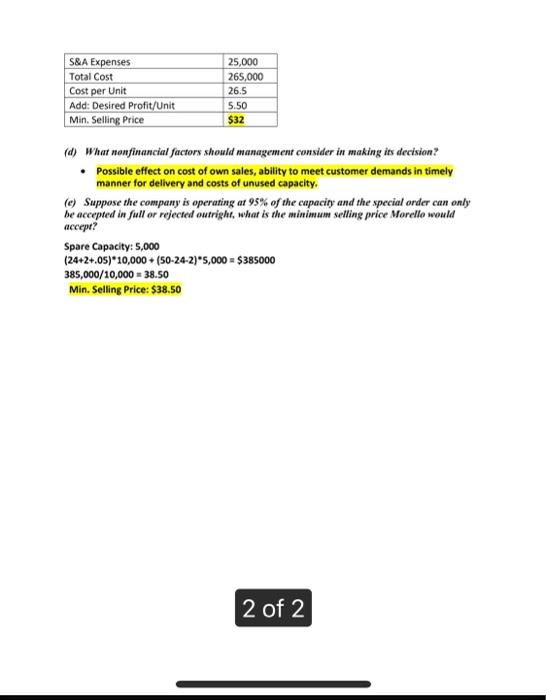

S&A Expenses Total Cost Cost per Unit Add: Desired Profit/Unit Min. Selling Price 25,000 265,000 26.5 5.50 $32 (d) What nonfinancial factors should management consider in making its decision Possible effect on cost of own sales, ability to meet customer demands in timely manner for delivery and costs of unused capacity. (e) Suppose the company is operating at 95% of the capacity and the special order can only be accepted in full or rejected outright, what is the minimum selling price Morello would accept? Spare Capacity: 5,000 (24+2+.05)*10,000 + (50-24-2)*5,000 = $385000 385,000/10,000 = 38.50 Min. Selling Price: $38.50 2 of 2 Problem 1-Special order Morello Inc, manufactures bankethath for the National Basketball Association (NBA) for the first 6 months of this year, the company reported the following operating while operating * 90% of plant capacity and producing 90.000 units Amat Per Sales S4 S00.000 so Cost of goods sold 3800 Seiling and administrative 60,000 expenses Net income SIN.000 512 Fixed costs for the period were cost of goods sold 900.000, and selling and de caps $180.000 In July, normally a stack manufacturing mouth. Morello receives a special eder flere 10,000 hakestalls at $30 each from the Chinese Basichall Association (CRA). Acceptance of the onder would increase variable selling and administrative expenses $0.50 percent because of shipping costs but would not increase fixed costs and expect Instructions (w) Prepare an incremental analysis for the special onder If Accept Incremental Revenue 300,000 Incremental Cost COGS 240,000 58A Expenses 25,000 Operating Income 35,000 Should Marelle Inc. accept the period ander? Decision: Accept, because would make Of of $35.000 What is the minimum telling price on the special order to producent income of 85.5 per incremental Cost Special Order Cost of Goods Sold 240,000 S&A Expenses Total Cost Cost per Unit Add: Desired Prot/Unit Min Selling Price 25,000 265,000 265 550 $32 14 Whar en financial factors should management consider in making in de Possible effect on cost of own sales, ability to meet customer demands in timely manner for delivery and costs of unused capacity (0) Suppose the company is aperating ar 95% of the capacity and the prioriter ceny be accepted in full or rejected outright, what is the minimum selling price Marelle weld deg? Spare Capacity: 5,000 (24+2+.05)*10,000.150-24-2)*5,000 $385000 385,000/10.000 16.50 Min. Selling Price: $8.50