Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Season Master Trading Company is dealing is consumable merchandise. The goods are sold on 60 days credit terms. The debit balance in the allowance

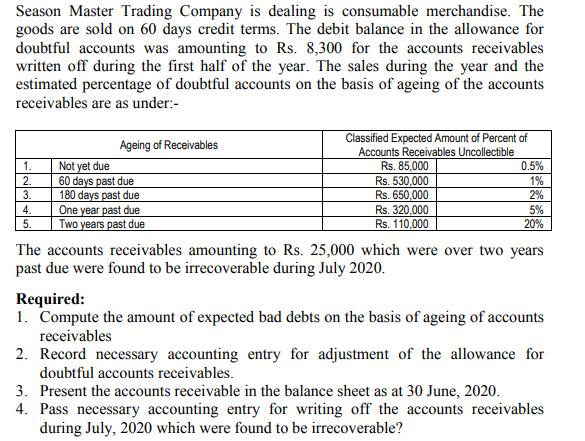

Season Master Trading Company is dealing is consumable merchandise. The goods are sold on 60 days credit terms. The debit balance in the allowance for doubtful accounts was amounting to Rs. 8,300 for the accounts receivables written off during the first half of the year. The sales during the year and the estimated percentage of doubtful accounts on the basis of ageing of the accounts receivables are as under:- 1. 2. 3. 4. 5. Ageing of Receivables Not yet due 60 days past due 180 days past due One year past due Two years past due Classified Expected Amount of Percent of Accounts Receivables Uncollectible Rs. 85,000 Rs. 530,000 Rs. 650,000 Rs. 320,000 Rs. 110,000 0.5% 1% 2% 5% 20% The accounts receivables amounting to Rs. 25,000 which were over two years past due were found to be irrecoverable during July 2020. Required: 1. Compute the amount of expected bad debts on the basis of ageing of accounts receivables 2. Record necessary accounting entry for adjustment of the allowance for doubtful accounts receivables. 3. Present the accounts receivable in the balance sheet as at 30 June, 2020. 4. Pass necessary accounting entry for writing off the accounts receivables during July, 2020 which were found to be irrecoverable?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 The amount of expected bad debts on the basis of ageing of accounts receivables is as follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started