Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Isorait Co is a company which installs kitchens and bathrooms to customer specifications. It is planning to invest KShs. 4,000,000 in a new facility

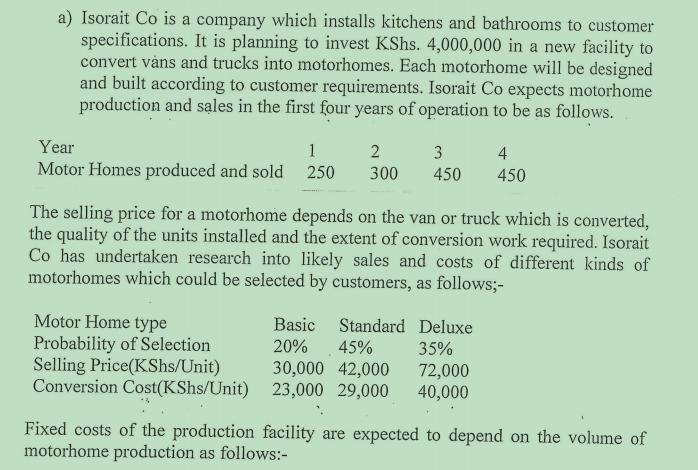

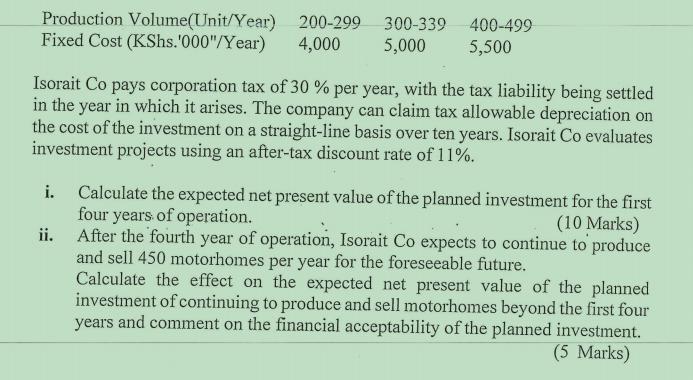

Isorait Co is a company which installs kitchens and bathrooms to customer specifications. It is planning to invest KShs. 4,000,000 in a new facility to convert vans and trucks into motorhomes. Each motorhome will be designed and built according to customer requirements. Isorait Co expects motorhome production and sales in the first four years of operation to be as follows. Year Motor Homes produced and sold 1 2 3 4 250 300 450 450 The selling price for a motorhome depends on the van or truck which is converted, the quality of the units installed and the extent of conversion work required. Isorait Co has undertaken research into likely sales and costs of different kinds of motorhomes which could be selected by customers, as follows;- Motor Home type Probability of Selection Selling Price (KShs/Unit) Conversion Cost(KShs/Unit) Standard Deluxe 45% 35% 30,000 42,000 72,000 23,000 29,000 40,000 Basic 20% Fixed costs of the production facility are expected to depend on the volume of motorhome production as follows:- Production Volume(Unit/Year) Fixed Cost (KShs.'000"/Year) 200-299 300-339 400-499 4,000 5,000 5,500 Isorait Co pays corporation tax of 30 % per year, with the tax liability being settled in the year in which it arises. The company can claim tax allowable depreciation on the cost of the investment on a straight-line basis over ten years. Isorait Co evaluates investment projects using an after-tax discount rate of 11%. i. Calculate the expected net present value of the planned investment for the first four years of operation. (10 Marks) ii. After the fourth year of operation, Isorait Co expects to continue to produce and sell 450 motorhomes per year for the foreseeable future. Calculate the effect on the expected net present value of the planned. investment of continuing to produce and sell motorhomes beyond the first four years and comment on the financial acceptability of the planned investment. (5 Marks)

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below i The expected net present value of the planned investment for the first four years of op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started