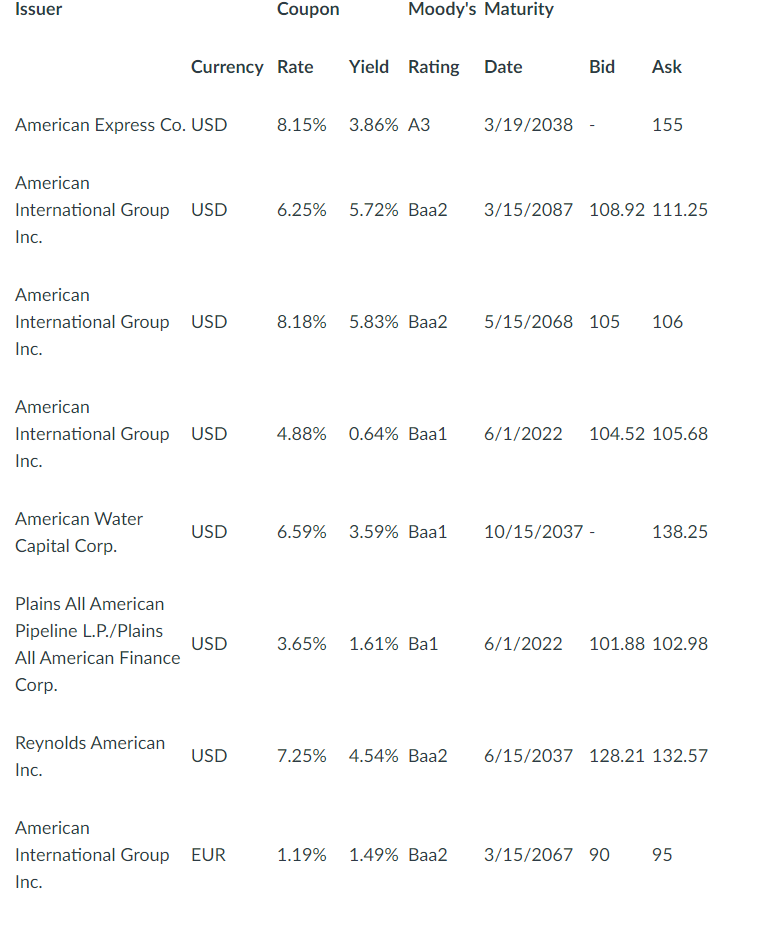

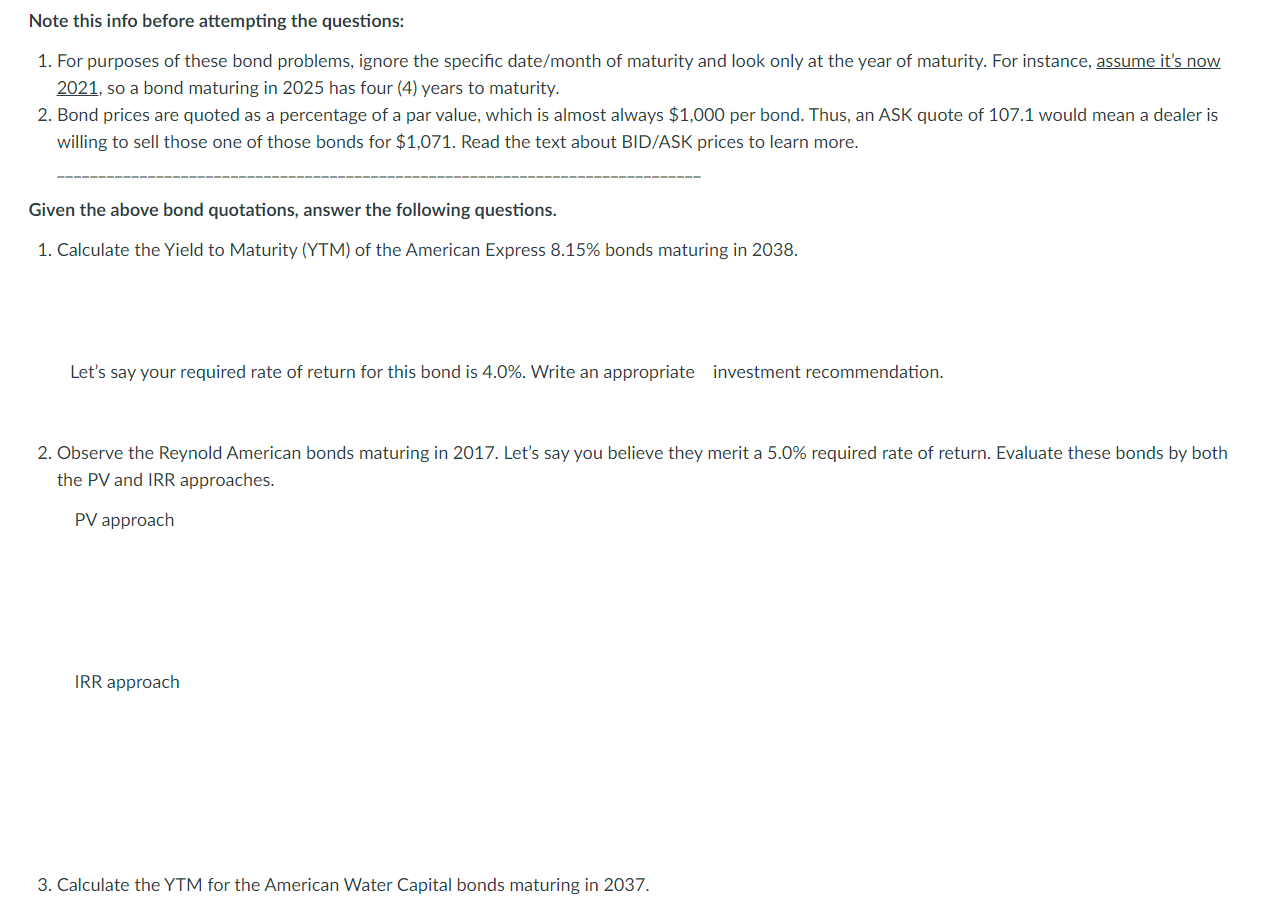

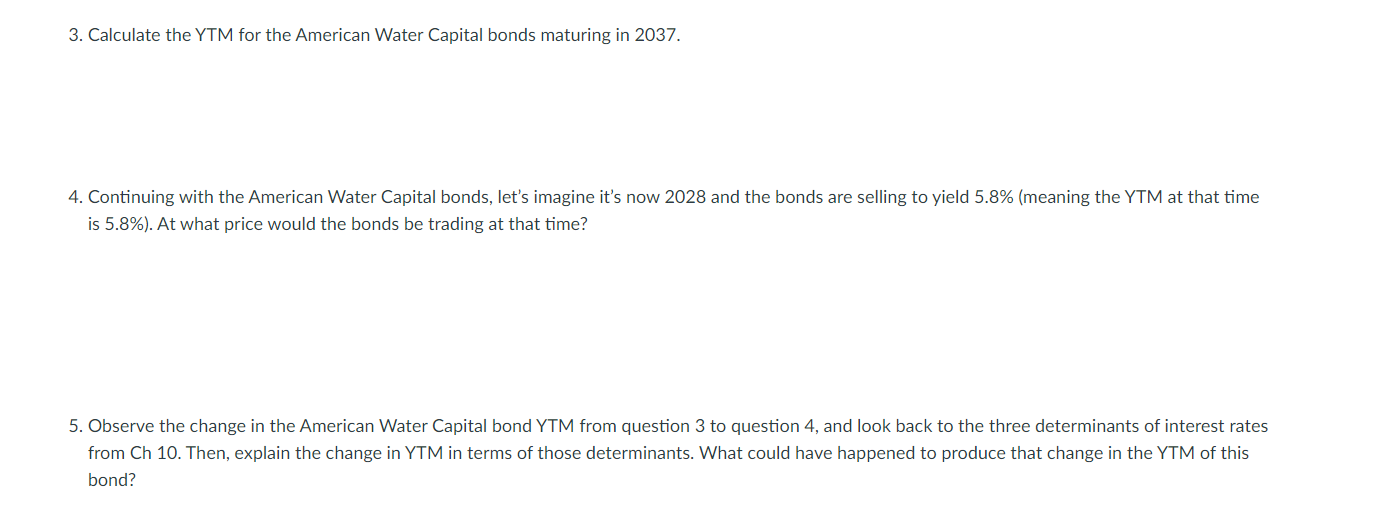

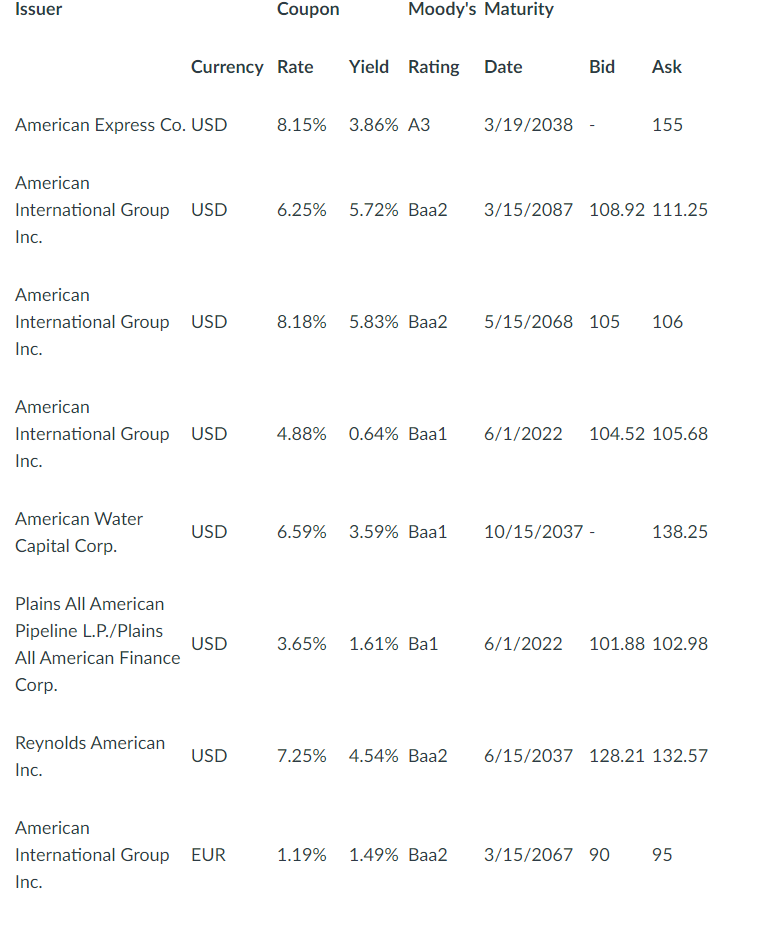

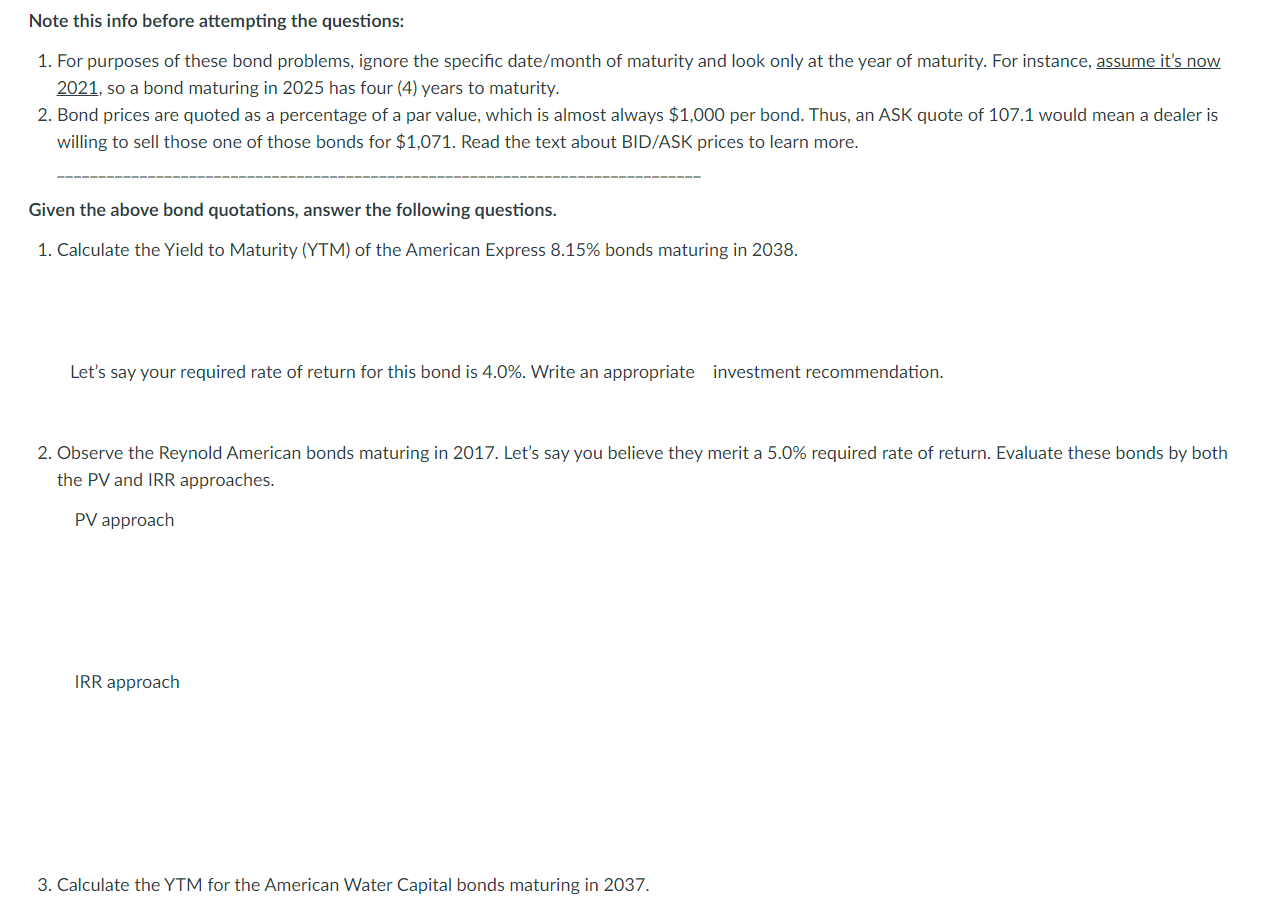

Issuer Coupon Moody's Maturity Currency Rate Yield Rating Date Bid Ask American Express Co. USD 8.15% 3.86% A3 3/19/2038 155 American International Group USD Inc. 6.25% 5.72% Baa2 3/15/2087 108.92 111.25 American International Group USD Inc. 8.18% 5.83% Baa2 5/15/2068 105 106 American International Group USD Inc. 4.88% 0.64% Baa1 6/1/2022 104.52 105.68 American Water Capital Corp. USD 6.59% 3.59% Baa1 10/15/2037 - 138.25 Plains All American Pipeline L.P./Plains All American Finance Corp. USD 1.61% Ba1 6/1/ 101.88 102.98 Reynolds American Inc. USD 7.25% 4.54% Baa2 6/15/2037 128.21 132.57 American International Group EUR Inc. 1.19% 1.49% Baa2 3/15/2067 90 95 Note this info before attempting the questions: 1. For purposes of these bond problems, ignore the specific date/month of maturity and look only at the year of maturity. For instance, assume it's now 2021, so a bond maturing in 2025 has four (4) years to maturity. 2. Bond prices are quoted as a percentage of a par value, which is almost always $1,000 per bond. Thus, an ASK quote of 107.1 would mean a dealer is willing to sell those one of those bonds for $1,071. Read the text about BID/ASK prices to learn more. Given the above bond quotations, answer the following questions. 1. Calculate the Yield to Maturity (YTM) of the American Express 8.15% bonds maturing in 2038. Let's say your required rate of return for this bond is 4.0%. Write an appropriate investment recommendation. 2. Observe the Reynold American bonds maturing in 2017. Let's say you believe they merit a 5.0% required rate of return. Evaluate these bonds by both the PV and IRR approaches. PV approach IRR approach 3. Calculate the YTM for the American Water Capital bonds maturing in 2037. 3. Calculate the YTM for the American Water Capital bonds maturing in 2037. 4. Continuing with the American Water Capital bonds, let's imagine it's now 2028 and the bonds are selling to yield 5.8% (meaning the YTM at that time is 5.8%). At what price would the bonds be trading at that time? 5. Observe the change in the American Water Capital bond YTM from question 3 to question 4, and look back to the three determinants of interest rates from Ch 10. Then, explain the change in YTM in terms of those determinants. What could have happened to produce that change in the YTM of this bond