Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Issuer Maturity Coupon Price (% Par) US Treasury Bond 2028 0% 75.75 XYZ Bond 2028 5.00% JKL Corp 2028 7.50% 89.1 Today you settled on

| Issuer | Maturity | Coupon | Price (% Par) |

| US Treasury Bond | 2028 | 0% | 75.75 |

| XYZ Bond | 2028 | 5.00% | |

| JKL Corp | 2028 | 7.50% | 89.1 |

Today you settled on the purchase of $2.0 Million Par value XYZ bonds, the yield to maturity at the time of sale is 3.75%; how much money did you need at settlement? There are 179 days between coupon payments and the next payment is due in 83 days?

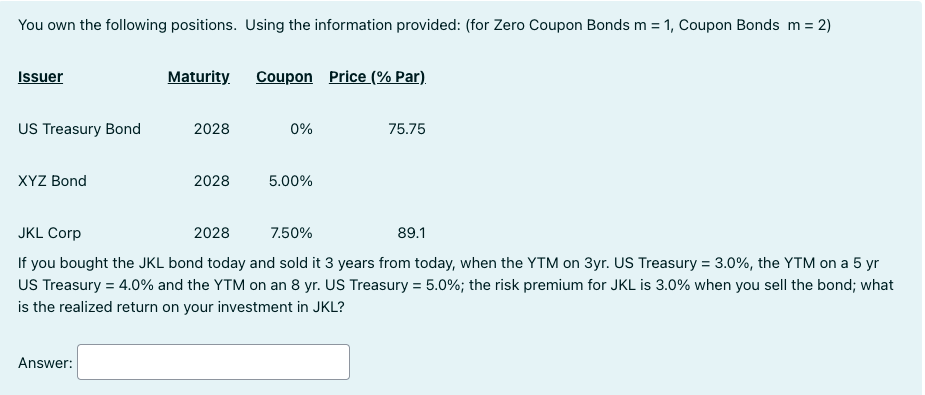

You own the following positions. Using the information provided: (for Zero Coupon Bonds m = 1, Coupon Bonds m = 2) Issuer Maturity. Coupon Price (% Par). US Treasury Bond 2028 0% 75.75 XYZ Bond 2028 5.00% JKL Corp 2028 7.50% 89.1 If you bought the JKL bond today and sold it 3 years from today, when the YTM on 3yr. US Treasury = 3.0%, the YTM on a 5 yr US Treasury = 4.0% and the YTM on an 8 yr. US Treasury = 5.0%; the risk premium for JKL is 3.0% when you sell the bond; what is the realized return on your investment in JKL? Answer: You own the following positions. Using the information provided: (for Zero Coupon Bonds m = 1, Coupon Bonds m = 2) Issuer Maturity. Coupon Price (% Par). US Treasury Bond 2028 0% 75.75 XYZ Bond 2028 5.00% JKL Corp 2028 7.50% 89.1 If you bought the JKL bond today and sold it 3 years from today, when the YTM on 3yr. US Treasury = 3.0%, the YTM on a 5 yr US Treasury = 4.0% and the YTM on an 8 yr. US Treasury = 5.0%; the risk premium for JKL is 3.0% when you sell the bond; what is the realized return on your investment in JKLStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started