Answered step by step

Verified Expert Solution

Question

1 Approved Answer

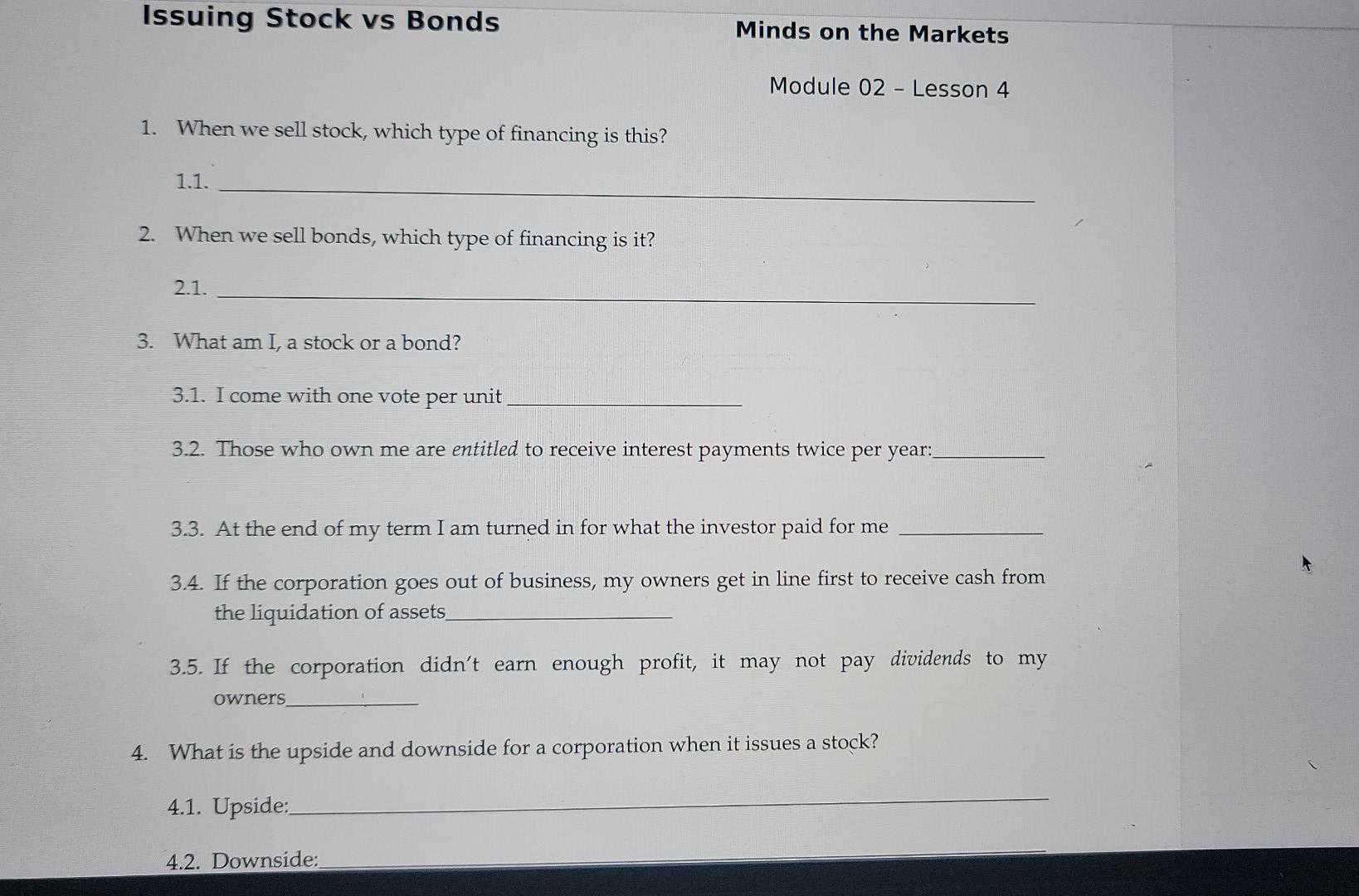

Issuing Stock vs Bonds Minds on the Markets Module 02 - Lesson 4 1. When we sell stock, which type of financing is this? 1.1.

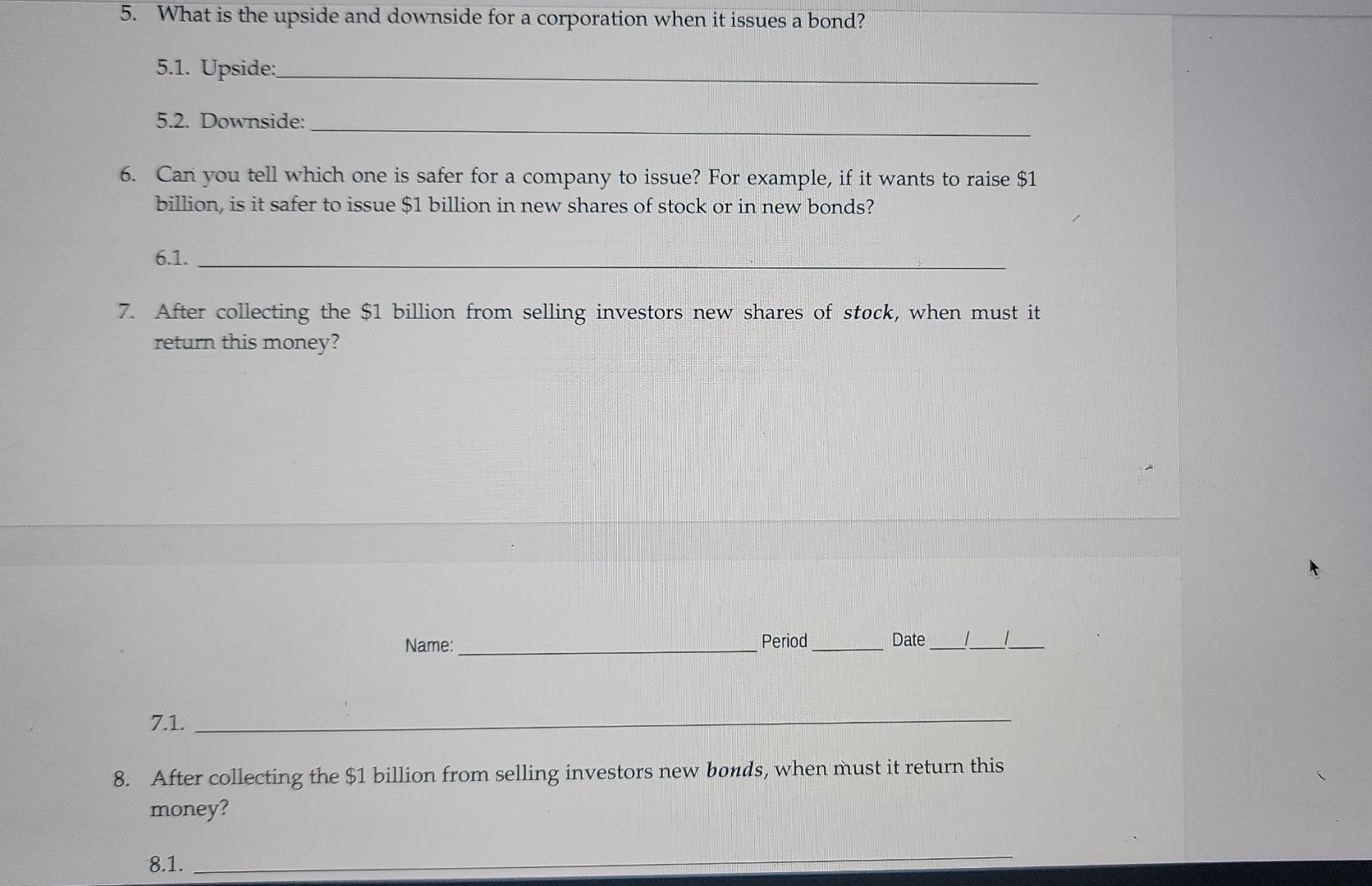

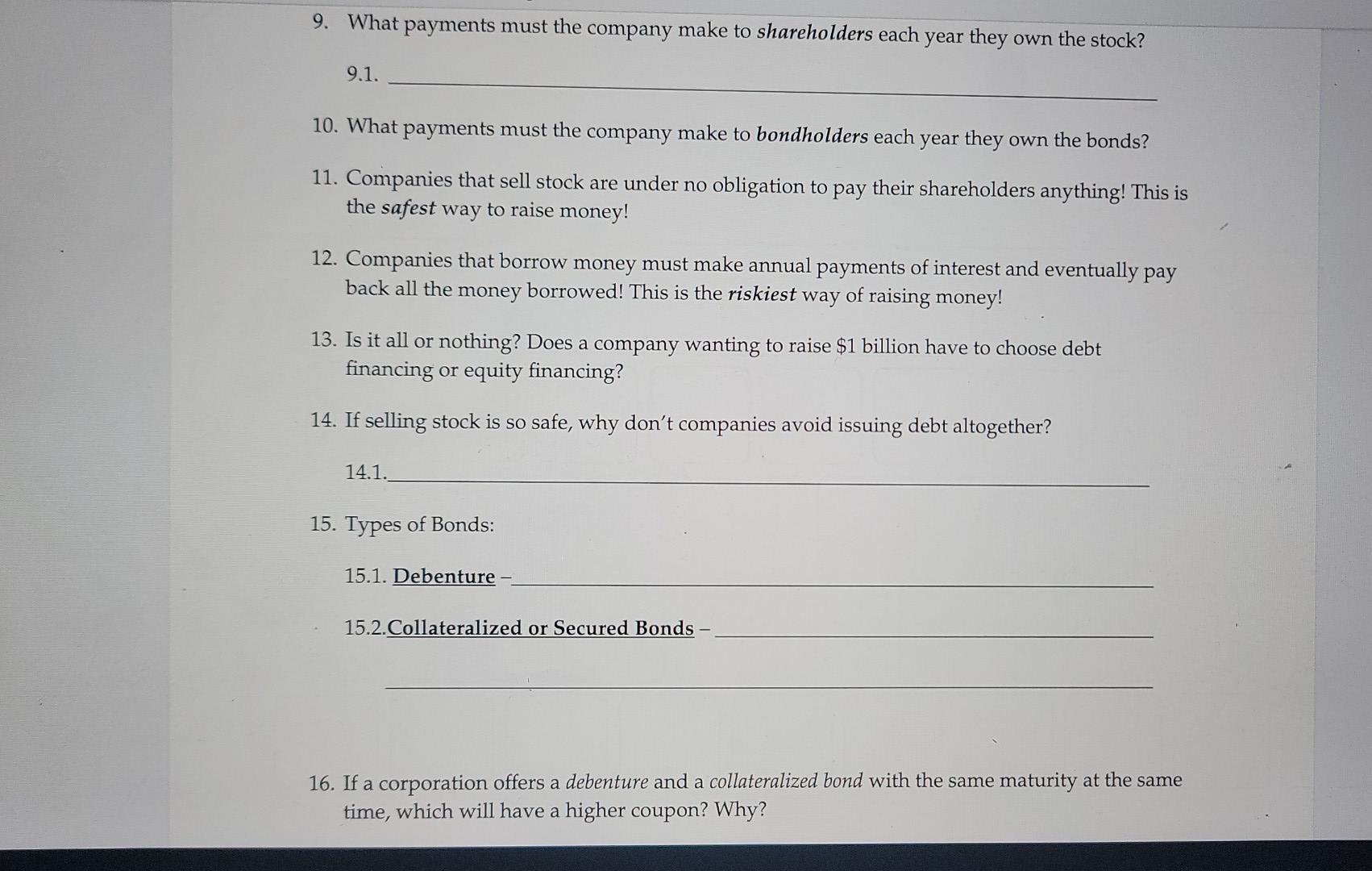

Issuing Stock vs Bonds Minds on the Markets Module 02 - Lesson 4 1. When we sell stock, which type of financing is this? 1.1. 2. When we sell bonds, which type of financing is it? 2.1. 3. What am I, a stock or a bond? 3.1. I come with one vote per unit 3.2. Those who own me are entitled to receive interest payments twice per year: 3.3. At the end of my term I am turned in for what the investor paid for me 3.4. If the corporation goes out of business, my owners get in line first to receive cash from the liquidation of assets 3.5. If the corporation didn't earn enough profit, it may not dividends to my pay owners 4. What is the upside and downside for a corporation when it issues a stock? 4.1. Upside: 4.2. Downside: 5. What is the upside and downside for a corporation when it issues a bond? 5.1. Upside: 5.2. Downside: 6. Can you tell which one is safer for a company to issue? For example, if it wants to raise $1 billion, is it safer to issue $1 billion in new shares of stock or in new bonds? 6.1. 7. After collecting the $1 billion from selling investors new shares of stock, when must it return this money? Name: Period Date 7.1. 8. After collecting the $1 billion from selling investors new bonds, when must it return this money? 8.1. 9. What payments must the company make to shareholders each year they own the stock? 9.1. 10. What payments must the company make to bondholders each year they own the bonds? 11. Companies that sell stock are under no obligation to pay their shareholders anything! This is the safest way to raise money! 12. Companies that borrow money must make annual payments of interest and eventually pay back all the money borrowed! This is the riskiest way of raising money! 13. Is it all or nothing? Does a company wanting to raise $1 billion have to choose debt financing or equity financing? 14. If selling stock is so safe, why don't companies avoid issuing debt altogether? 14.1. 15. Types of Bonds: 15.1. Debenture 15.2.Collateralized or Secured Bonds - a 16. If a corporation offers a debenture and a collateralized bond with the same maturity at the same time, which will have a higher coupon? Why? 17. Web Challenge #1: Research highly leveraged companies that are having difficulties staying alive. What problems are they having in their business or industry that is causing them to have trouble making their interest payments? 18. Web Challenge #2: There are trillions of dollars invested in publicly held companies. One way to determine if a company has too much debt is to compare its debt to some other Name: Period Date dollar figure in the company, such as its annual profit. This is called ratio analysis. Research "financial leverage ratios" and find three that are commonly used to assess indebtedness. 19. Web Challenge #3: Interest is required to be paid to bondholders. Therefore, it is a valid business expense that reduces overall company profits. Lower profits means lower income taxes. The same is not true for dividends, which are an optional payout of excess profits. In a way, the gov't tax policy actually gives a preference to borrowing, which is risky. Research this issue and identify proposals to change the policy so companies do not borrow excessively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started