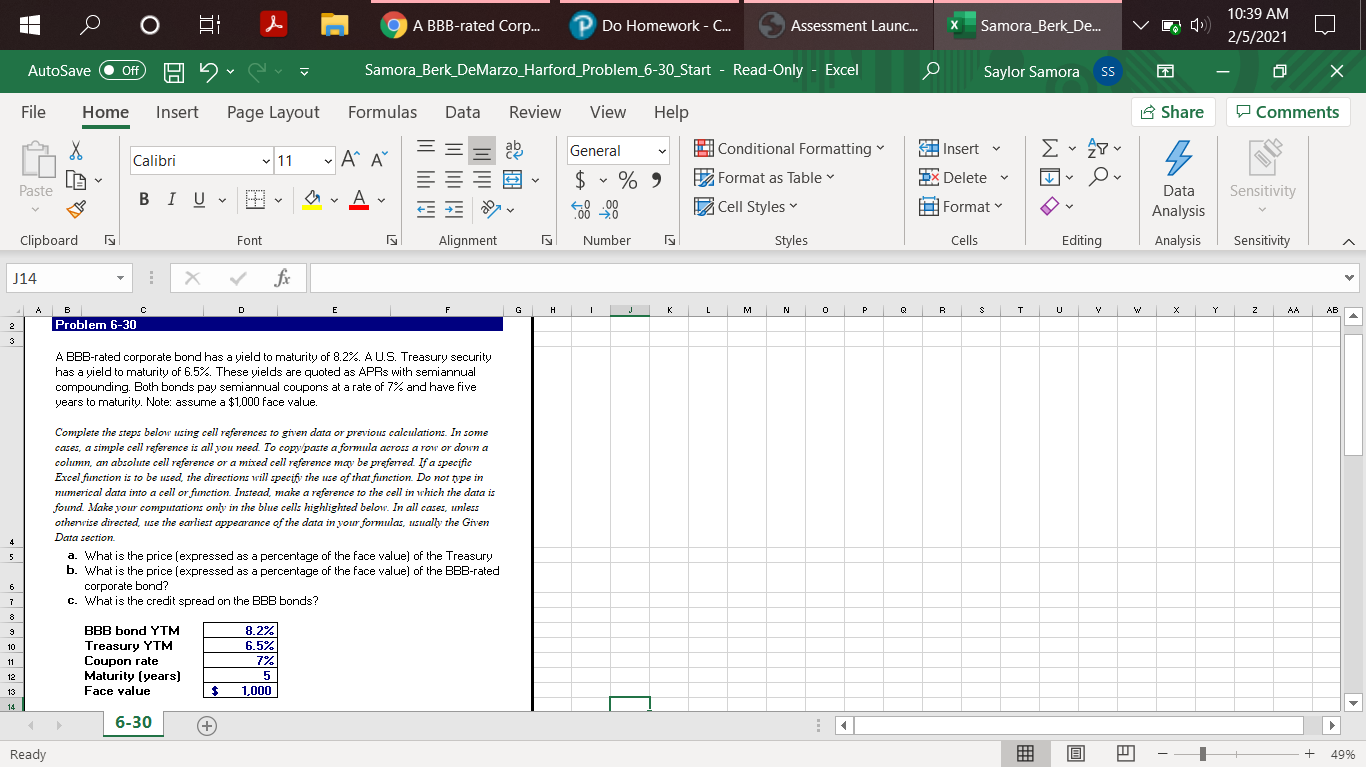

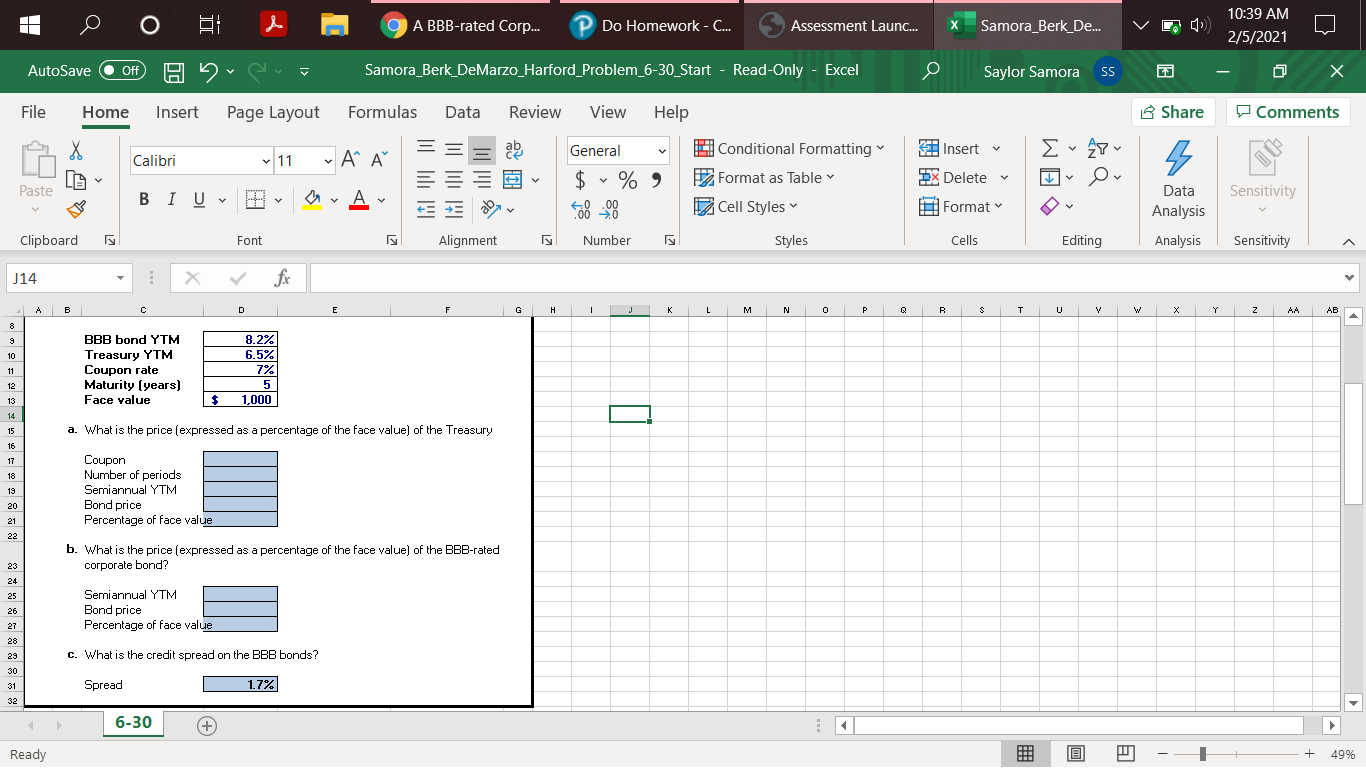

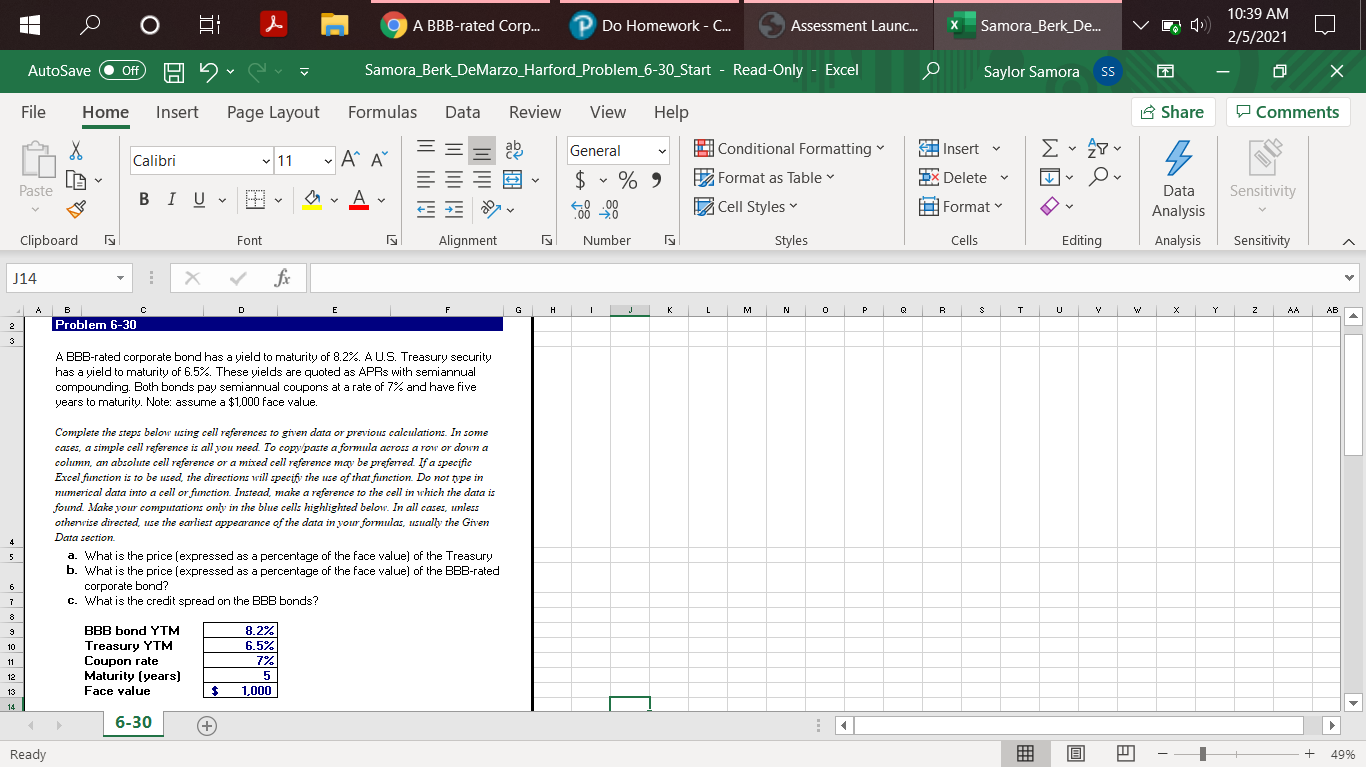

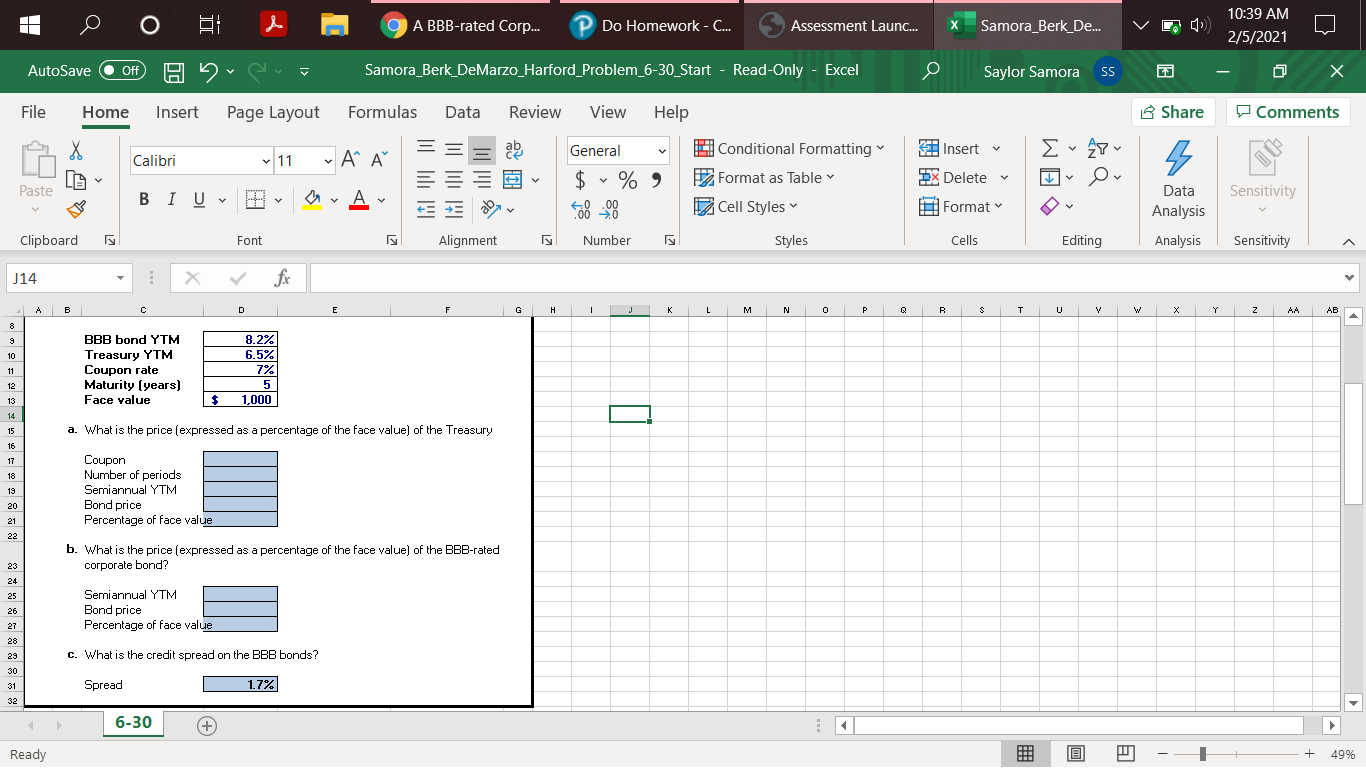

IT 0 0 BI 9 A BBB-rated Corp... Do Homework-C... Assessment Launc... X Samora_Berk_De... 10:39 AM 2/5/2021 AutoSave Off Samora_Berk_DeMarzo_Harford_Problem_6-30_Start - Read-Only - Excel Saylor Samora SS File Home Insert Page Layout Formulas Data Review View Help Share Comments ab # Insert Calibri A - 11 General $ % Qox Conditional Formatting Format as Table Cell Styles 3 E27 Or O AM v 2X Delete Paste BI U Sensitivity .. A Format Data Analysis Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity J14 A H I K M N 0 P Q R T U W Y Z AB Problem 6-30 A BBB-rated corporate bond has a yield to maturity of 8.2%. AU.S. Treasury security has a yield to maturity of 6.5%. These yields are quoted as APRs with semiannual compounding. Both bonds pay semiannual coupons at a rate of 7% and have five years to maturity. Note: assume a $1,000 face value. an Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need to copy paste a formula across a row or down a olute ference or a ed cell reference may be preferred. If scific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found Make your computations only in the blue cells highlighted below. In all cases, unless othenvise directed, use the earliest appearance of the data in your formulas, usually the Given Data section a. What is the price (expressed as a percentage of the face value) of the Treasury b. What is the price lexpressed as a percentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? 8.2% 6.5% BBB bond YTM Treasury YTM Coupon rate Maturity (years) Face value 12 7% 5 1,000 13 $ 14 6-30 6-30 + Ready 1 49% IT 0 0 & 9 A BBB-rated Corp... Do Homework-C... Assessment Launc... Samora_Berk_De... 10:39 AM 2/5/2021 AutoSave Off Ha Samora_Berk_DeMarzo_Harford_Problem_6-30_Start - Read-Only - Excel O Saylor Samora SS File Home Insert Page Layout Formulas Data Review View Help Share Comments X ale # Insert Calibri ~AP - 11 General $ ~ % .00 3 E27 Ov O AM Conditional Formatting Format as Table Cell Styles v v 2X Delete Paste Sensitivity -- Av Format Data Analysis Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity J14 X B C D E F H I K L L M N 0 P Q R T U X Y z AB 8 9 10 11 BBB bond YTM Treasury YTM Coupon rate Maturity (years) Face value 8.2% 6.5% 7% 5 1,000 12 13 14 TI 15 a. What is the price (expressed as a percentage of the face value) of the Treasury 16 17 18 19 Coupon Number of periods Semiannual YTM Bond price Percentage of face value 20 21 22 b. What is the price (expressed as a percentage of the face value) of the BBB-rated corporate bond? 23 24 25 26 27 Semiannual YTM Bond price Percentage of face value 28 c. What is the credit spread on the BBB bonds? 29 30 31 32 Spread 1.7% 6-30 Ready 11 + 49%