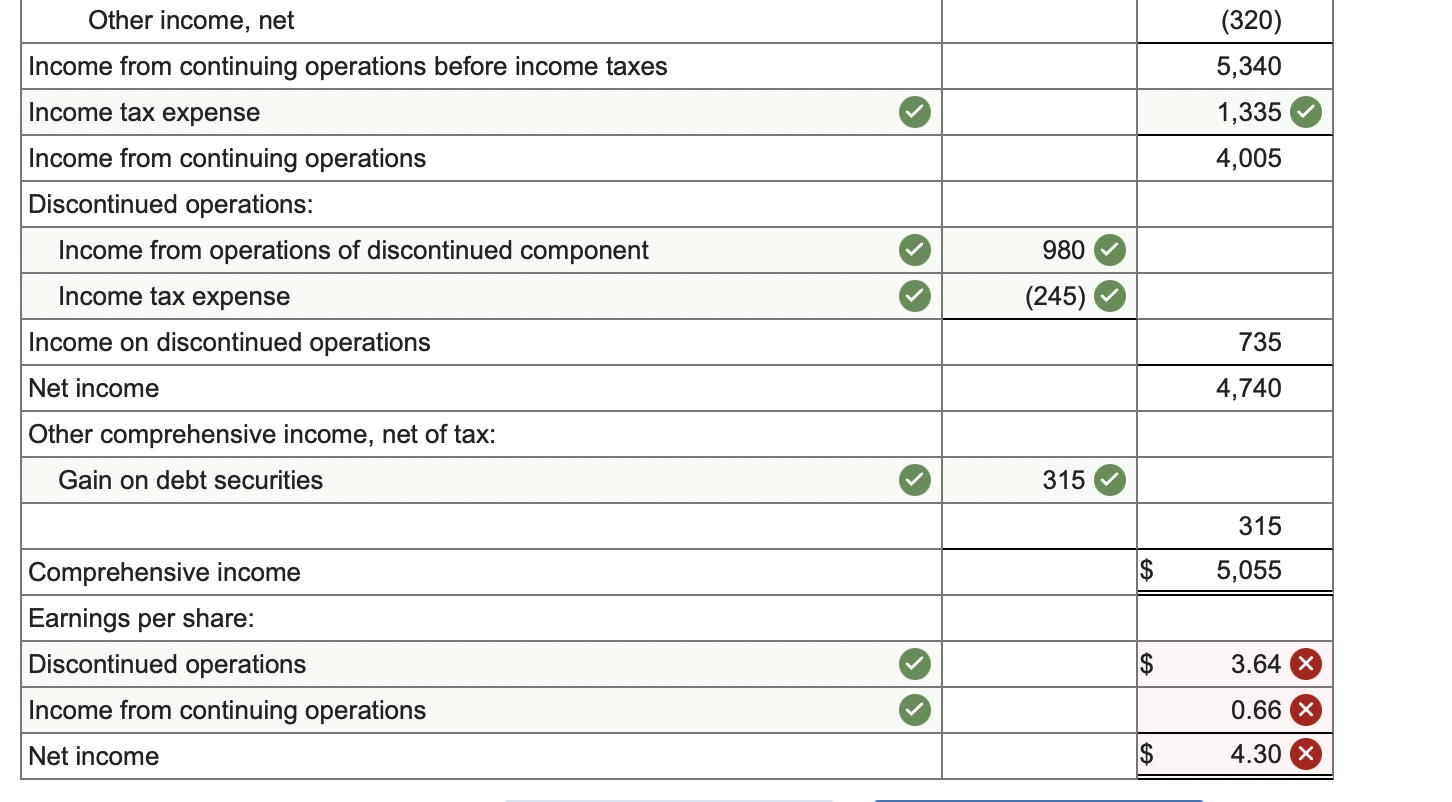

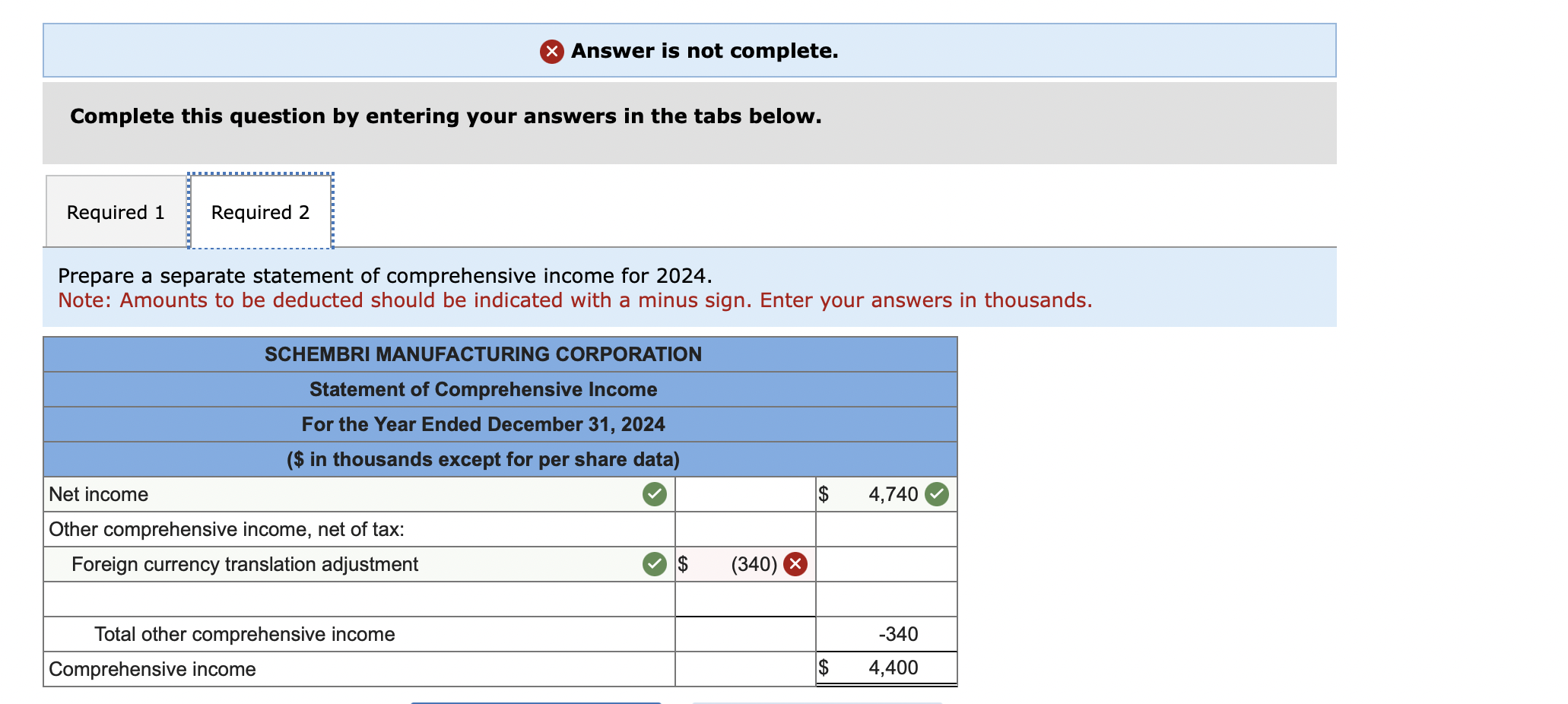

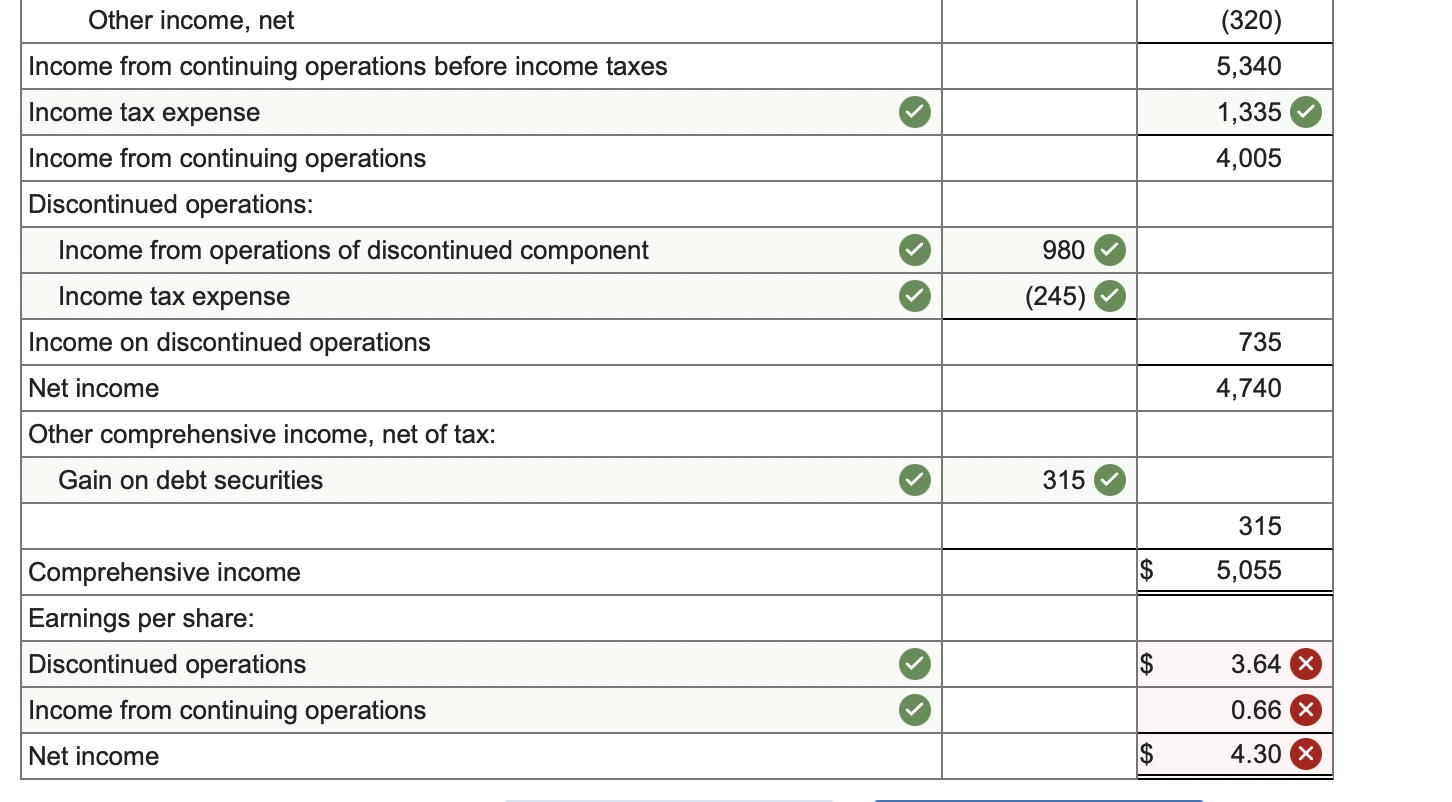

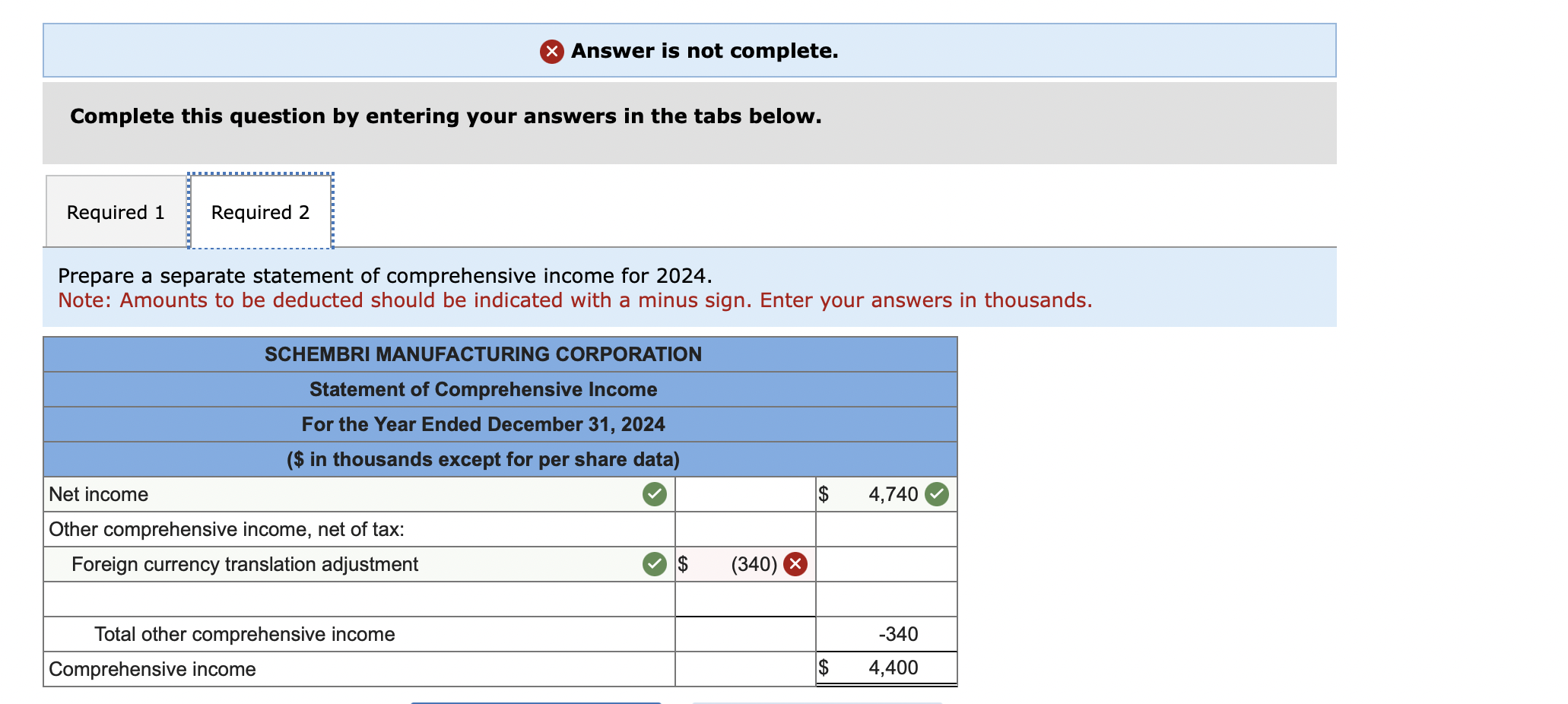

It also says not complete, meaning im missing an account somewhere

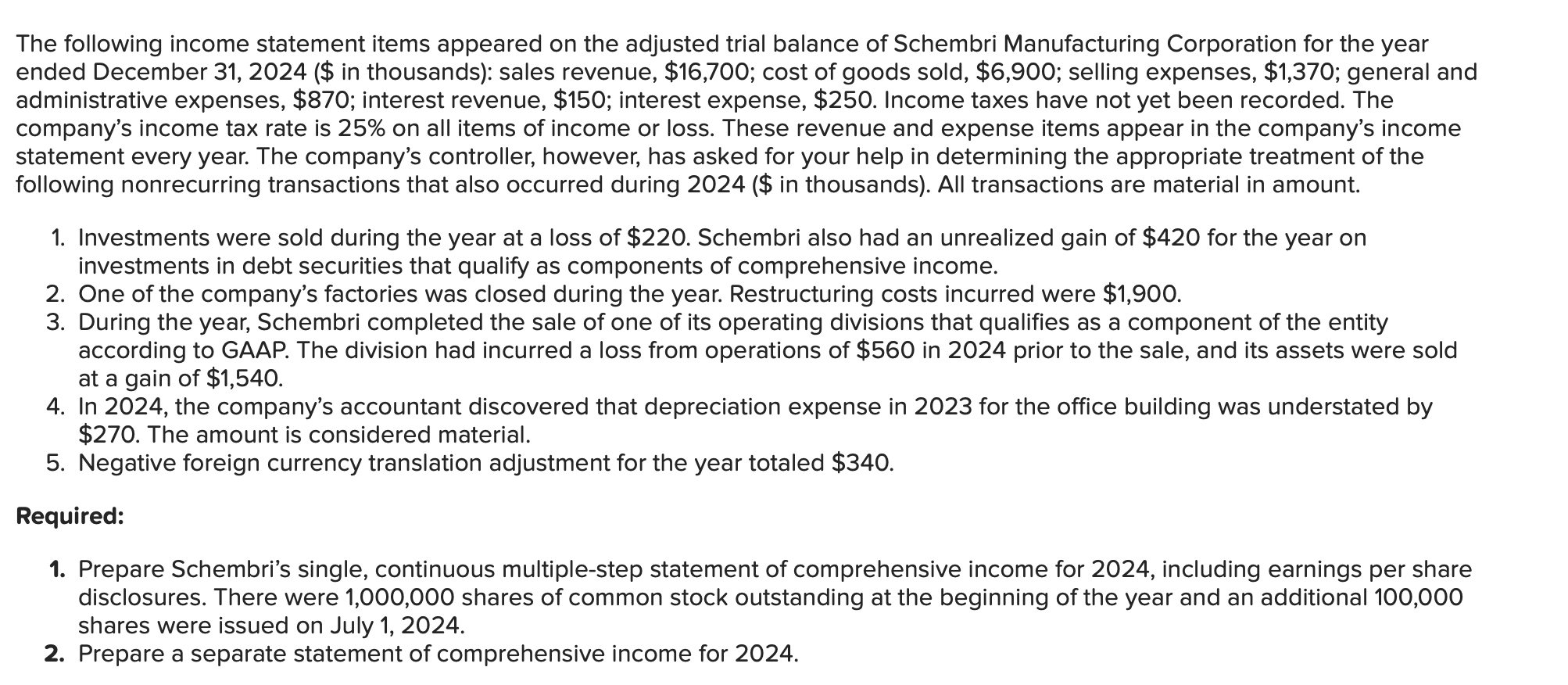

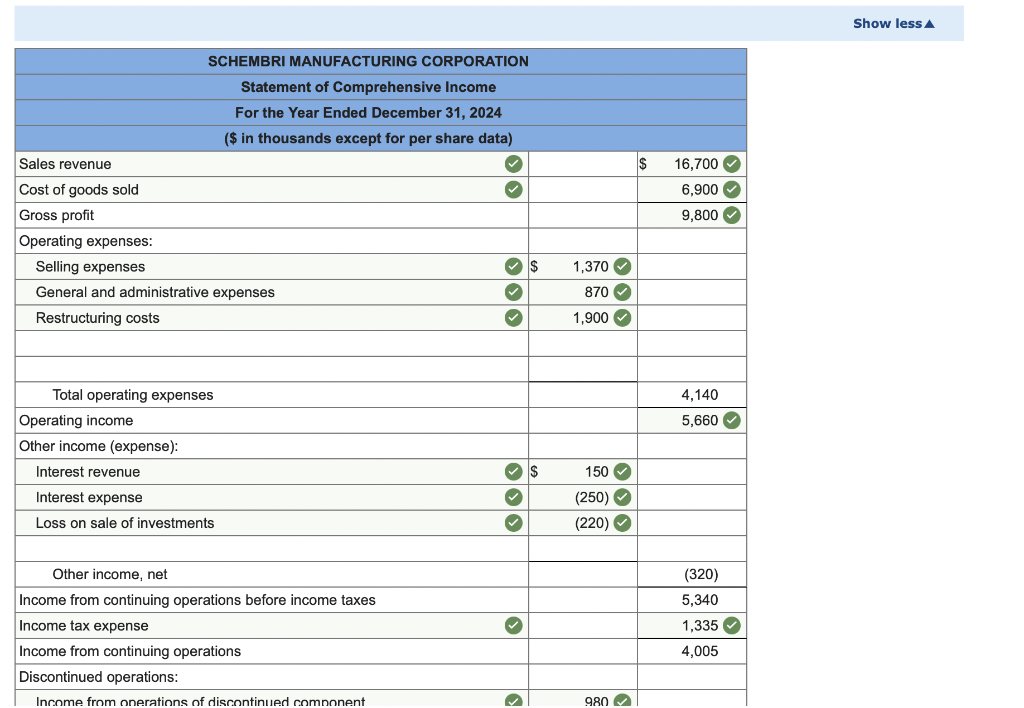

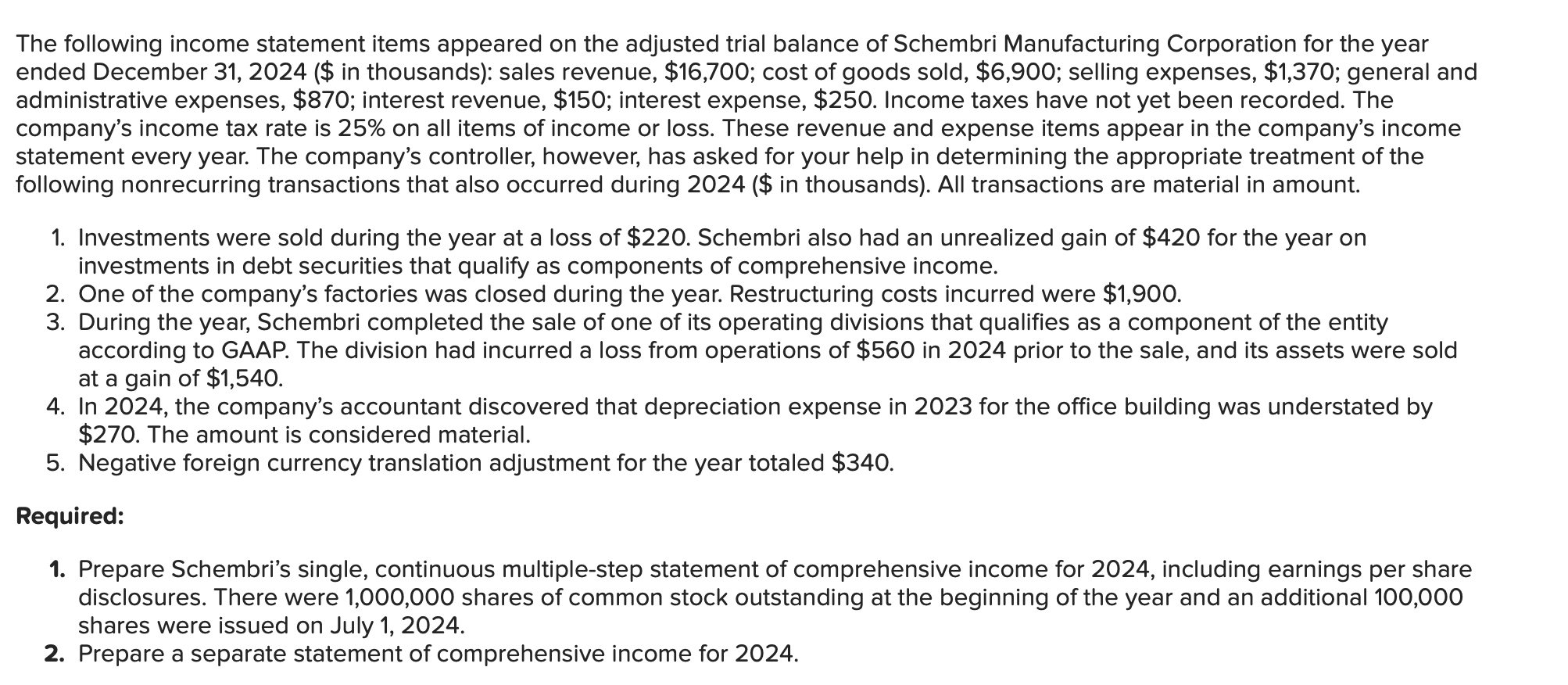

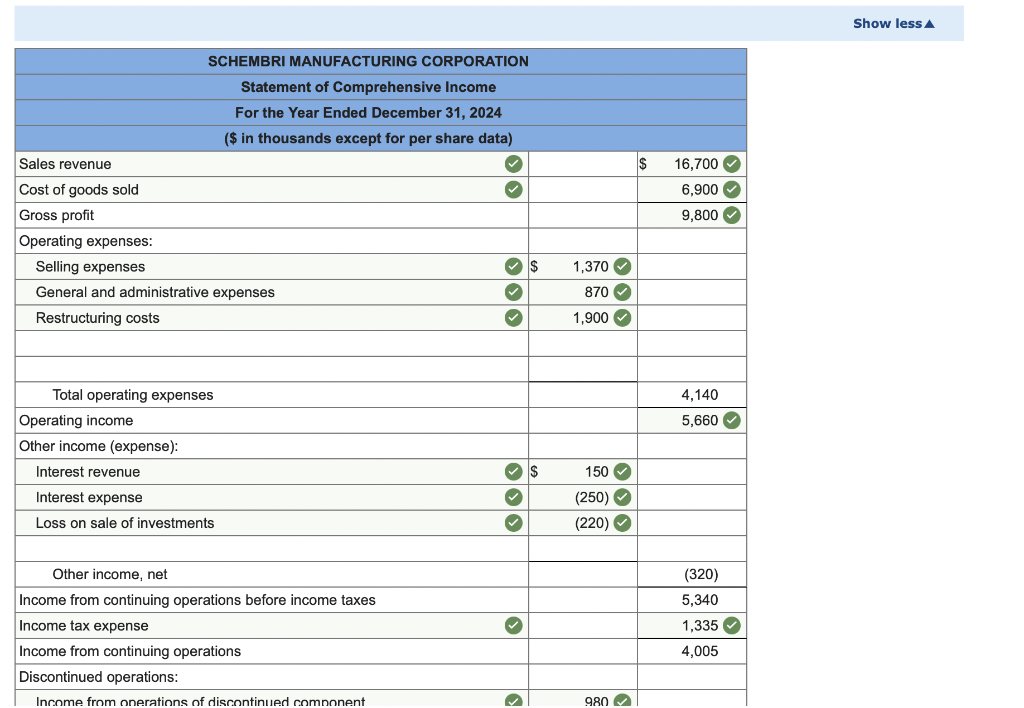

The following income statement items appeared on the adjusted trial balance of Schembri Manufacturing Corporation for the year ended December 31, 2024 ( $ in thousands): sales revenue, $16,700; cost of goods sold, $6,900; selling expenses, $1,370; general and administrative expenses, \$870; interest revenue, $150; interest expense, $250. Income taxes have not yet been recorded. The company's income tax rate is 25% on all items of income or loss. These revenue and expense items appear in the company's income statement every year. The company's controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2024 (\$ in thousands). All transactions are material in amount. 1. Investments were sold during the year at a loss of $220. Schembri also had an unrealized gain of $420 for the year on investments in debt securities that qualify as components of comprehensive income. 2. One of the company's factories was closed during the year. Restructuring costs incurred were $1,900. 3. During the year, Schembri completed the sale of one of its operating divisions that qualifies as a component of the entity according to GAAP. The division had incurred a loss from operations of $560 in 2024 prior to the sale, and its assets were sold at a gain of $1,540. 4. In 2024, the company's accountant discovered that depreciation expense in 2023 for the office building was understated by $270. The amount is considered material. 5. Negative foreign currency translation adjustment for the year totaled $340. Required: disclosures. There were 1,000,000 shares of common stock outstanding at the beginning of the year and an additional 100,000 shares were issued on July 1,2024. 2. Prepare a separate statement of comprehensive income for 2024 . Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a separate statement of comprehensive income for 2024. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands. The following income statement items appeared on the adjusted trial balance of Schembri Manufacturing Corporation for the year ended December 31, 2024 ( $ in thousands): sales revenue, $16,700; cost of goods sold, $6,900; selling expenses, $1,370; general and administrative expenses, \$870; interest revenue, $150; interest expense, $250. Income taxes have not yet been recorded. The company's income tax rate is 25% on all items of income or loss. These revenue and expense items appear in the company's income statement every year. The company's controller, however, has asked for your help in determining the appropriate treatment of the following nonrecurring transactions that also occurred during 2024 (\$ in thousands). All transactions are material in amount. 1. Investments were sold during the year at a loss of $220. Schembri also had an unrealized gain of $420 for the year on investments in debt securities that qualify as components of comprehensive income. 2. One of the company's factories was closed during the year. Restructuring costs incurred were $1,900. 3. During the year, Schembri completed the sale of one of its operating divisions that qualifies as a component of the entity according to GAAP. The division had incurred a loss from operations of $560 in 2024 prior to the sale, and its assets were sold at a gain of $1,540. 4. In 2024, the company's accountant discovered that depreciation expense in 2023 for the office building was understated by $270. The amount is considered material. 5. Negative foreign currency translation adjustment for the year totaled $340. Required: disclosures. There were 1,000,000 shares of common stock outstanding at the beginning of the year and an additional 100,000 shares were issued on July 1,2024. 2. Prepare a separate statement of comprehensive income for 2024 . Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a separate statement of comprehensive income for 2024. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands