Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inker manufactures portable batteries for mobile devices and has a large presence globally. A senior accountant at Inker has approached you for advice on

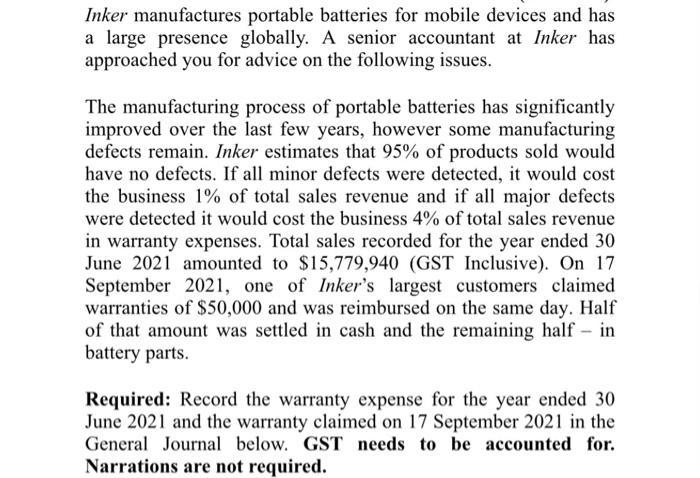

Inker manufactures portable batteries for mobile devices and has a large presence globally. A senior accountant at Inker has approached you for advice on the following issues. The manufacturing process of portable batteries has significantly improved over the last few years, however some manufacturing defects remain. Inker estimates that 95% of products sold would have no defects. If all minor defects were detected, it would cost the business 1% of total sales revenue and if all major defects were detected it would cost the business 4% of total sales revenue in warranty expenses. Total sales recorded for the year ended 30 June 2021 amounted to $15,779,940 (GST Inclusive). On 17 September 2021, one of Inker's largest customers claimed warranties of $50,000 and was reimbursed on the same day. Half of that amount was settled in cash and the remaining half - in battery parts. Required: Record the warranty expense for the year ended 30 June 2021 and the warranty claimed on 17 September 2021 in the General Journal below. GST needs to be accounted for. Narrations are not required.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

General Journal AS AT 30062021 Particulars Sales Made during the year Warrant f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started