Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it has all of the info it has everything $170,000 loday it wil be depreciated on a straight-tine basis over 10 years and has no

it has all of the info

it has everything

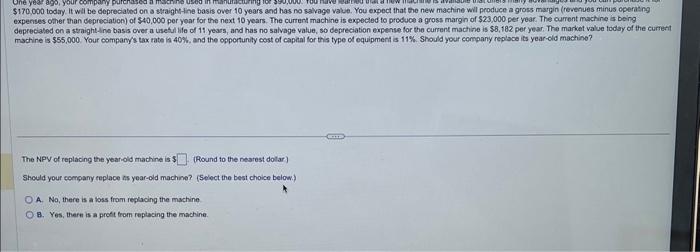

$170,000 loday it wil be depreciated on a straight-tine basis over 10 years and has no salkage value. You expect that the new machine wil produce a gross margin (revenues minus operasng expenses oher than depreciation) of $40,000 per year for the next 10 years. The current machine is expecled to produce a gross margin of $23,000 per year. The current machine is being depreciated on a straight. Ine basis over a usetul lifo of 11 years, and has no salvage value, so depreciation expense for the current mactine is $8,182 per year. The market value today of the current machine is $55,000 Your company/s tax rate is 40%, and the opportunity cost of capial for this type of equipment is 11%. Should your company reploce its year-old machine? The NPV of replacing the yeariold machine is 4 (Pound to the nearest dolar) Should your cempany eeplace is year-old machine? (Select the best choice below.) A. No, there is a toss from replacing the machine B. Yes, thern is a preft from replacing the machine Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started