Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is 1 July 20X5. Woodhouse Co runs a chain of fashion stores with 30 stores nationally and 11 internationally. The company has recently

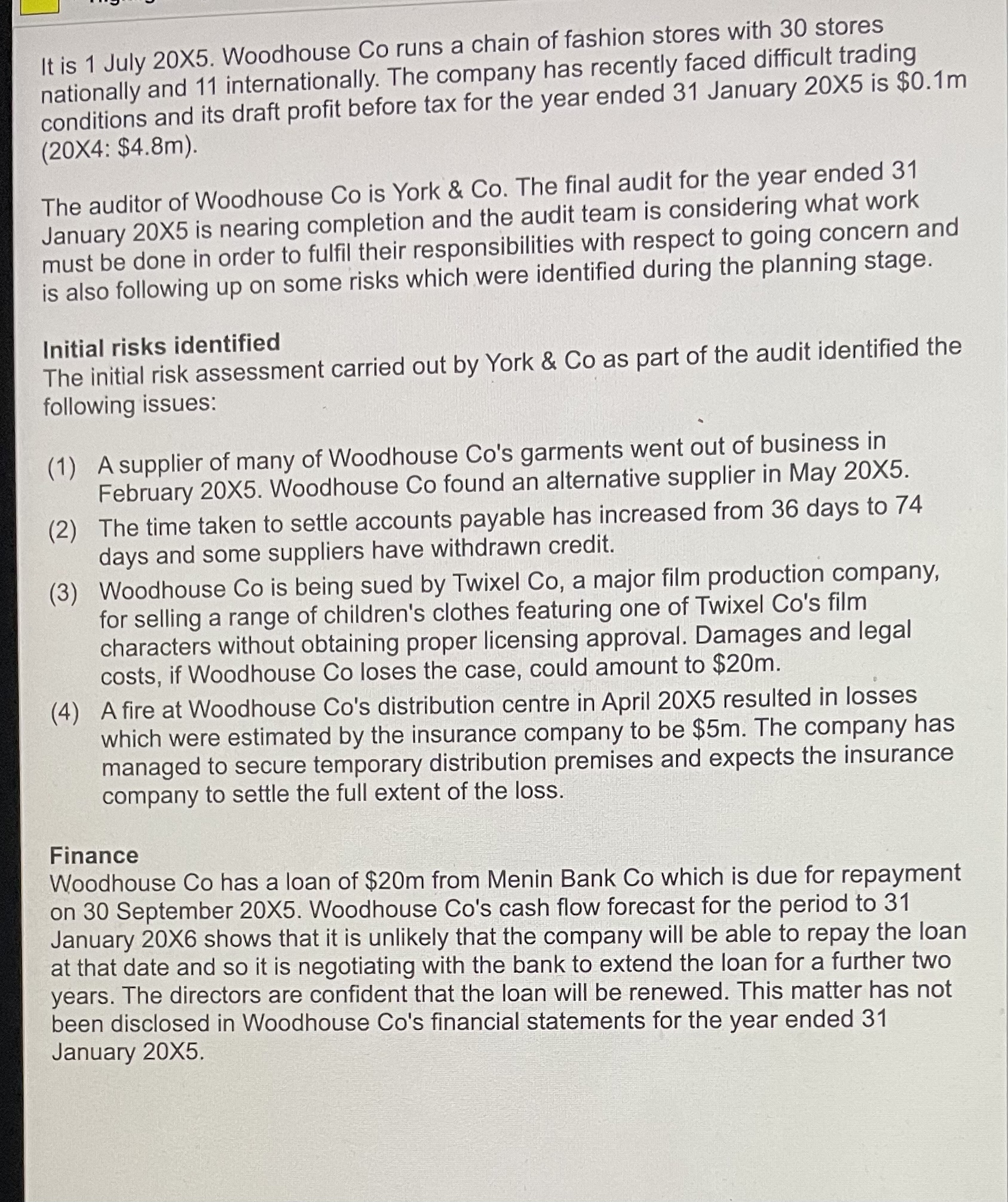

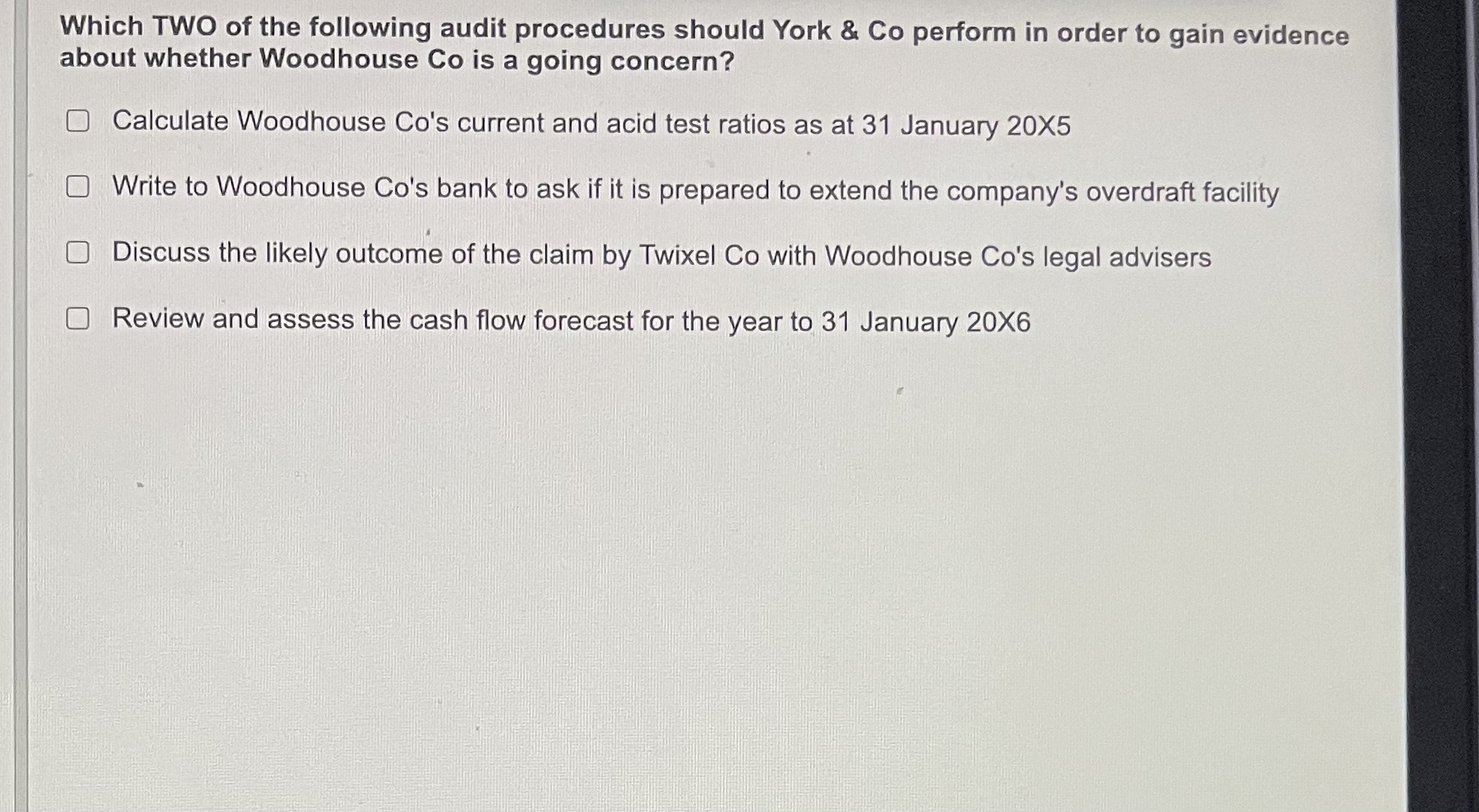

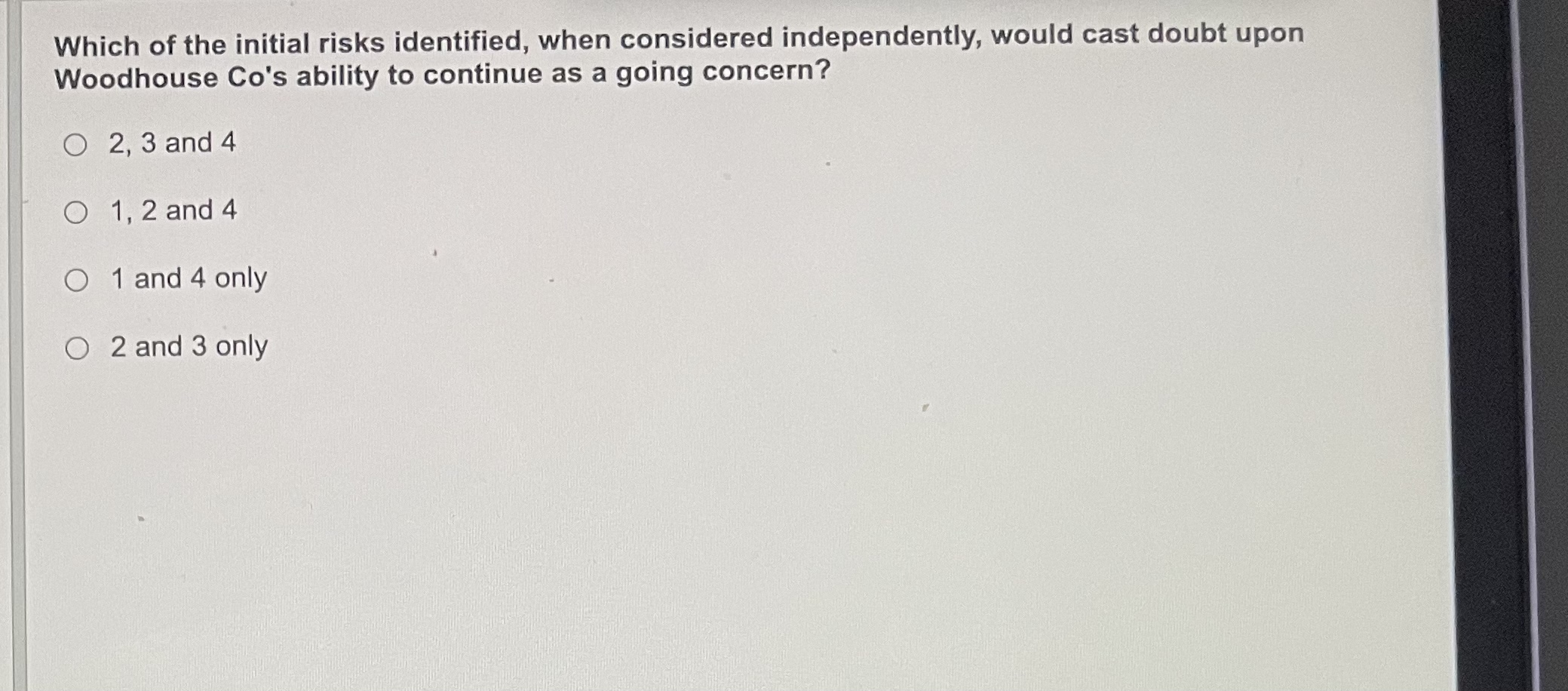

It is 1 July 20X5. Woodhouse Co runs a chain of fashion stores with 30 stores nationally and 11 internationally. The company has recently faced difficult trading conditions and its draft profit before tax for the year ended 31 January 20X5 is $0.1m (20X4: $4.8m). The auditor of Woodhouse Co is York & Co. The final audit for the year ended 31 January 20X5 is nearing completion and the audit team is considering what work must be done in order to fulfil their responsibilities with respect to going concern and is also following up on some risks which were identified during the planning stage. Initial risks identified The initial risk assessment carried out by York & Co as part of the audit identified the following issues: (1) A supplier of many of Woodhouse Co's garments went out of business in February 20X5. Woodhouse Co found an alternative supplier in May 20X5. (2) The time taken to settle accounts payable has increased from 36 days to 74 days and some suppliers have withdrawn credit. (3) Woodhouse Co is being sued by Twixel Co, a major film production company, for selling a range of children's clothes featuring one of Twixel Co's film characters without obtaining proper licensing approval. Damages and legal costs, if Woodhouse Co loses the case, could amount to $20m. (4) A fire at Woodhouse Co's distribution centre in April 20X5 resulted in losses which were estimated by the insurance company to be $5m. The company has managed to secure temporary distribution premises and expects the insurance company to settle the full extent of the loss. Finance Woodhouse Co has a loan of $20m from Menin Bank Co which is due for repayment on 30 September 20X5. Woodhouse Co's cash flow forecast for the period to 31 January 20X6 shows that it is unlikely that the company will be able to repay the loan at that date and so it is negotiating with the bank to extend the loan for a further two years. The directors are confident that the loan will be renewed. This matter has not been disclosed in Woodhouse Co's financial statements for the year ended 31 January 20X5. Which TWO of the following audit procedures should York & Co perform in order to gain evidence about whether Woodhouse Co is a going concern? Calculate Woodhouse Co's current and acid test ratios as at 31 January 20X5 Write to Woodhouse Co's bank to ask if it is prepared to extend the company's overdraft facility Discuss the likely outcome of the claim by Twixel Co with Woodhouse Co's legal advisers Review and assess the cash flow forecast for the year to 31 January 20X6 Which of the initial risks identified, when considered independently, would cast doubt upon Woodhouse Co's ability to continue as a going concern? O 2, 3 and 4 O 1, 2 and 4 O 1 and 4 only O2 and 3 only

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Explain each of the audit procedures and their relevance to assessing whether Woodhouse Co is a going concern Calculate Woodhouse Cos current and acid test ratios as at 31 January 20X5 This audit pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started