Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is 2023, and Black Friday Inc. has successfully been growing its sales over the last 3 years: from just $200 million in 2020

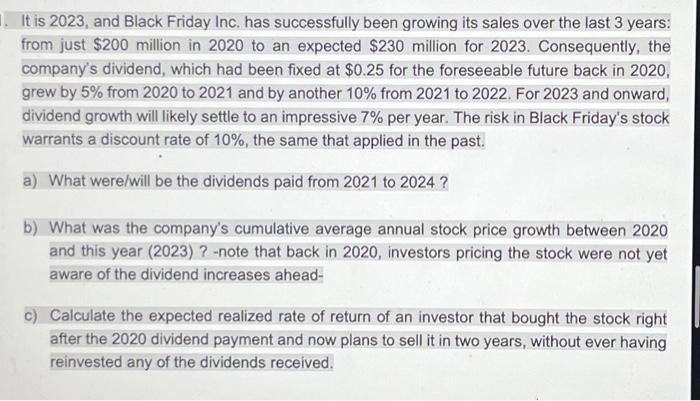

It is 2023, and Black Friday Inc. has successfully been growing its sales over the last 3 years: from just $200 million in 2020 to an expected $230 million for 2023. Consequently, the company's dividend, which had been fixed at $0.25 for the foreseeable future back in 2020, grew by 5% from 2020 to 2021 and by another 10% from 2021 to 2022. For 2023 and onward, dividend growth will likely settle to an impressive 7% per year. The risk in Black Friday's stock warrants a discount rate of 10%, the same that applied in the past. a) What were/will be the dividends paid from 2021 to 2024 ? b) What was the company's cumulative average annual stock price growth between 2020 and this year (2023) ? -note that back in 2020, investors pricing the stock were not yet aware of the dividend increases ahead- c) Calculate the expected realized rate of return of an investor that bought the stock right after the 2020 dividend payment and now plans to sell it in two years, without ever having reinvested any of the dividends received. It is 2023, and Black Friday Inc. has successfully been growing its sales over the last 3 years: from just $200 million in 2020 to an expected $230 million for 2023. Consequently, the company's dividend, which had been fixed at $0.25 for the foreseeable future back in 2020, grew by 5% from 2020 to 2021 and by another 10% from 2021 to 2022. For 2023 and onward, dividend growth will likely settle to an impressive 7% per year. The risk in Black Friday's stock warrants a discount rate of 10%, the same that applied in the past. a) What were/will be the dividends paid from 2021 to 2024 ? b) What was the company's cumulative average annual stock price growth between 2020 and this year (2023) ? -note that back in 2020, investors pricing the stock were not yet aware of the dividend increases ahead- c) Calculate the expected realized rate of return of an investor that bought the stock right after the 2020 dividend payment and now plans to sell it in two years, without ever having reinvested any of the dividends received.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a The dividends paid from 2021 to 2024 are 2021 025 unchanged from 2020 2022 0275 5 increase from 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started