It is about option and put-call parity. Please solve this question for me. Thanks

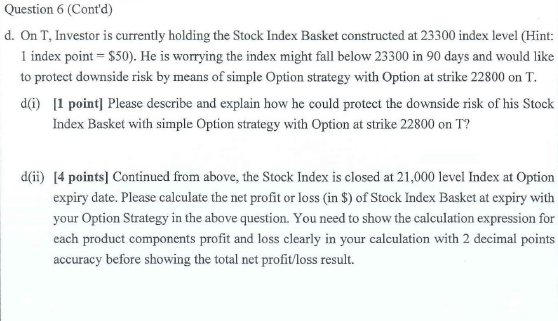

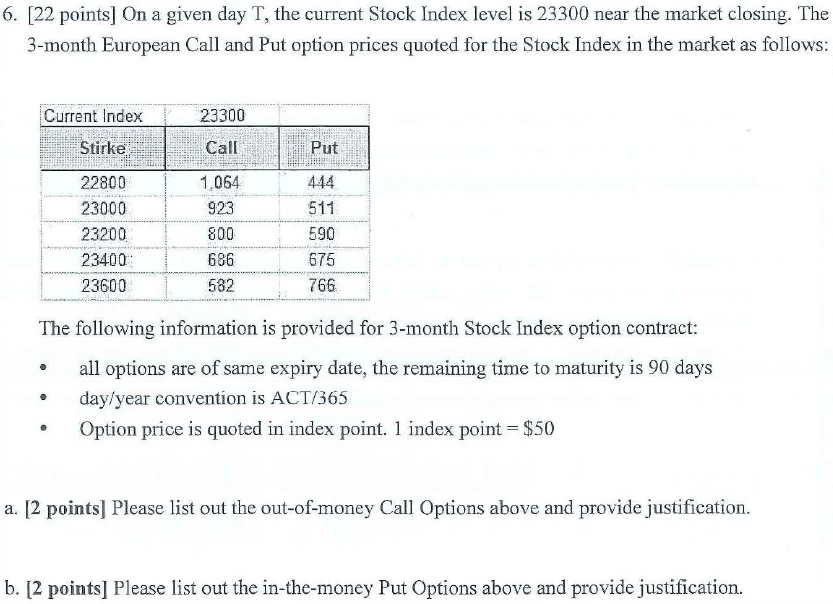

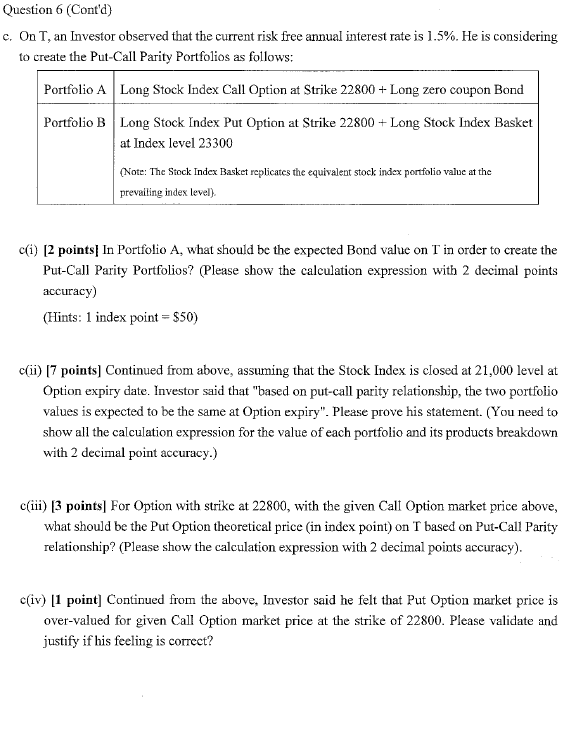

22 points On a given day I , the current Stock Index level is 23300 near the market closing . The 3 - month European Call and Put option prices quoted for the Stock Index in the market as follows The following i information is provided for 3 - month Stock Index option contract : all options are of same expiry date , the remaining time to maturity is 90 days day / year convention is ACT 1 365 Option price is quoted in index point . I index point - 850 a . 2 points Please list out the out- of money Call Options above and provide justification 6 . 1 2 points Please list out the in- the money Put Options above and provide justificationQuestion 6 ( Cont'd ) C . On I , an Investor observed that the current risk free annual interest rate is 1 5 . He is considering SOCIAL to create the Put - Call Parity Portfolios as follow FLOWS Portfolio A Long Stock Index Call Option at Strike 22800 + Long zero coupon Bond Portfolio B Long Stock Index Put Option at Strike 22800 + Long Stock Index Basket at Index level 23300 Note : The Stock Index Basket replicates the equivalent stock index portfolio value at it at the prevailline loides level of1 ) 2 points In Portfolio A what should be the expected Bond value on I in order to create the Put - Call Parity Portfolios ? Please show the calculation expression with 2 decimal point accuracy ) ( Hints : I index point - 350 ( 11 ) 7 points Continued from above , assuming that the Stock Index is closed at 21 090 level at Option expiry date . Investor said that " based on put - call parity relationship , the two portfolio values is expected to be the same at Option expiry " Please prove his statement . ( You need to show all the calculation expression for the value of each portfolio and it's products breakdown with 2 decimal point accuracy . ) ( 1 3 points For Option with strike at 2280 0 with the given Call Option market price above what should be the Put Option theoretical price ( in index point ) on I based on Put - Call Parity relationship ? ( Please show the calculation expression with 2 decimal points accuracy ) (in 1 point Continued from the above , Investor said he felt that Put Option market price rice is over-valued for given Call Option market price at the strike of 22809 Please validate and justify if his feeling is correct ?Question 6 (Cont'd) d. On T, Investor is currently holding the Stock Index Basket constructed at 23300 index level (Hint: 1 index point = $50). He is worrying the index might fall below 23300 in 90 days and would like to protect downside risk by means of simple Option strategy with Option at strike 22800 on T. d(i) [1 point] Please describe and explain how he could protect the downside risk of his Stock Index Basket with simple Option strategy with Option at strike 22800 on T? d(ii) [4 points] Continued from above, the Stock Index is closed at 21,000 level Index at Option expiry date. Please calculate the net profit or loss (in $) of Stock Index Basket at expiry with your Option Strategy in the above question. You need to show the calculation expression for each product components profit and loss clearly in your calculation with 2 decimal points accuracy before showing the total net profit/loss result