Answered step by step

Verified Expert Solution

Question

1 Approved Answer

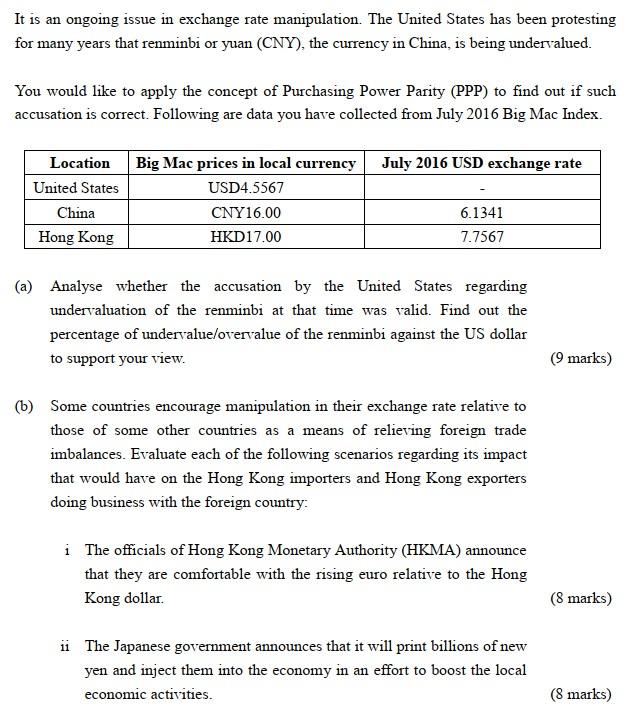

It is an ongoing issue in exchange rate manipulation. The United States has been protesting for many years that renminbi or yuan (CNY), the

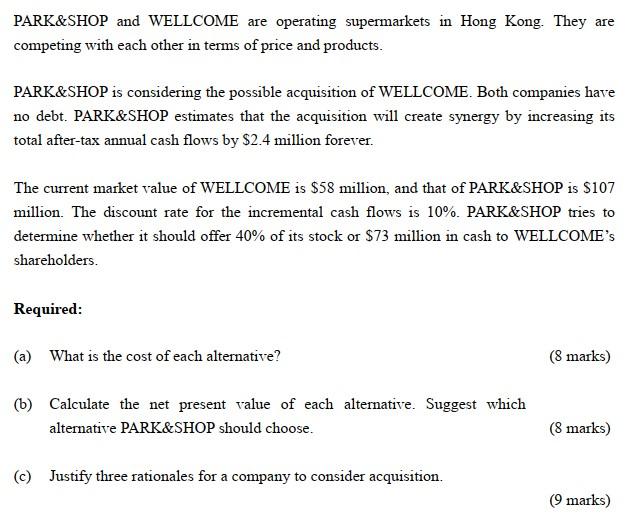

It is an ongoing issue in exchange rate manipulation. The United States has been protesting for many years that renminbi or yuan (CNY), the currency in China, is being undervalued. You would like to apply the concept of Purchasing Power Parity (PPP) to find out if such accusation is correct. Following are data you have collected from July 2016 Big Mac Index. Location United States China Hong Kong Big Mac prices in local currency July 2016 USD exchange rate USD4.5567 CNY 16.00 HKD17.00 6.1341 7.7567 (a) Analyse whether the accusation by the United States regarding undervaluation of the renminbi at that time was valid. Find out the percentage of undervalue/overvalue of the renminbi against the US dollar to support your view. (b) Some countries encourage manipulation in their exchange rate relative to those of some other countries as a means of relieving foreign trade imbalances. Evaluate each of the following scenarios regarding its impact that would have on the Hong Kong importers and Hong Kong exporters doing business with the foreign country: i The officials of Hong Kong Monetary Authority (HKMA) announce that they are comfortable with the rising euro relative to the Hong Kong dollar. ii The Japanese government announces that it will print billions of new yen and inject them into the economy in an effort to boost the local economic activities. (9 marks) (8 marks) (8 marks) PARK&SHOP and WELLCOME are operating supermarkets in Hong Kong. They are competing with each other in terms of price and products. PARK&SHOP is considering the possible acquisition of WELLCOME. Both companies have no debt. PARK&SHOP estimates that the acquisition will create synergy by increasing its total after-tax annual cash flows by $2.4 million forever. The current market value of WELLCOME is $58 million, and that of PARK&SHOP is $107 million. The discount rate for the incremental cash flows is 10%. PARK&SHOP tries to determine whether it should offer 40% of its stock or $73 million in cash to WELLCOME's shareholders. Required: (a) What is the cost of each alternative? (b) Calculate the net present value of each alternative. Suggest which alternative PARK&SHOP should choose. (c) Justify three rationales for a company to consider acquisition. (8 marks) (8 marks) (9 marks)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution This case study involves analyzing the impact of exchange rate manipulation on the Hong Kong economy and evaluating the effectiveness of diff...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started