Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is April 3,2023 , and a manager of Renewable Fuels, Inc. anticipates buying 375,000 bu of grain sorghum on May 30, 2023. Grain sorghum

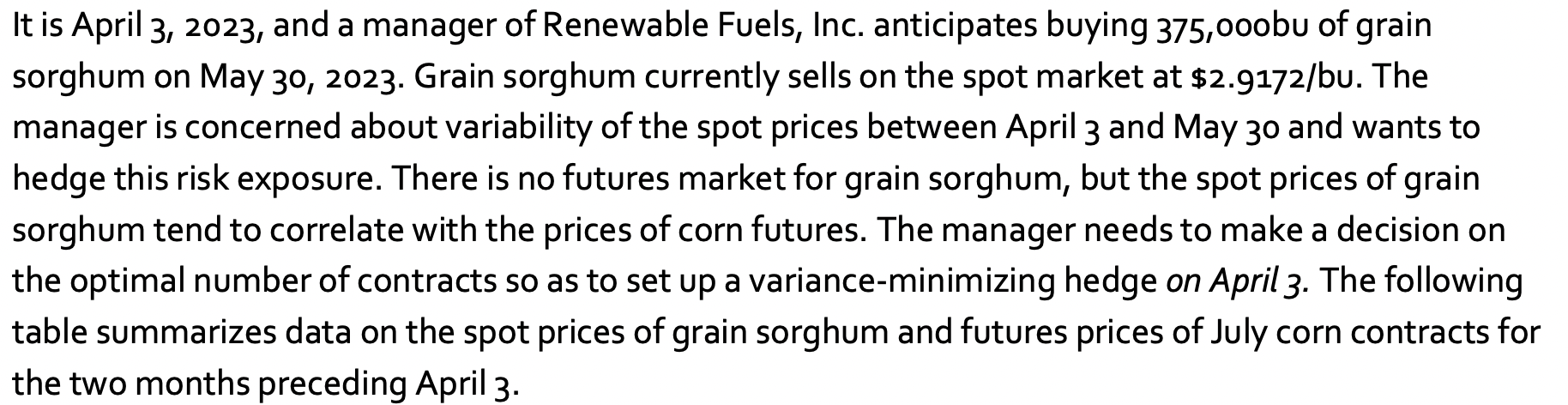

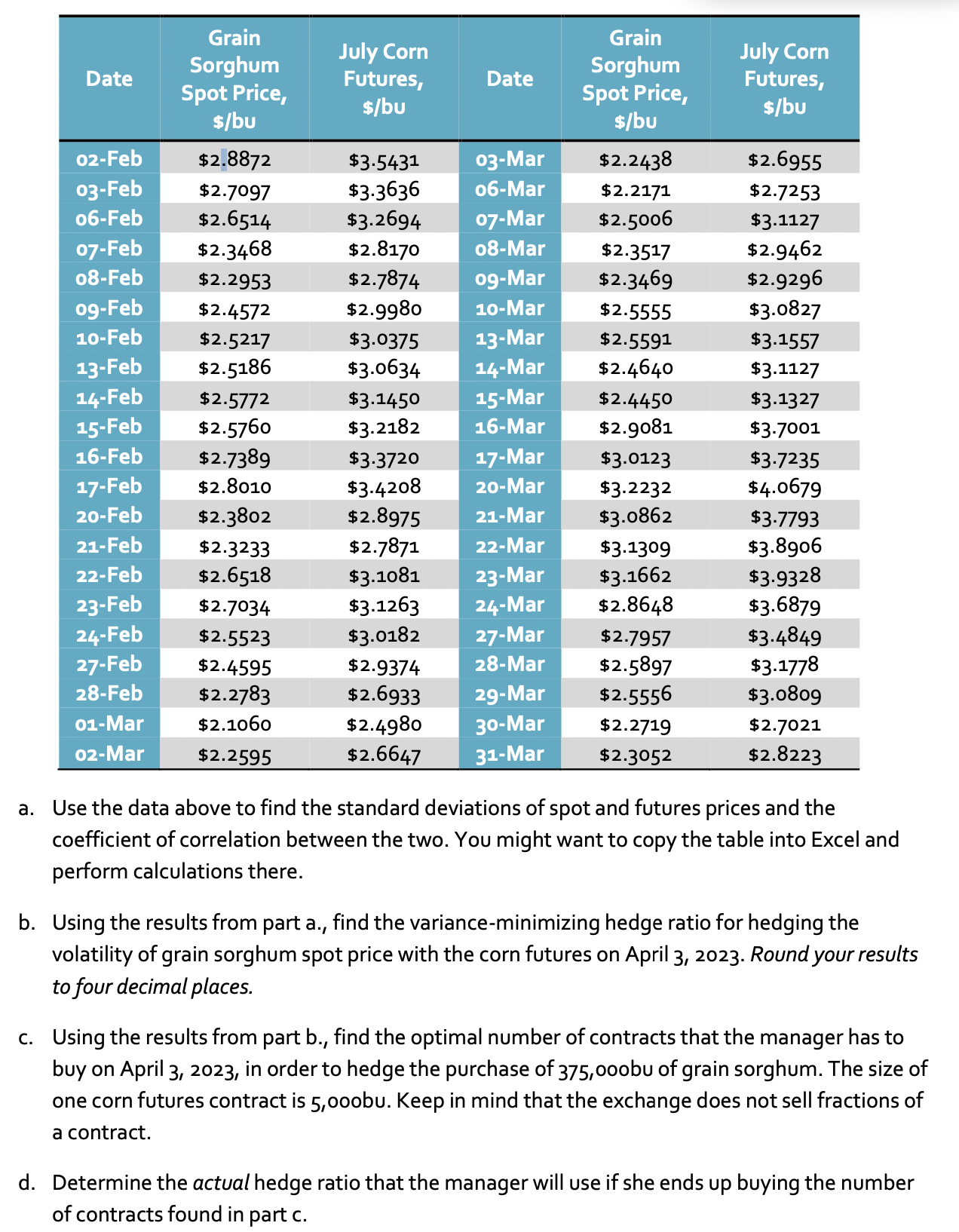

It is April 3,2023 , and a manager of Renewable Fuels, Inc. anticipates buying 375,000 bu of grain sorghum on May 30, 2023. Grain sorghum currently sells on the spot market at $2.9172/bu. The manager is concerned about variability of the spot prices between April 3 and May 30 and wants to hedge this risk exposure. There is no futures market for grain sorghum, but the spot prices of grain sorghum tend to correlate with the prices of corn futures. The manager needs to make a decision on the optimal number of contracts so as to set up a variance-minimizing hedge on April 3 . The following table summarizes data on the spot prices of grain sorghum and futures prices of July corn contracts fo the two months preceding April 3. a. Use the data above to find the standard deviations of spot and futures prices and the coefficient of correlation between the two. You might want to copy the table into Excel and perform calculations there. b. Using the results from part a., find the variance-minimizing hedge ratio for hedging the volatility of grain sorghum spot price with the corn futures on April 3, 2023. Round your results to four decimal places. c. Using the results from part b., find the optimal number of contracts that the manager has to buy on April 3,2023, in order to hedge the purchase of 375,000 bu of grain sorghum. The size of one corn futures contract is 5,000 bu. Keep in mind that the exchange does not sell fractions of a contract. d. Determine the actual hedge ratio that the manager will use if she ends up buying the number of contracts found in part c

It is April 3,2023 , and a manager of Renewable Fuels, Inc. anticipates buying 375,000 bu of grain sorghum on May 30, 2023. Grain sorghum currently sells on the spot market at $2.9172/bu. The manager is concerned about variability of the spot prices between April 3 and May 30 and wants to hedge this risk exposure. There is no futures market for grain sorghum, but the spot prices of grain sorghum tend to correlate with the prices of corn futures. The manager needs to make a decision on the optimal number of contracts so as to set up a variance-minimizing hedge on April 3 . The following table summarizes data on the spot prices of grain sorghum and futures prices of July corn contracts fo the two months preceding April 3. a. Use the data above to find the standard deviations of spot and futures prices and the coefficient of correlation between the two. You might want to copy the table into Excel and perform calculations there. b. Using the results from part a., find the variance-minimizing hedge ratio for hedging the volatility of grain sorghum spot price with the corn futures on April 3, 2023. Round your results to four decimal places. c. Using the results from part b., find the optimal number of contracts that the manager has to buy on April 3,2023, in order to hedge the purchase of 375,000 bu of grain sorghum. The size of one corn futures contract is 5,000 bu. Keep in mind that the exchange does not sell fractions of a contract. d. Determine the actual hedge ratio that the manager will use if she ends up buying the number of contracts found in part c Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started