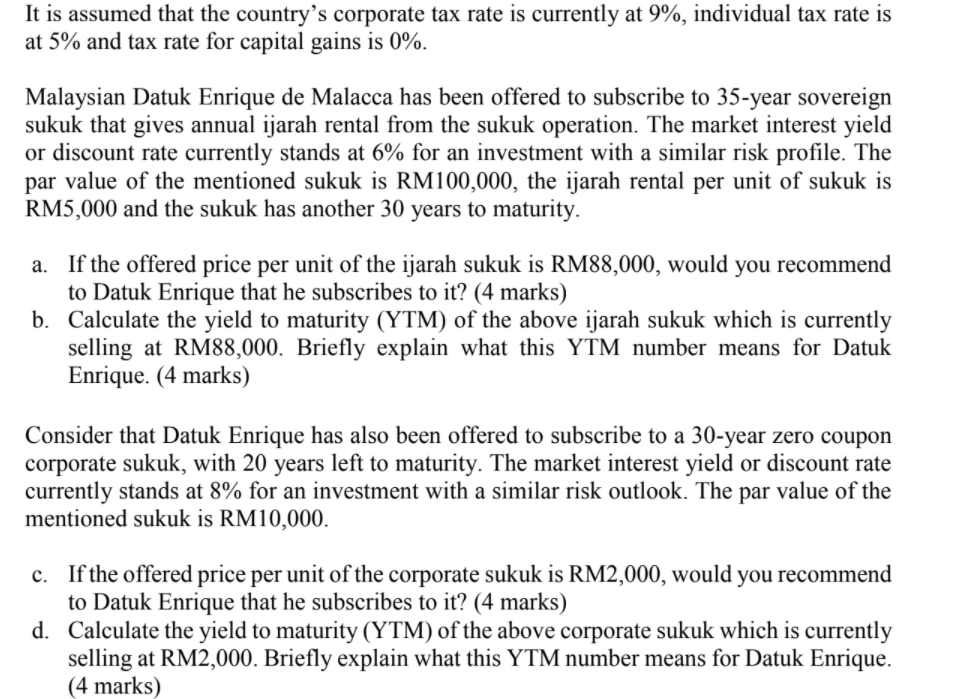

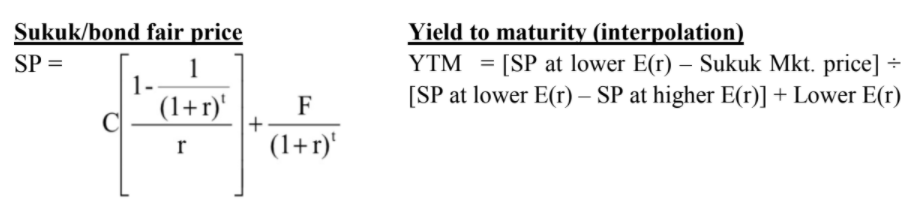

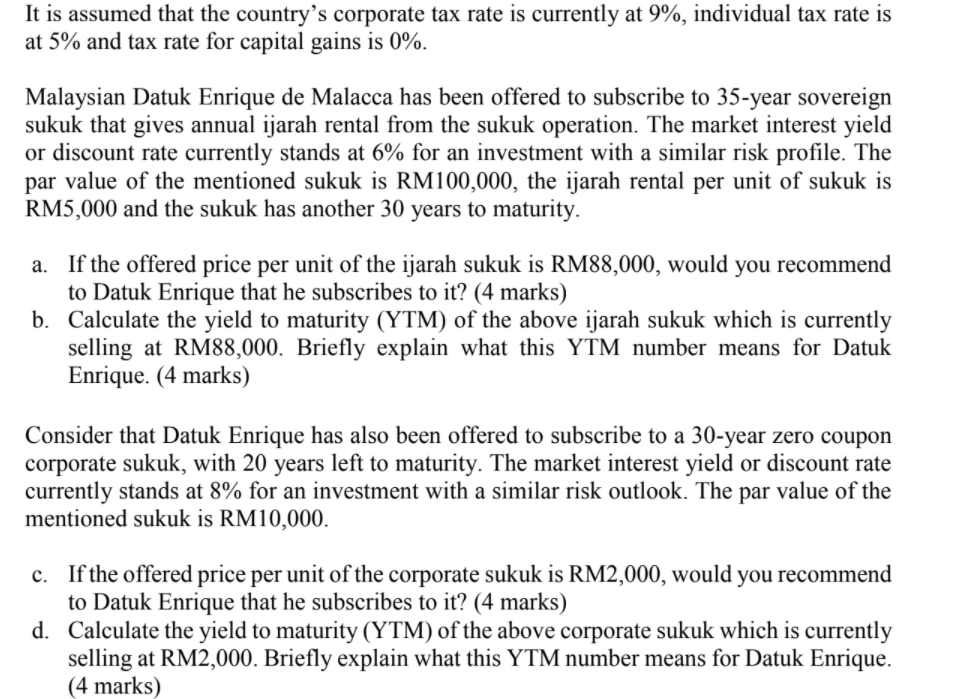

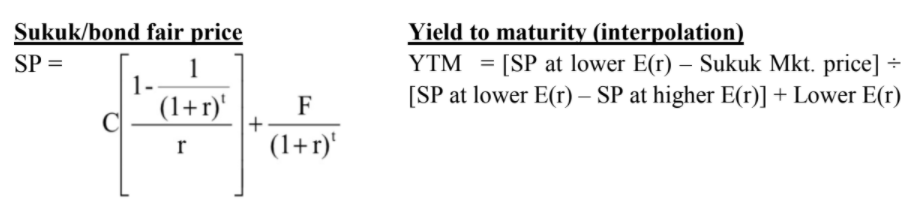

It is assumed that the country's corporate tax rate is currently at 9%, individual tax rate is at 5% and tax rate for capital gains is 0%. Malaysian Datuk Enrique de Malacca has been offered to subscribe to 35-year sovereign sukuk that gives annual ijarah rental from the sukuk operation. The market interest yield or discount rate currently stands at 6% for an investment with a similar risk profile. The par value of the mentioned sukuk is RM100,000, the ijarah rental per unit of sukuk is RM5,000 and the sukuk has another 30 years to maturity. If the offered price per unit of the ijarah sukuk is RM88,000, would you recommend to Datuk Enrique that he subscribes to it? (4 marks) b. Calculate the yield to maturity (YTM) of the above ijarah sukuk which is currently selling at RM88,000. Briefly explain what this YTM number means for Datuk Enrique. (4 marks) Consider that Datuk Enrique has also been offered to subscribe to a 30-year zero coupon corporate sukuk, with 20 years left to maturity. The market interest yield or discount rate currently stands at 8% for an investment with a similar risk outlook. The par value of the mentioned sukuk is RM10,000. c. If the offered price per unit of the corporate sukuk is RM2,000, would you recommend to Datuk Enrique that he subscribes to it? (4 marks) d. Calculate the yield to maturity (YTM) of the above corporate sukuk which is currently selling at RM2,000. Briefly explain what this YTM number means for Datuk Enrique. (4 marks) Sukuk/bond fair price SP= 1 1 - (1+r)' Yield to maturity (interpolation) YTM = [SP at lower E(r) - Sukuk Mkt. price] = [SP at lower E(r) SP at higher E(r)] + Lower E(r) F (1+r)' r It is assumed that the country's corporate tax rate is currently at 9%, individual tax rate is at 5% and tax rate for capital gains is 0%. Malaysian Datuk Enrique de Malacca has been offered to subscribe to 35-year sovereign sukuk that gives annual ijarah rental from the sukuk operation. The market interest yield or discount rate currently stands at 6% for an investment with a similar risk profile. The par value of the mentioned sukuk is RM100,000, the ijarah rental per unit of sukuk is RM5,000 and the sukuk has another 30 years to maturity. If the offered price per unit of the ijarah sukuk is RM88,000, would you recommend to Datuk Enrique that he subscribes to it? (4 marks) b. Calculate the yield to maturity (YTM) of the above ijarah sukuk which is currently selling at RM88,000. Briefly explain what this YTM number means for Datuk Enrique. (4 marks) Consider that Datuk Enrique has also been offered to subscribe to a 30-year zero coupon corporate sukuk, with 20 years left to maturity. The market interest yield or discount rate currently stands at 8% for an investment with a similar risk outlook. The par value of the mentioned sukuk is RM10,000. c. If the offered price per unit of the corporate sukuk is RM2,000, would you recommend to Datuk Enrique that he subscribes to it? (4 marks) d. Calculate the yield to maturity (YTM) of the above corporate sukuk which is currently selling at RM2,000. Briefly explain what this YTM number means for Datuk Enrique. (4 marks) Sukuk/bond fair price SP= 1 1 - (1+r)' Yield to maturity (interpolation) YTM = [SP at lower E(r) - Sukuk Mkt. price] = [SP at lower E(r) SP at higher E(r)] + Lower E(r) F (1+r)' r