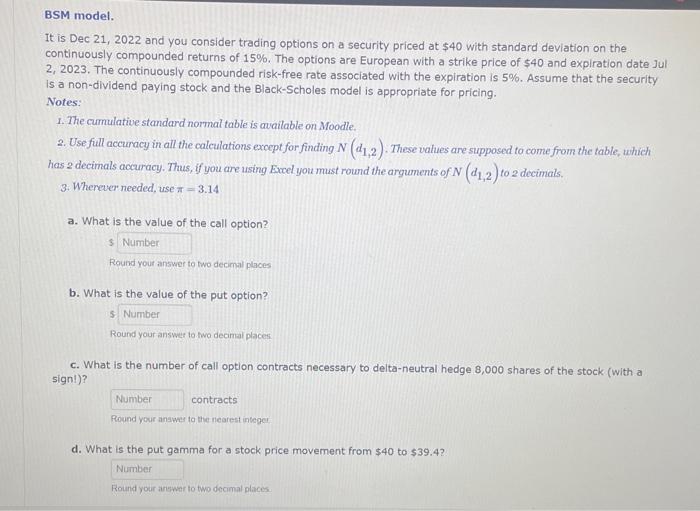

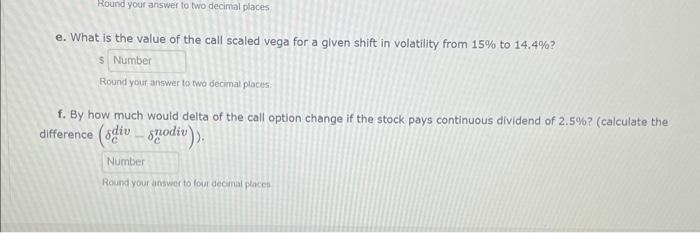

It is Dec 21,2022 and you consider trading options on a security priced at $40 with standard deviation on the continuously compounded returns of 15%. The options are European with a strike price of $40 and expiration date Jul 2,2023 . The continuously compounded risk-free rate associated with the expiration is 5%. Assume that the security is a non-dividend paying stock and the Black-Scholes model is appropriate for pricing. Notes: 1. The curmulative standard normal table is available on Moodle. 2. Use full accuracy in all the calculations except for finding N(d1,2). These values are supposed to come from the table, which has 2 decimals accuracy. Thus, if you are using Excel you must round the arguments of N(d1,2) to 2 decimals. 3. Wherever needed, use =3.14 a. What is the value of the call option? s. Round your answer to two decimal places b. What is the value of the put option? 5 Round your answer to two decomal places c. What is the number of call option contracts necessary to delta-neutral hedge 8,000 shares of the stock (with a sign!)? contracts Round your angwes to the nearest integer d. What is the put gamma for a stock price movement from $40 to $39.4 ? Rounid your ariser to two decimal plinces. e. What is the value of the call scaled vega for a given shift in volatility from 15% to 14.4% ? Round your answer to two decimal places: f. By how much would delta of the call option change if the stock pays continuous dividend of 2.5% ? (calculate the difference (cdivcnodiv)). Round your answer to foar decinal places It is Dec 21,2022 and you consider trading options on a security priced at $40 with standard deviation on the continuously compounded returns of 15%. The options are European with a strike price of $40 and expiration date Jul 2,2023 . The continuously compounded risk-free rate associated with the expiration is 5%. Assume that the security is a non-dividend paying stock and the Black-Scholes model is appropriate for pricing. Notes: 1. The curmulative standard normal table is available on Moodle. 2. Use full accuracy in all the calculations except for finding N(d1,2). These values are supposed to come from the table, which has 2 decimals accuracy. Thus, if you are using Excel you must round the arguments of N(d1,2) to 2 decimals. 3. Wherever needed, use =3.14 a. What is the value of the call option? s. Round your answer to two decimal places b. What is the value of the put option? 5 Round your answer to two decomal places c. What is the number of call option contracts necessary to delta-neutral hedge 8,000 shares of the stock (with a sign!)? contracts Round your angwes to the nearest integer d. What is the put gamma for a stock price movement from $40 to $39.4 ? Rounid your ariser to two decimal plinces. e. What is the value of the call scaled vega for a given shift in volatility from 15% to 14.4% ? Round your answer to two decimal places: f. By how much would delta of the call option change if the stock pays continuous dividend of 2.5% ? (calculate the difference (cdivcnodiv)). Round your answer to foar decinal places