Answered step by step

Verified Expert Solution

Question

1 Approved Answer

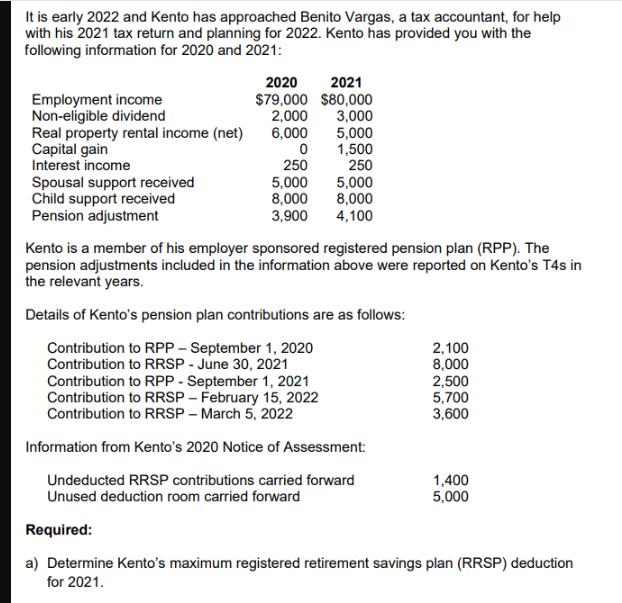

It is early 2022 and Kento has approached Benito Vargas, a tax accountant, for help with his 2021 tax return and planning for 2022.

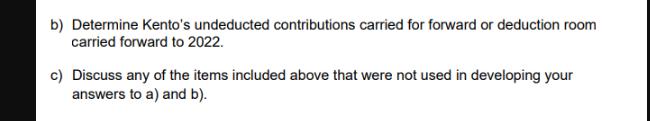

It is early 2022 and Kento has approached Benito Vargas, a tax accountant, for help with his 2021 tax return and planning for 2022. Kento has provided you with the following information for 2020 and 2021: Employment income Non-eligible dividend Real property rental income (net) Capital gain Interest income Spousal support received Child support received Pension adjustment 2020 $79,000 2,000 6,000 0 250 5,000 8,000 3,900 2021 $80,000 3,000 5,000 1,500 250 5,000 8,000 4,100 Kento is a member of his employer sponsored registered pension plan (RPP). The pension adjustments included in the information above were reported on Kento's T4s in the relevant years. Details of Kento's pension plan contributions are as follows: Contribution to RPP - September 1, 2020 Contribution to RRSP - June 30, 2021 Contribution to RPP - September 1, 2021 Contribution to RRSP - February 15, 2022 Contribution to RRSP - March 5, 2022 Information from Kento's 2020 Notice of Assessment: Undeducted RRSP contributions carried forward Unused deduction room carried forward Required: 2,100 8,000 2,500 5,700 3,600 1,400 5,000 a) Determine Kento's maximum registered retirement savings plan (RRSP) deduction for 2021. b) Determine Kento's undeducted contributions carried for forward or deduction room carried forward to 2022. c) Discuss any of the items included above that were not used in developing your answers to a) and b).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution To determine Kentos maximum registered retirement savings plan RRSP deduction for 2021 and his undeducted contributions carried forward or deduction room carried forward to 2022 we need to co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started