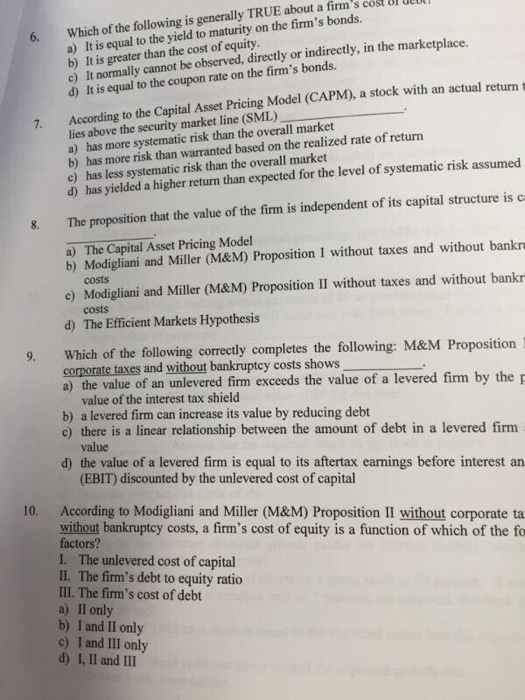

It is equal to the yield to maturity on the firm's bonds. a) b) It is greater than the cost of equity c) It normally cannot be observed, directly or indirectly, in the marketplace. d) It is equal to the coupon rate on the firm's bonds. 6. Which of the following is generally TRUE about a firm's cost 1 GeU 7. According to the Capital Asset Pricing Model (CAPM), a stock with an actual return t lies above the security market line (SML) a) has more systematic risk than the overall market b) has more risk than warranted based on the realized rate of return c) has less systematic risk than the overall market d) has yielded a higher return than expected for the level of systematic risk assumed 8. The proposition that the value of the firm is independent of its capital structure is c a) The Capital Asset Pricing Model b) Modigliani and Miller (M&M) Proposition I without taxes and without bankra costs c) Modigliani and Miller (M&M) Proposition II without taxes and without bankr costs d) The Efficient Markets Hypothesis 9. Which of the following correctly completes the following: M&M Proposition cormorate taxes and without bankruptcy costs shows a) the value of an unlevered firm exceeds the value of a levered firm by thep value of the interest tax shield b) a levered firm can increase its value by reducing debt c) there is a linear relationship between the amount of debt in a levered firm value d) the value of a levered firm is equal to its aftertax earnings before interest an (EBIT) discounted by the unlevered cost of capital 10. According to Modigliani and Miller (M&M) Proposition II without corporate ta without bankruptcy costs, a firm's cost of equity is a function of which of the fo factors? I. The unlevered cost of capital II. The firm's debt to equity ratio III. The firm's cost of debt a) II only b) I and II only c) I and III only d) I, II and III It is equal to the yield to maturity on the firm's bonds. a) b) It is greater than the cost of equity c) It normally cannot be observed, directly or indirectly, in the marketplace. d) It is equal to the coupon rate on the firm's bonds. 6. Which of the following is generally TRUE about a firm's cost 1 GeU 7. According to the Capital Asset Pricing Model (CAPM), a stock with an actual return t lies above the security market line (SML) a) has more systematic risk than the overall market b) has more risk than warranted based on the realized rate of return c) has less systematic risk than the overall market d) has yielded a higher return than expected for the level of systematic risk assumed 8. The proposition that the value of the firm is independent of its capital structure is c a) The Capital Asset Pricing Model b) Modigliani and Miller (M&M) Proposition I without taxes and without bankra costs c) Modigliani and Miller (M&M) Proposition II without taxes and without bankr costs d) The Efficient Markets Hypothesis 9. Which of the following correctly completes the following: M&M Proposition cormorate taxes and without bankruptcy costs shows a) the value of an unlevered firm exceeds the value of a levered firm by thep value of the interest tax shield b) a levered firm can increase its value by reducing debt c) there is a linear relationship between the amount of debt in a levered firm value d) the value of a levered firm is equal to its aftertax earnings before interest an (EBIT) discounted by the unlevered cost of capital 10. According to Modigliani and Miller (M&M) Proposition II without corporate ta without bankruptcy costs, a firm's cost of equity is a function of which of the fo factors? I. The unlevered cost of capital II. The firm's debt to equity ratio III. The firm's cost of debt a) II only b) I and II only c) I and III only d) I, II and