Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is February 9 and the managers of Oklahoma Cattle Feeds realize they will need to buy 1 0 0 , 0 0 0 bushels

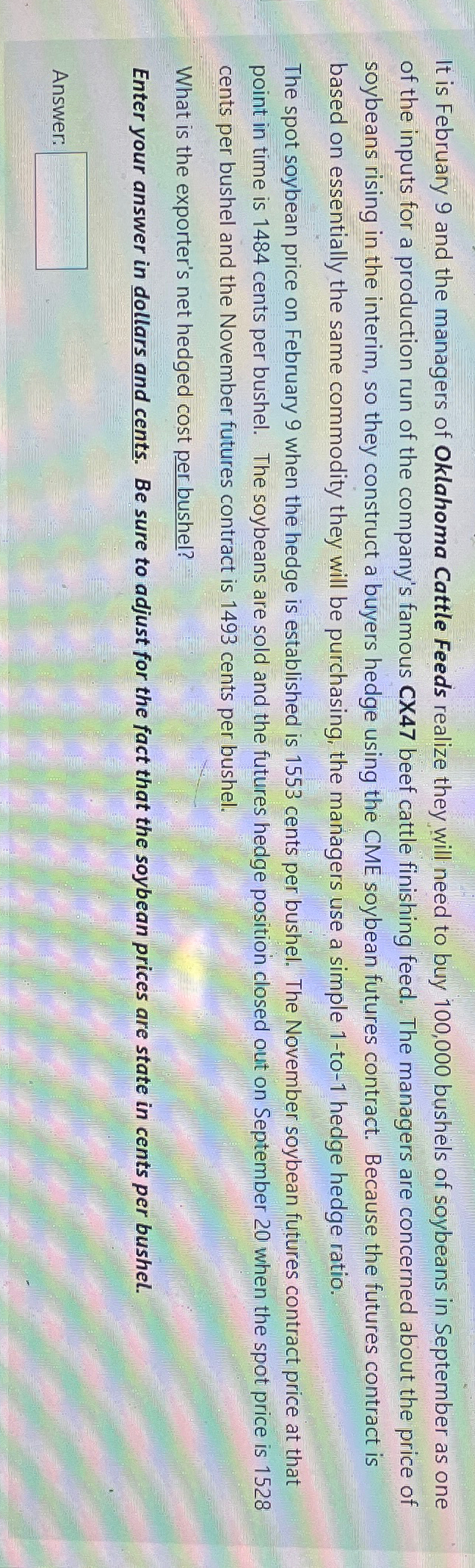

It is February and the managers of Oklahoma Cattle Feeds realize they will need to buy bushels of soybeans in September as one of the inputs for a production run of the company's famous CX beef cattle finishing feed. The managers are concerned about the price of soybeans rising in the interim, so they construct a buyers hedge using the CME soybean futures contract. Because the futures contract is based on essentially the same commodity they will be purchasing, the managers use a simple to hedge hedge ratio.

The spot soybean price on February when the hedge is established is cents per bushel. The November soybean futures contract price at that point in time is cents per bushel. The soybeans are sold and the futures hedge position closed out on September when the spot price is cents per bushel and the November futures contract is cents per bushel.

What is the exporter's net hedged cost per bushel?

Enter your answer in dollars and cents. Be sure to adjust for the fact that the soybean prices are state in cents per bushel.

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started