Answered step by step

Verified Expert Solution

Question

1 Approved Answer

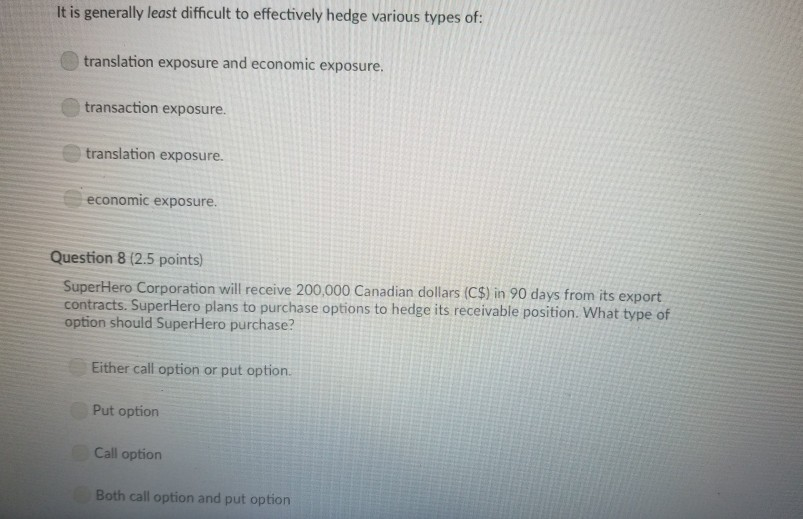

It is generally least difficult to effectively hedge various types of: translation exposure and economic exposure transaction exposure. translation exposure. economic exposure. Question 8 (2.5

It is generally least difficult to effectively hedge various types of: translation exposure and economic exposure transaction exposure. translation exposure. economic exposure. Question 8 (2.5 points) SuperHero Corporation will receive 200,000 Canadian dollars (C$) in 90 days from its export contracts. SuperHero plans to purchase options to hedge its receivable position. What type of option should SuperHero purchase? Either call option or put option. Put option Call option Both call option and put option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started