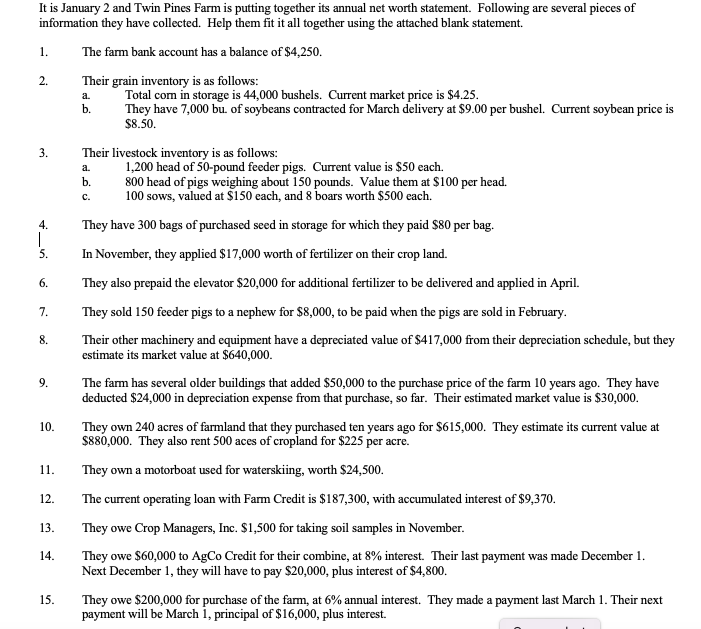

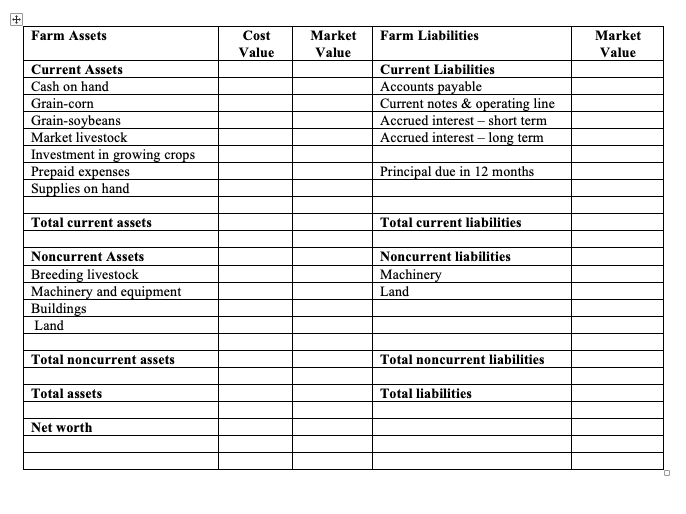

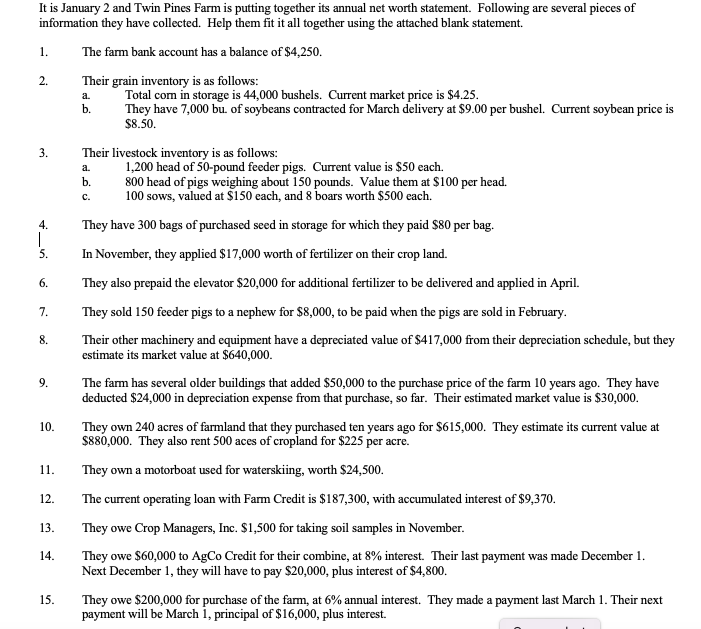

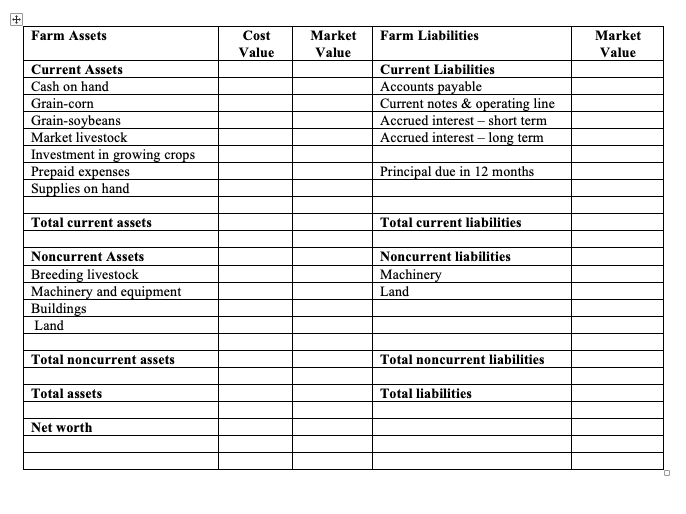

It is January 2 and Twin Pines Farm is putting together its annual net worth statement. Following are several pieces of information they have collected. Help them fit it all together using the attached blank statement. 1. The farm bank account has a balance of $4,250. 2. Their grain inventory is as follows: a. Total com in storage is 44,000 bushels. Current market price is $4.25. b. They have 7,000 bu. of soybeans contracted for March delivery at $9.00 per bushel. Current soybean price is $8.50. 3. Their livestock inventory is as follows: a. 1,200 head of 50 -pound feeder pigs. Current value is $50 each. b. 800 head of pigs weighing about 150 pounds. Value them at $100 per head. c. 100 sows, valued at $150 each, and 8 boars worth $500 each. 4. They have 300 bags of purchased seed in storage for which they paid $80 per bag. 5. In November, they applied $17,000 worth of fertilizer on their crop land. 6. They also prepaid the elevator $20,000 for additional fertilizer to be delivered and applied in April. 7. They sold 150 feeder pigs to a nephew for $8,000, to be paid when the pigs are sold in February. 8. Their other machinery and equipment have a depreciated value of $417,000 from their depreciation schedule, but they estimate its market value at $640,000. 9. The farm has several older buildings that added $50,000 to the purchase price of the farm 10 years ago. They have deducted $24,000 in depreciation expense from that purchase, so far. Their estimated market value is $30,000. 10. They own 240 acres of farmland that they purchased ten years ago for $615,000. They estimate its current value at $880,000. They also rent 500 aces of cropland for $225 per acre. 11. They own a motorboat used for waterskiing, worth $24,500. 12. The current operating loan with Farm Credit is $187,300, with accumulated interest of $9,370. 13. They owe Crop Managers, Inc. $1,500 for taking soil samples in November. 14. They owe $60,000 to AgCo Credit for their combine, at 8% interest. Their last payment was made December 1 . Next December 1 , they will have to pay $20,000, plus interest of $4,800. 15. They owe $200,000 for purchase of the farm, at 6% annual interest. They made a payment last March 1 . Their next payment will be March 1 , principal of $16,000, plus interest. \begin{tabular}{|l|l|l|l|l|} \hline Farm Assets & Cost Value & Market Value & Farm Liabilities & Market Value \\ \hline Current Assets & & & Current Liabilities & \\ \hline Cash on hand & & & Accounts payable & \\ \hline Grain-corn & & & Current notes \& operating line & \\ \hline Grain-soybeans & & & Accrued interest - short term & \\ \hline Market livestock & & & Accrued interest - long term & \\ \hline Investment in growing crops & & & Principal due in 12 months & \\ \hline Prepaid expenses & & & & \\ \hline Supplies on hand & & & Total current liabilities & \\ \hline & & & Noncurrent liabilities & \\ \hline Total current assets & & & Machinery & \\ \hline & & & Land & \\ \hline Noncurrent Assets & & & & \\ \hline Breeding livestock & & & & \\ \hline Machinery and equipment & & & & \\ \hline Buildings & & & Total noncurrent liabilities & \\ \hline Land & & & & \\ \hline Total noncurrent assets & & & & \\ \hline & & & & \\ \hline Total assets & & & Total liabilities & \\ \hline Net worth & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} It is January 2 and Twin Pines Farm is putting together its annual net worth statement. Following are several pieces of information they have collected. Help them fit it all together using the attached blank statement. 1. The farm bank account has a balance of $4,250. 2. Their grain inventory is as follows: a. Total com in storage is 44,000 bushels. Current market price is $4.25. b. They have 7,000 bu. of soybeans contracted for March delivery at $9.00 per bushel. Current soybean price is $8.50. 3. Their livestock inventory is as follows: a. 1,200 head of 50 -pound feeder pigs. Current value is $50 each. b. 800 head of pigs weighing about 150 pounds. Value them at $100 per head. c. 100 sows, valued at $150 each, and 8 boars worth $500 each. 4. They have 300 bags of purchased seed in storage for which they paid $80 per bag. 5. In November, they applied $17,000 worth of fertilizer on their crop land. 6. They also prepaid the elevator $20,000 for additional fertilizer to be delivered and applied in April. 7. They sold 150 feeder pigs to a nephew for $8,000, to be paid when the pigs are sold in February. 8. Their other machinery and equipment have a depreciated value of $417,000 from their depreciation schedule, but they estimate its market value at $640,000. 9. The farm has several older buildings that added $50,000 to the purchase price of the farm 10 years ago. They have deducted $24,000 in depreciation expense from that purchase, so far. Their estimated market value is $30,000. 10. They own 240 acres of farmland that they purchased ten years ago for $615,000. They estimate its current value at $880,000. They also rent 500 aces of cropland for $225 per acre. 11. They own a motorboat used for waterskiing, worth $24,500. 12. The current operating loan with Farm Credit is $187,300, with accumulated interest of $9,370. 13. They owe Crop Managers, Inc. $1,500 for taking soil samples in November. 14. They owe $60,000 to AgCo Credit for their combine, at 8% interest. Their last payment was made December 1 . Next December 1 , they will have to pay $20,000, plus interest of $4,800. 15. They owe $200,000 for purchase of the farm, at 6% annual interest. They made a payment last March 1 . Their next payment will be March 1 , principal of $16,000, plus interest. \begin{tabular}{|l|l|l|l|l|} \hline Farm Assets & Cost Value & Market Value & Farm Liabilities & Market Value \\ \hline Current Assets & & & Current Liabilities & \\ \hline Cash on hand & & & Accounts payable & \\ \hline Grain-corn & & & Current notes \& operating line & \\ \hline Grain-soybeans & & & Accrued interest - short term & \\ \hline Market livestock & & & Accrued interest - long term & \\ \hline Investment in growing crops & & & Principal due in 12 months & \\ \hline Prepaid expenses & & & & \\ \hline Supplies on hand & & & Total current liabilities & \\ \hline & & & Noncurrent liabilities & \\ \hline Total current assets & & & Machinery & \\ \hline & & & Land & \\ \hline Noncurrent Assets & & & & \\ \hline Breeding livestock & & & & \\ \hline Machinery and equipment & & & & \\ \hline Buildings & & & Total noncurrent liabilities & \\ \hline Land & & & & \\ \hline Total noncurrent assets & & & & \\ \hline & & & & \\ \hline Total assets & & & Total liabilities & \\ \hline Net worth & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular}