Question

It is June 1, 2015, the first business day of the month, and you have just been hired as the accountant for Allarco Inc., which

It is June 1, 2015, the first business day of the month, and you have just been hired as the accountant for Allarco Inc., which operates with monthly accounting periods. For simplicity, ignore all sales tax considerations and assume that Allarco Inc. sells one product. All of the company's accounting work has been completed through the end of May, 2015. Allarco Inc.'s year end is June 30. The post-closing alphabetized trial balance at May 31, 2015 follows.

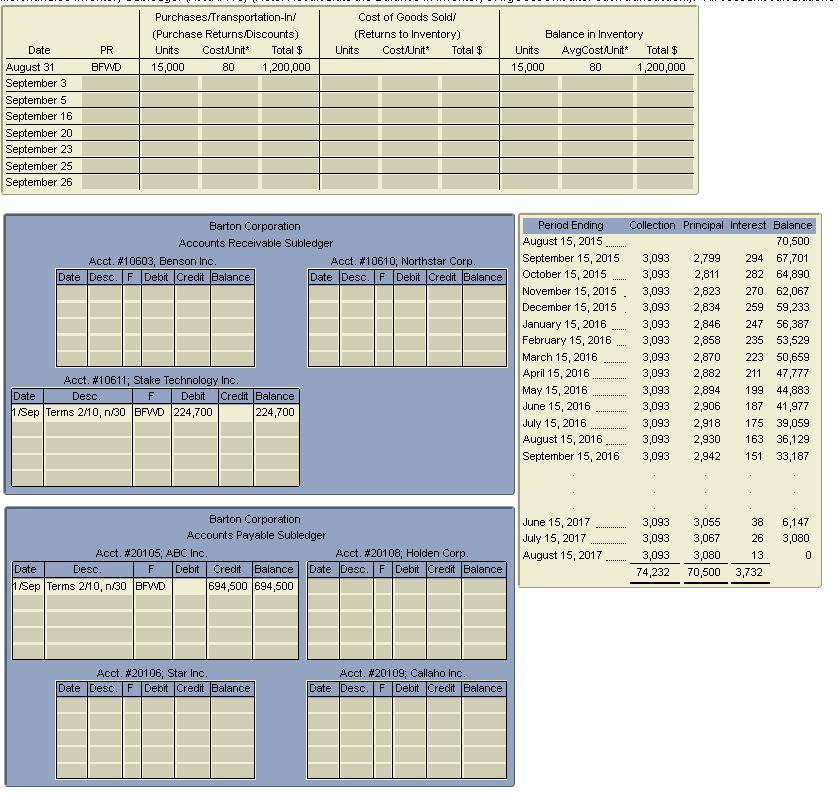

Part 1 [140 points] It is September 1, 2015, the first business day of the month, and you have just been hired as the accountant for Barton Corporation, which operates with monthly accounting periods. For simplicity, ignore all sales tax considerations and assume that Barton Corporation sells one product. All of the company's accounting work has been completed through the end of August, 2015. Barton Corporation's year end is September 30. The post-closing alphabetized trial balance at August 31, 2015 follows.

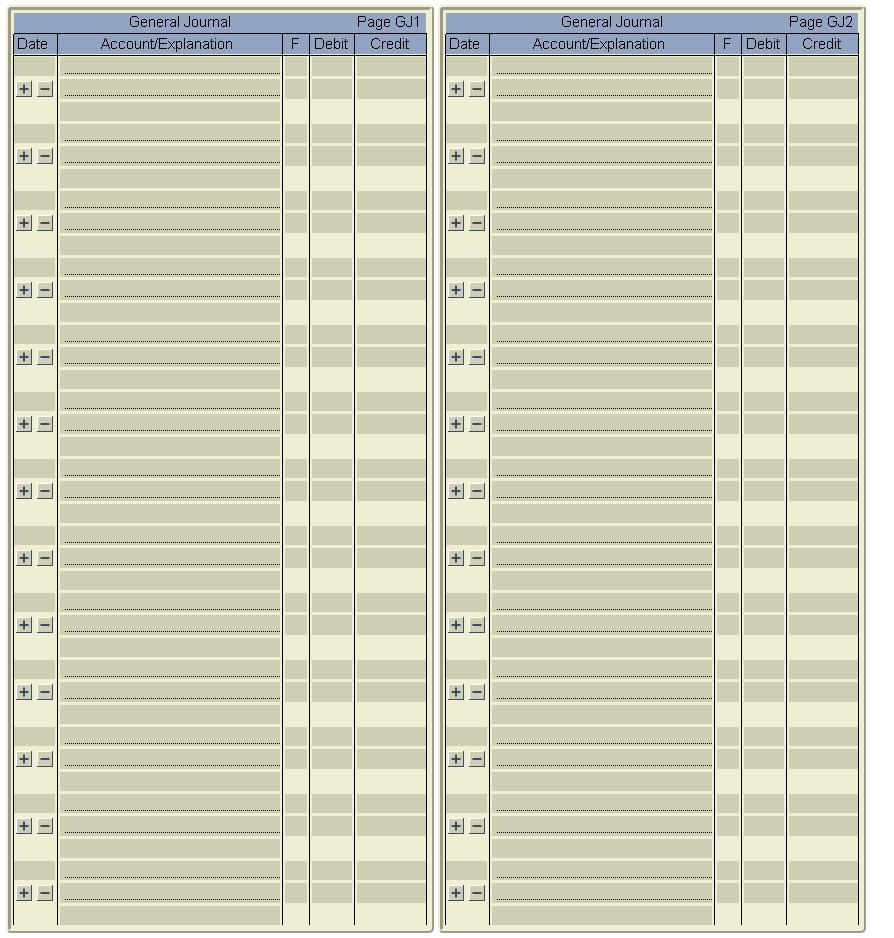

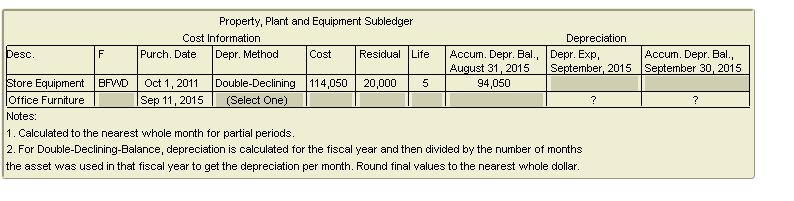

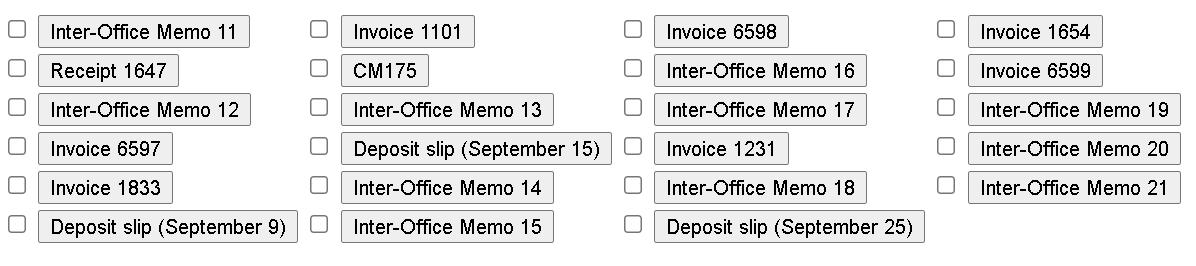

The following source documents are from September :  For all parts of the Case Study, round all calculations to two decimal places unless otherwise specified. a) Journalizing: Prepare journal entries based on an analysis of the preceding source documents and post-closing trial balance as well as the tables and subledgers below. Note that some source documents may not require an entry. Use the gross method for recording purchases. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (ie. January 15 would be 15/Jan). General JournalPage GJ1DateAccount/ExplanationFDebitCredit

b) Posting: Posting from the general journal into the subledgers is required. Posting in the general ledger is not required. The subledgers used in this case study are Accounts Receivable (AR), Accounts Payable (AP), Merchandise Inventory(MI), and Property, Plant and Equipment (PPE). The subledgers can be found below. Transactions affecting the subledgers must be posted by using the subledger abbreviations AR, AP, MI, and PPE in the folio (F) column. For transactions that do not affect one of these subledgers, leave the F column blank. The posting reference to be used in the subledgers will be the abbreviation for the general journal (GJ1 or GJ2 as appropriate).

|

O Inter-Office Memo 11 0 Receipt 1647 Inter-Office Memo 12 Invoice 6597 Invoice 1833 Deposit slip (September 9) Invoice 1101 CM175 Inter-Office Memo 13 Deposit slip (September 15) Inter-Office Memo 14 Inter-Office Memo 15 U M 000 Invoice 6598 Inter-Office Memo 16 Inter-Office Memo 17 Invoice 1231 Inter-Office Memo 18 Deposit slip (September 25) 0 Invoice 1654 U Invoice 6599 U U 0 Inter-Office Memo 19 Inter-Office Memo 20 Inter-Office Memo 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ans The accounting cycle is a collective process of identifying analyzing and recording the accounti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started