Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is my case study 2 in my class. I asked my teacher that do we need more any infor for solve this and she

It is my case study 2 in my class. I asked my teacher that do we need more any infor for solve this and she said no. Do you have any idea?

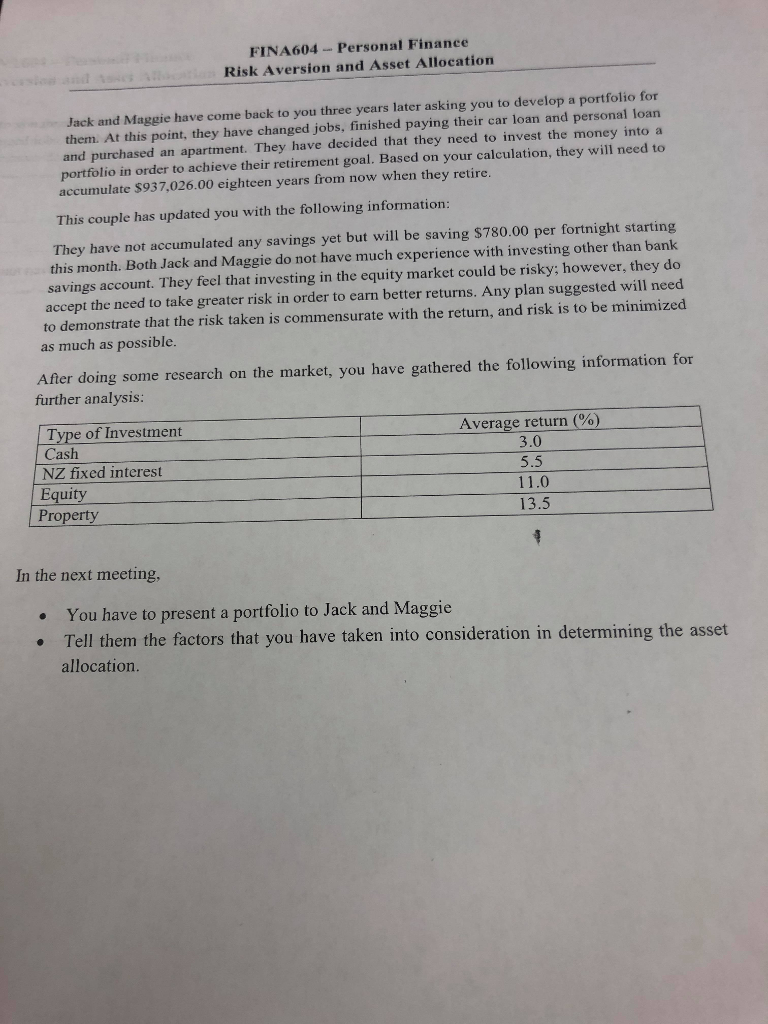

FINA604-Personal Finance Risk Aversion and Asset Allocation Jack and Maggie have come back to you three years later asking you to develop a portfolio for them. At this point, they have changed jobs, finished paying their car loan and personal loan and purchased an apartment. They have decided that they need to invest the money into a portfolio in order to achieve their retirement goal. Based on your calculation, they will need to accumulate $937,026.00 eighteen years from now when they retire This couple has updated you with the following information: They have not accumulated any savings yet but will be saving $780.00 per fortnight starting this month. Both Jack and Maggie do not have much experience with investing other than bank savings account. They feel that investing in the equity market could be risky; however, they do accept the nced to take greater risk in order to earn better returns. Any plan suggested will need to demonstrate that the risk taken is commensurate with the return, and risk is to be minimized as much as possible. After doing some research on the market, you have gathered the following information for further analysis: Type of Investment Cash NZ fixed interest Average return (%) 3.0 5.5 11.0 13.5 Equity Property In the next meeting, . You have to present a portfolio to Jack and Maggice Tell them the factors that you have taken into consideration in determining the asset allocationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started