Question

It is now 2021 and David has worked with us for several years. He always likes what he hears regarding our analysis. He would like

It is now 2021 and David has worked with us for several years. He always likes what he hears regarding our analysis. He would like to see a budget for his brewery that is very ambitious. He wants to pay himself $50,000 in salary and earn after tax (net income) $100,000. 1. He thinks he could raise the prices per case for each of the beer lines and/or change his packaging strategy, in order to reflect current marketing practices and pricing. 2. He has obtained assurances from his suppliers that the direct material costs will remain consistent on a per-unit basis. (It appears that the commodity prices for hops and barley vary from year to year based on various factors. This is to be expected since they are dependent on the weather for the crop size each year.) 3. Other variable costs have probably increased roughly two percent each year since 2013. Except for direct labor. David was already paying $15 per hour. So you need to decide on what your group would consider a reasonable wage per hour in 2021. 4. Also, in addition to the $50,000 salary for himself the fixed costs will also have increased roughly two percent per year on a per shift basis (except for depreciation, it will remain the same regardless of how many shifts). Note: Assumptions will need to be made for increased fixed costs if shifts are added. 5. The brewery must continue to produce and sell all four beer lines in order to satisfy the distributors and end-users. However, and there is always a however in life, all types of changes are on the table for your analysis, except buying new equipment. 6. David would also like your recommendation regarding the Sales Commission percentage. Incorporate your ideas into the budget and make sure to explain them to David.

Q1 a: You need to provide a budgeted income statement for David complete with all supporting schedules (in good form) that support the budgeted income statement. You are free to propose anything you want except: buying new equipment and/or dropping a beer line. The tax rate to use is 26.5%. Q1 b: In a second memo to David assume David took your groups recommendation regarding root beer which is to produce the root beer in-house. David intends to set up a second division/company for the root beer. You need to provide a budgeted income statement for David complete with all supporting schedules (in good form) that support the budgeted income statement. The tax rate to use is 26.5%. The root beer budget should not be combined with the beer budget.

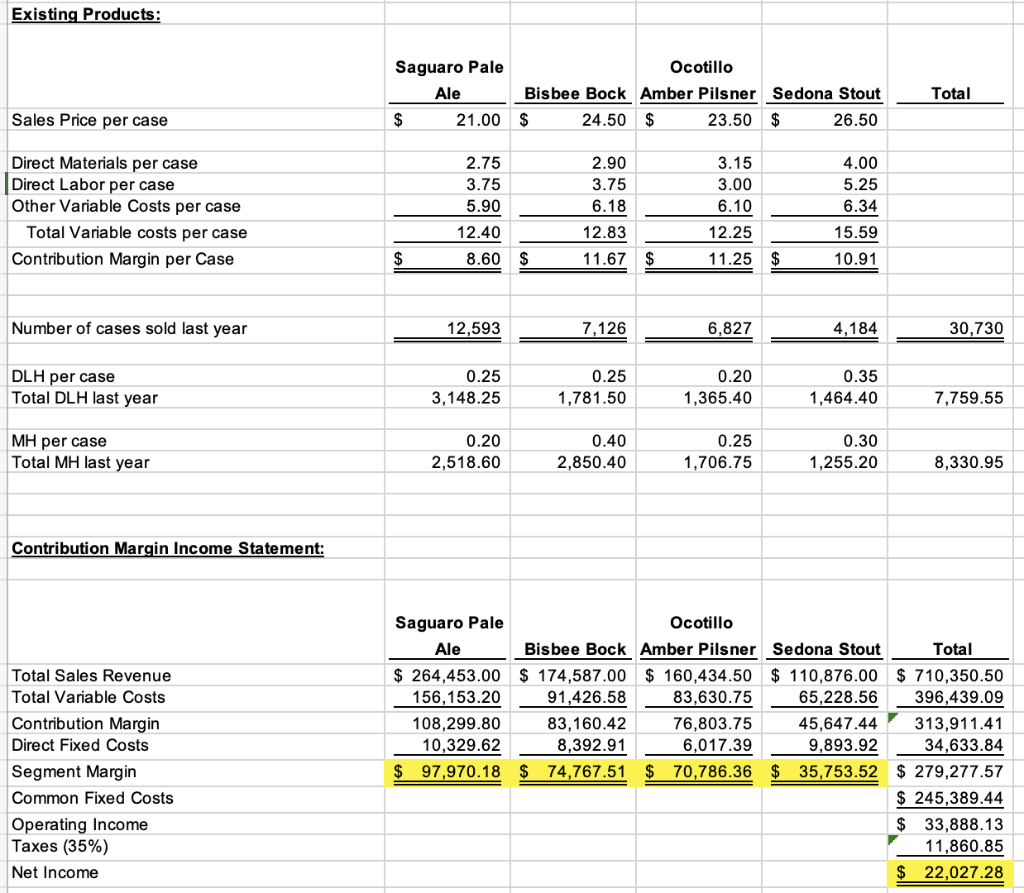

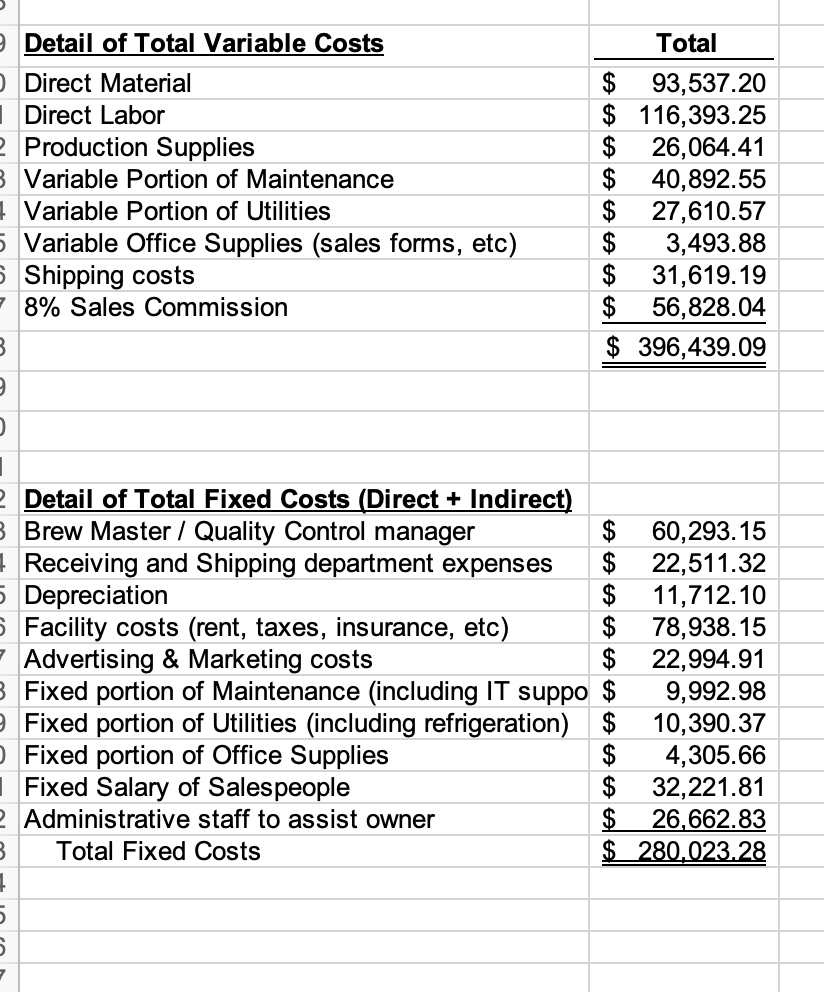

Existing Products: Saguaro Pale Ocotillo Ale Bisbee Bock Amber Pilsner Sedona Stout $ 21.00 $ 24.50 $ 23.50 $ 26.50 Total Sales Price per case Direct Materials per case Direct Labor per case Other Variable Costs per case Total Variable costs per case Contribution Margin per Case 2.75 3.75 5.90 12.40 8.60 $ 2.90 3.75 6.18 12.83 11.67 3.15 3.00 6.10 12.25 11.25 $ 4.00 5.25 6.34 15.59 10.91 $ $ Number of cases sold last year 12,593 7,126 6,827 4,184 30,730 DLH per case Total DLH last year 0.25 3,148.25 0.25 1,781.50 0.20 1,365.40 0.35 1,464.40 7,759.55 MH per case Total MH last year 0.20 2,518.60 0.40 2,850.40 0.25 1,70 0.30 1,255.20 8,330.95 Contribution Margin Income Statement: Total Sales Revenue Total Variable Costs Contribution Margin Direct Fixed Costs Segment Margin Common Fixed Costs Operating Income Taxes (35%) Net Income Saguaro Pale Ocotillo Ale Bisbee Bock Amber Pilsner Sedona Stout Total $ 264,453.00 $ 174,587.00 $ 160,434.50 $ 110,876.00 $ 710,350.50 156, 153.20 91,426.58 83,630.75 65,228.56 396,439.09 108,299.80 83,160.42 76,803.75 45,647.44 313,911.41 10,329.62 8,392.91 6,017.39 9,893.92 34,633.84 $ 97,970.18 $ 74,767.51 $ 70,786.36 $ 35,753.52 $ 279,277.57 $ 245,389.44 $ 33,888.13 11,860.85 $ 22,027.28 Detail of Total Variable Costs Direct Material | Direct Labor 2 Production Supplies 3 Variable Portion of Maintenance I Variable Portion of Utilities 5 Variable Office Supplies (sales forms, etc) 5 Shipping costs - 8% Sales Commission Total $ 93,537.20 $ 116,393.25 $ 26,064.41 $ 40,892.55 $ 27,610.57 $ 3,493.88 $ 31,619.19 $ 56,828.04 $ 396,439.09 da da da da da da da B 2 EA EA EA EA EA 2 Detail of Total Fixed Costs (Direct + Indirect) B Brew Master / Quality Control manager $ 60,293.15 Receiving and Shipping department expenses $ 22,511.32 5 Depreciation $ 11,712.10 Facility costs (rent, taxes, insurance, etc) $ 78,938.15 Advertising & Marketing costs $ 22,994.91 3 Fixed portion of Maintenance (including IT suppo $ 9,992.98 Fixed portion of Utilities (including refrigeration) $ 10,390.37 Fixed portion of Office Supplies $ 4,305.66 Fixed Salary of Salespeople $ 32,221.81 Administrative staff to assist owner $ 26,662.83 B Total Fixed Costs $ 280.023.28 1 7 Existing Products: Saguaro Pale Ocotillo Ale Bisbee Bock Amber Pilsner Sedona Stout $ 21.00 $ 24.50 $ 23.50 $ 26.50 Total Sales Price per case Direct Materials per case Direct Labor per case Other Variable Costs per case Total Variable costs per case Contribution Margin per Case 2.75 3.75 5.90 12.40 8.60 $ 2.90 3.75 6.18 12.83 11.67 3.15 3.00 6.10 12.25 11.25 $ 4.00 5.25 6.34 15.59 10.91 $ $ Number of cases sold last year 12,593 7,126 6,827 4,184 30,730 DLH per case Total DLH last year 0.25 3,148.25 0.25 1,781.50 0.20 1,365.40 0.35 1,464.40 7,759.55 MH per case Total MH last year 0.20 2,518.60 0.40 2,850.40 0.25 1,70 0.30 1,255.20 8,330.95 Contribution Margin Income Statement: Total Sales Revenue Total Variable Costs Contribution Margin Direct Fixed Costs Segment Margin Common Fixed Costs Operating Income Taxes (35%) Net Income Saguaro Pale Ocotillo Ale Bisbee Bock Amber Pilsner Sedona Stout Total $ 264,453.00 $ 174,587.00 $ 160,434.50 $ 110,876.00 $ 710,350.50 156, 153.20 91,426.58 83,630.75 65,228.56 396,439.09 108,299.80 83,160.42 76,803.75 45,647.44 313,911.41 10,329.62 8,392.91 6,017.39 9,893.92 34,633.84 $ 97,970.18 $ 74,767.51 $ 70,786.36 $ 35,753.52 $ 279,277.57 $ 245,389.44 $ 33,888.13 11,860.85 $ 22,027.28 Detail of Total Variable Costs Direct Material | Direct Labor 2 Production Supplies 3 Variable Portion of Maintenance I Variable Portion of Utilities 5 Variable Office Supplies (sales forms, etc) 5 Shipping costs - 8% Sales Commission Total $ 93,537.20 $ 116,393.25 $ 26,064.41 $ 40,892.55 $ 27,610.57 $ 3,493.88 $ 31,619.19 $ 56,828.04 $ 396,439.09 da da da da da da da B 2 EA EA EA EA EA 2 Detail of Total Fixed Costs (Direct + Indirect) B Brew Master / Quality Control manager $ 60,293.15 Receiving and Shipping department expenses $ 22,511.32 5 Depreciation $ 11,712.10 Facility costs (rent, taxes, insurance, etc) $ 78,938.15 Advertising & Marketing costs $ 22,994.91 3 Fixed portion of Maintenance (including IT suppo $ 9,992.98 Fixed portion of Utilities (including refrigeration) $ 10,390.37 Fixed portion of Office Supplies $ 4,305.66 Fixed Salary of Salespeople $ 32,221.81 Administrative staff to assist owner $ 26,662.83 B Total Fixed Costs $ 280.023.28 1 7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started