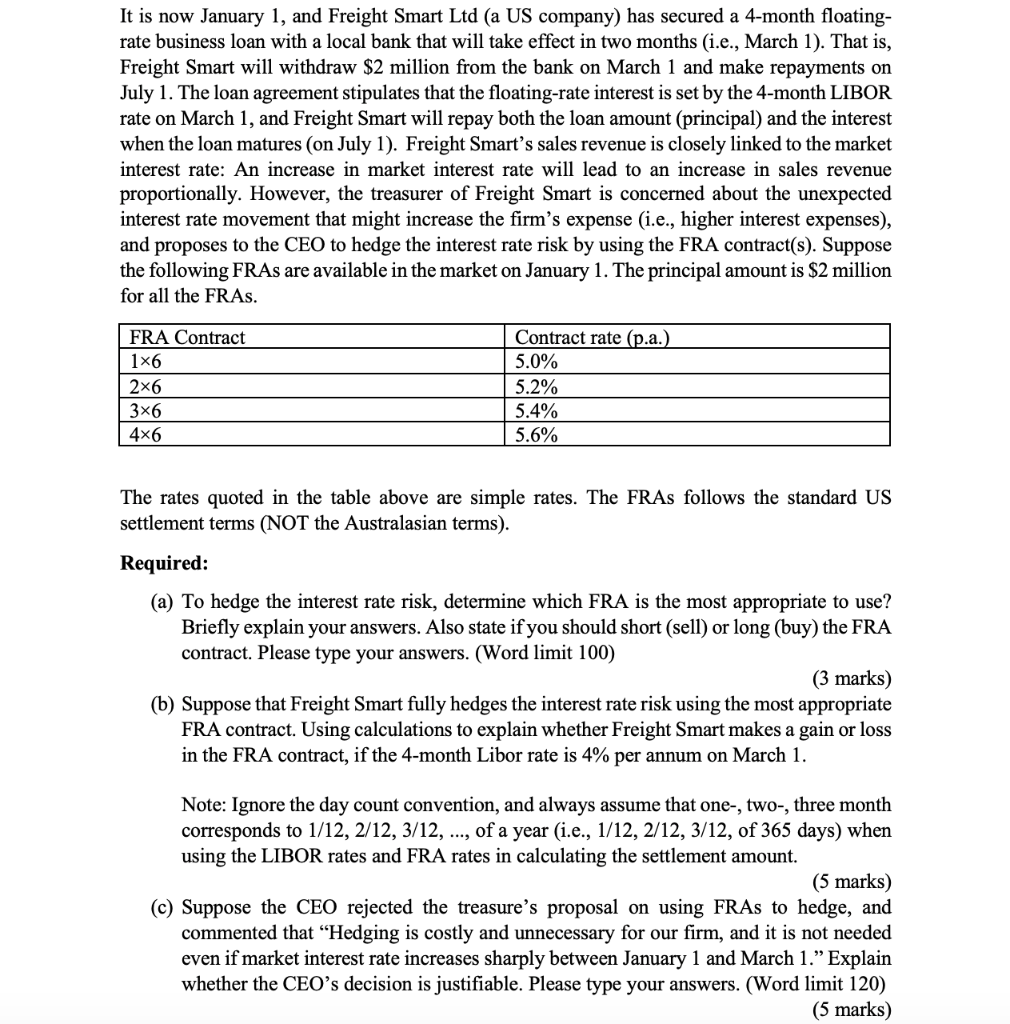

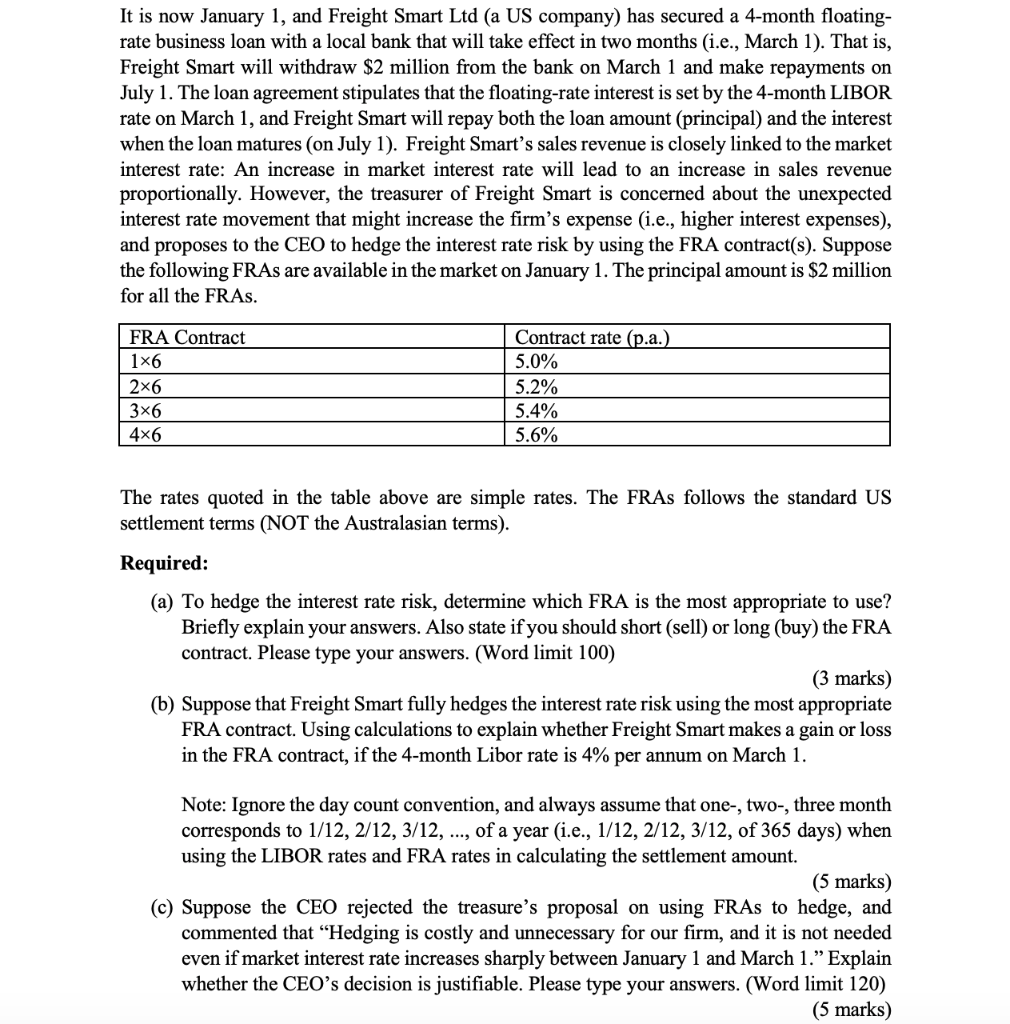

It is now January 1, and Freight Smart Ltd (a US company) has secured a 4-month floatingrate business loan with a local bank that will take effect in two months (i.e., March 1). That is, Freight Smart will withdraw \$2 million from the bank on March 1 and make repayments on July 1 . The loan agreement stipulates that the floating-rate interest is set by the 4-month LIBOR rate on March 1, and Freight Smart will repay both the loan amount (principal) and the interest when the loan matures (on July 1). Freight Smart's sales revenue is closely linked to the market interest rate: An increase in market interest rate will lead to an increase in sales revenue proportionally. However, the treasurer of Freight Smart is concerned about the unexpected interest rate movement that might increase the firm's expense (i.e., higher interest expenses), and proposes to the CEO to hedge the interest rate risk by using the FRA contract(s). Suppose the following FRAs are available in the market on January 1. The principal amount is $2 million for all the FRAs. The rates quoted in the table above are simple rates. The FRAs follows the standard US settlement terms (NOT the Australasian terms). Required: (a) To hedge the interest rate risk, determine which FRA is the most appropriate to use? Briefly explain your answers. Also state if you should short (sell) or long (buy) the FRA contract. Please type your answers. (Word limit 100) (3 marks) (b) Suppose that Freight Smart fully hedges the interest rate risk using the most appropriate FRA contract. Using calculations to explain whether Freight Smart makes a gain or loss in the FRA contract, if the 4-month Libor rate is 4% per annum on March 1. Note: Ignore the day count convention, and always assume that one-, two-, three month corresponds to 1/12,2/12,3/12,, of a year (i.e., 1/12,2/12,3/12, of 365 days) when using the LIBOR rates and FRA rates in calculating the settlement amount. ( 5 marks) (c) Suppose the CEO rejected the treasure's proposal on using FRAs to hedge, and commented that "Hedging is costly and unnecessary for our firm, and it is not needed even if market interest rate increases sharply between January 1 and March 1." Explain whether the CEO's decision is justifiable. Please type your answers. (Word limit 120)