Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is now September 1, and you are considering investing in NZ 90-day bank bills in two months' time (November 1). On this date of

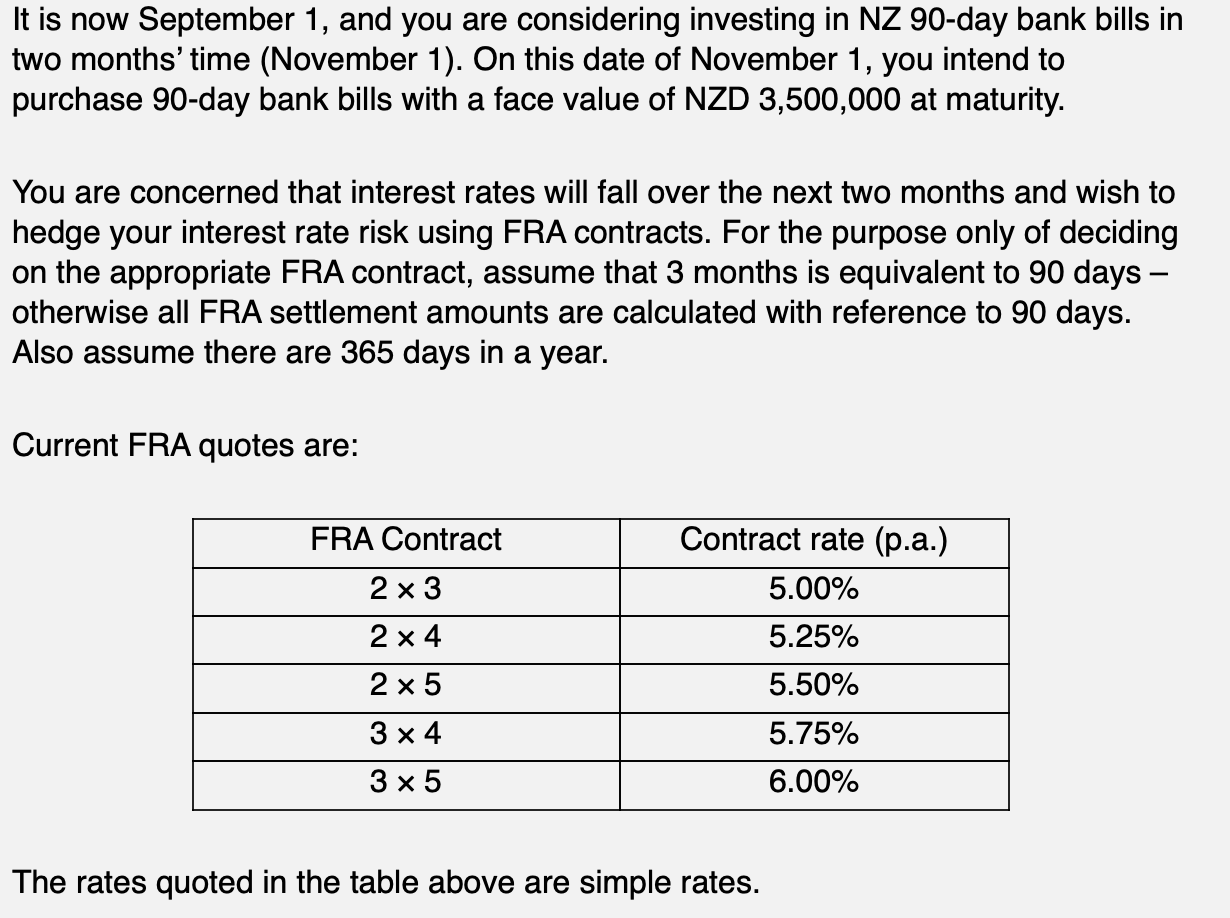

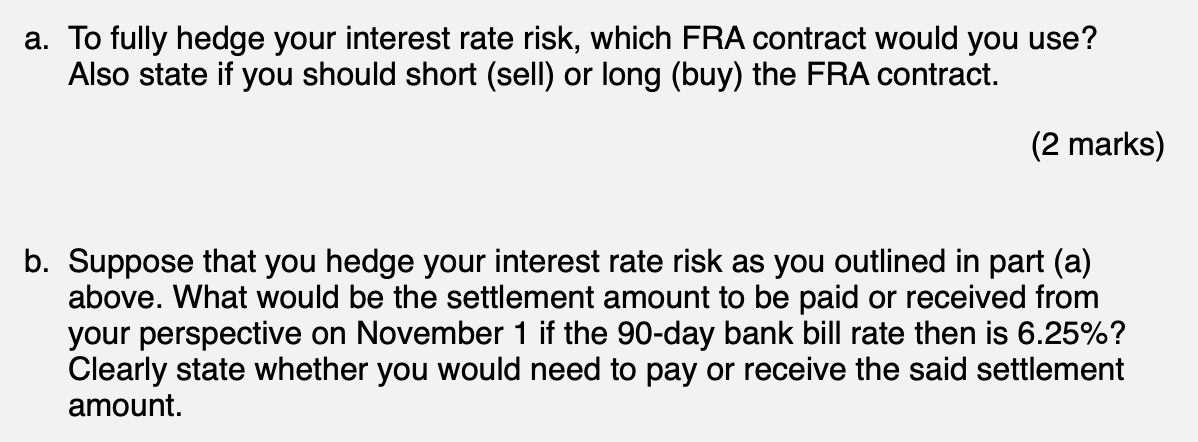

It is now September 1, and you are considering investing in NZ 90-day bank bills in two months' time (November 1). On this date of November 1, you intend to purchase 90-day bank bills with a face value of NZD 3,500,000 at maturity. You are concerned that interest rates will fall over the next two months and wish to hedge your interest rate risk using FRA contracts. For the purpose only of deciding on the appropriate FRA contract, assume that 3 months is equivalent to 90 days otherwise all FRA settlement amounts are calculated with reference to 90 days. Also assume there are 365 days in a year. Current FRA quotes are: FRA Contract 2x3 2 x 4 2 x 5 3x4 3 x 5 Contract rate (p.a.) 5.00% 5.25% 5.50% 5.75% 6.00% The rates quoted in the table above are simple rates. a. To fully hedge your interest rate risk, which FRA contract would you use? Also state if you should short (sell) or long (buy) the FRA contract. (2 marks) b. Suppose that you hedge your interest rate risk as you outlined in part (a) above. What would be the settlement amount to be paid or received from your perspective on November 1 if the 90-day bank bill rate then is 6.25%? Clearly state whether you would need to pay or receive the said settlement amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started