Question

It is now the first of February and Genevieve had a very busy January. Genevieve has journalized and posted Januarys transactions, the adjusting entries, and

It is now the first of February and Genevieve had a very busy January. Genevieve has journalized and posted January’s transactions, the adjusting entries, and prepared the January 31 Trial Balance following your instructions and those she found on the internet. On January 28, Genevieve initially recorded some additional equipment purchased on account for $1,500 as “supplies expense.” After posting the original transaction, she then made an entry to correct this error. Had she not made a correcting entry, would the financial statements have been misstated? How? In January, Geoff Zanetti called asking for a time extension on his $400 Accounts Receivable as he is out of province until Feb 26. Geoff likes to pay in person and was not able to come around in January to settle his account. Genevieve agreed and had his e-mail over a signed, two-month, 6% note. The extension starts January 1 and payment plus interest is due February 28. Genevieve needs your help in preparing the entry to record Geoff’s extension.

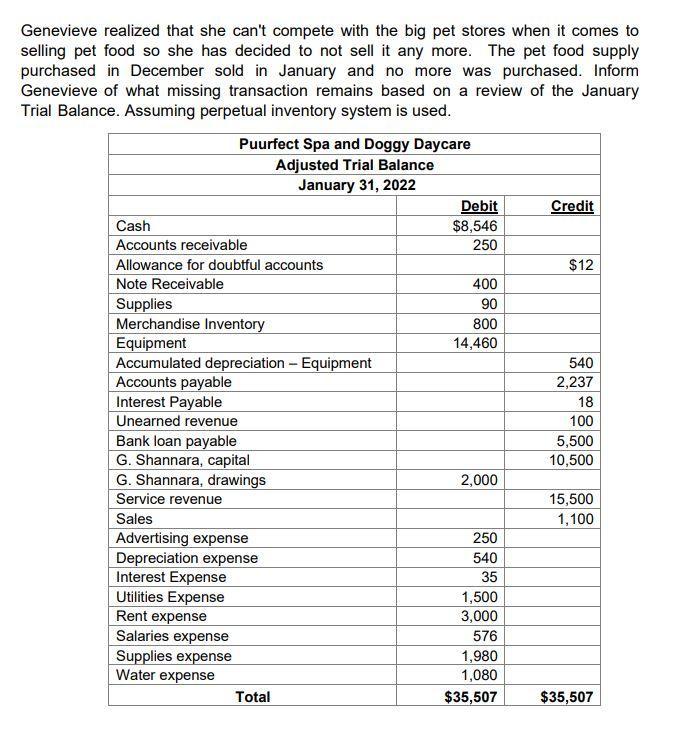

Genevieve realized that she can't compete with the big pet stores when it comes to selling pet food so she has decided to not sell it anymore. The pet food supply purchased in December sold in January and no more were purchased. Inform Genevieve of what missing transaction remains based on a review of the January Trial Balance. Assuming perpetual inventory system is used.

Genevieve comes to you for advice on how to account for these healthy treats. She wants to have up-to-date inventory records at all times so she wants to use the perpetual inventory system like you would have assumed. She also wants to use the earnings approach for revenue recognition. Genevieve would like a description of the different cost formulas that she could use to account for the pet treats inventory.

Genevieve asks you to provide a recommendation of the most appropriate cost formula she should use. She also asks that you provide her with an inventory record (she was personally leaning toward the FIFO method), for the February purchases and sales of treats, and the balance in the cat and dog treat inventory accounts. Then, prepare the journal entries for the February transactions, using your recommended method.

Genevieve realized that she can't compete with the big pet stores when it comes to selling pet food so she has decided to not sell it any more. The pet food supply purchased in December sold in January and no more was purchased. Inform Genevieve of what missing transaction remains based on a review of the January Trial Balance. Assuming perpetual inventory system is used. Cash Accounts receivable Allowance for doubtful accounts Note Receivable Puurfect Spa and Doggy Daycare Adjusted Trial Balance January 31, 2022 Supplies Merchandise Inventory Equipment Accumulated depreciation - Equipment Accounts payable Interest Payable Unearned revenue Bank loan payable G. Shannara, capital G. Shannara, drawings Service revenue Sales Advertising expense Depreciation expense Interest Expense Utilities Expense Rent expense Salaries expense Supplies expense Water expense Total Debit $8,546 250 400 90 800 14,460 2,000 250 540 35 1,500 3,000 576 1,980 1,080 $35,507 Credit $12 540 2,237 18 100 5,500 10,500 15,500 1,100 $35,507

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Genevieve wants to use a perpetual inventory system to track the costs of her pet treats inventory T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started