It is one long problem. Problem 1. C Corp. is an all-equity (ie. Unlevered) firm. The firms cost of capital is 15%, and the cost

It is one long problem.

Problem 1.

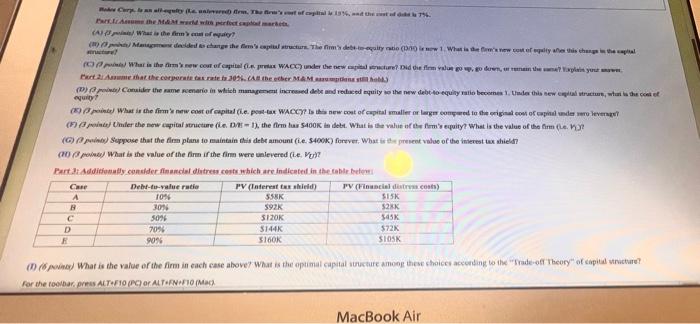

C Corp. is an all-equity (ie. Unlevered) firm. The firms cost of capital is 15%, and the cost of debt is 7%/

Part 1: Assume the M&M world with perfect capital markets.

What is the firms cost of equity?

Management decided to change the firms capital structure. The firms debt-to-equity ratio (D/E) is now 1. What is the firms new cost of equity after this change in the capital structure?

What is the firms new cost of capital (i.e. pretax WACC) under the new capital structure? Did the firm value go up, down, or stayed the same? Explain your answer.

Part 2: Assume that the corporate tax rate is 30%. (All the other M&M assumptions still hold.)

Consider same scenario in which management increased debt and reduce equity so the new debt-to-equity ratio becomes 1. Under this new capital structure, what is the cost of equity?

What is the firms new cost of capital (i.e. post-tax WACC)? IS this new cost of capital smaller or larger compared to the original cost of capital under zero leverage?

Under the new capital structure (i.e. D/E = 1), the firm has $400K in debt. What is the value of the firms equity? What is the value of the firm (i.e. VL)?

Suppose that the firm plans to maintain this debt amount (i.e. $400K) forever. What is the present value of the interest tax shield?

What is the value of the firm if the firm were un levered (i.e. Vu)?

Part 3: Additionally consider financial distress cost which are indicated in the table below:

| Case | Debt-to-value ratio | PV (Interest Tax Shield) | PV (financial distress cost) |

| A | 10% | $58K | $15K |

| B | 30% | $92K | $28K |

| C | 50% | $120K | $45K |

| D | 70% | $144K | $72K |

| E | 90% | $160K | $105K |

What is the value of the firm in each case above? What is the optimal capital structure among these choices according to the trade-off-theory of capital structure?

ving? (W) P paved) What is the value of the firm if the finm were unlevered (i.e. VU? Pert th Addifiesafy consher finencief distress rests which are indicated in the fable betemi or the rowhar, preis ACT+S10 (RC) of AUT +PN+f 10 (Mac) ving? (W) P paved) What is the value of the firm if the finm were unlevered (i.e. VU? Pert th Addifiesafy consher finencief distress rests which are indicated in the fable betemi or the rowhar, preis ACT+S10 (RC) of AUT +PN+f 10 (Mac)Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started