Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(It is one question but the chart was too big to screenshot for one image, so I had to take 2 separate ones.) Please, complete

(It is one question but the chart was too big to screenshot for one image, so I had to take 2 separate ones.) Please, complete the two parts it is asking. I can't see the rest of the assignment until the first question is answered.

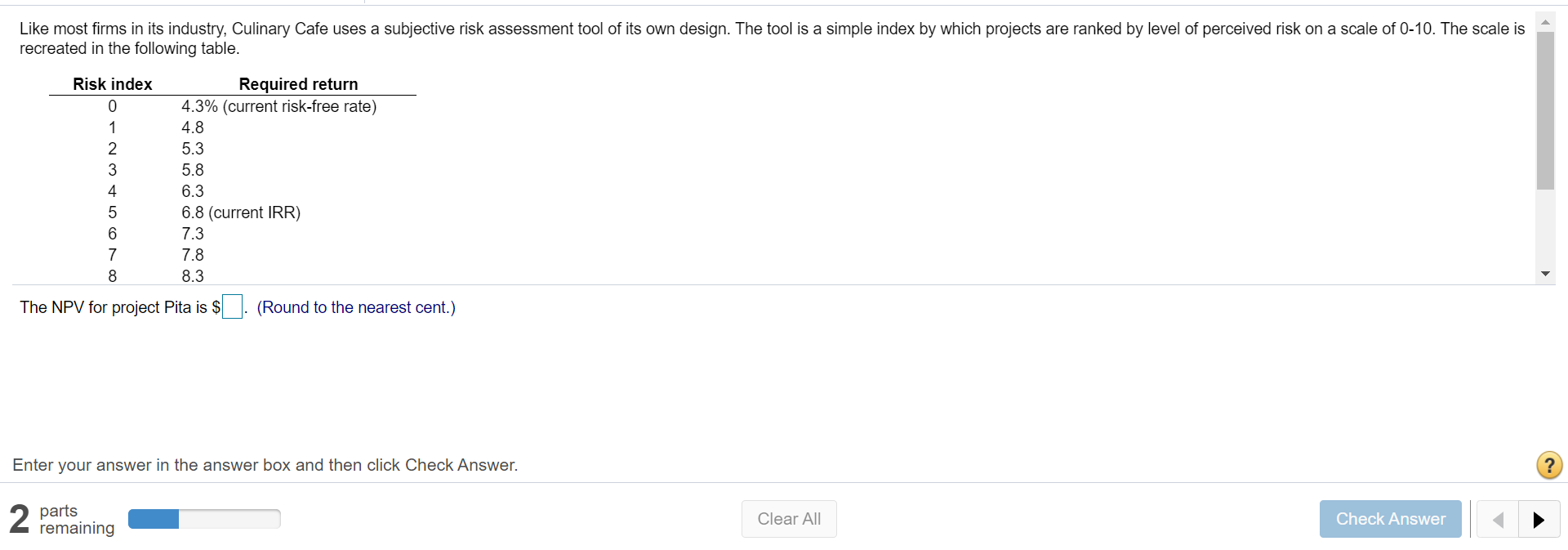

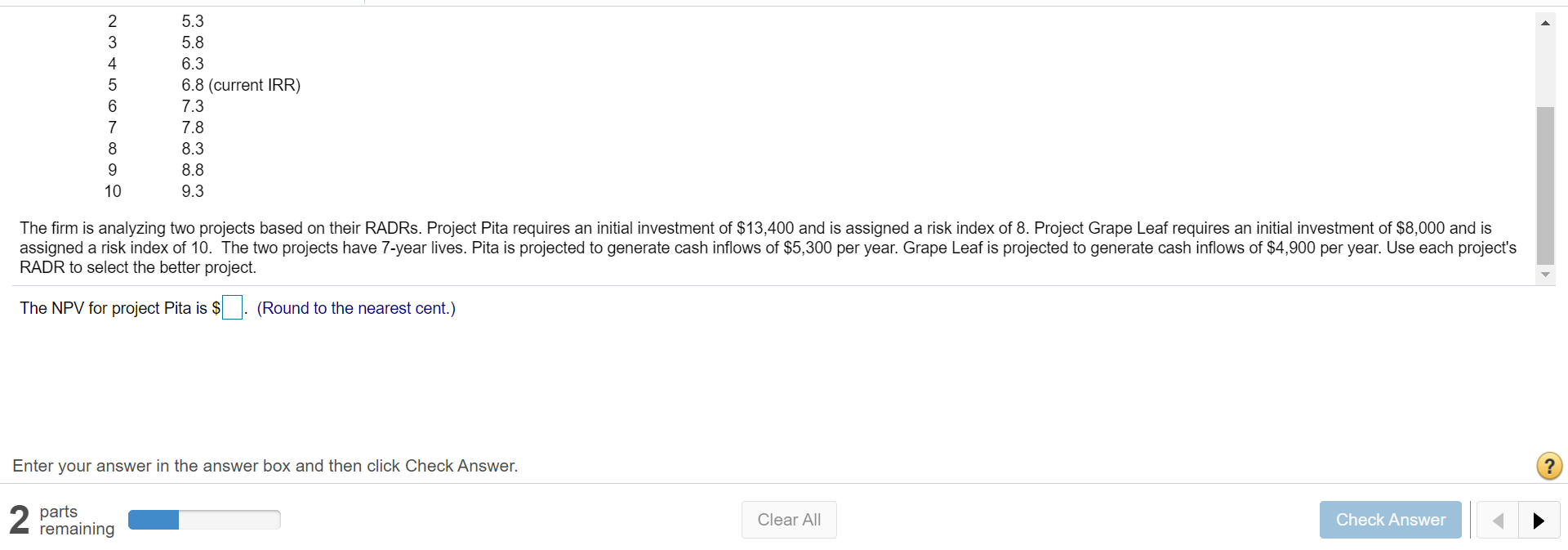

Like most firms in its industry, Culinary Cafe uses a subjective risk assessment tool of its own design. The tool is a simple index by which projects are ranked by level of perceived risk on a scale of 0-10. The scale is recreated in the following table. Risk index 0 1 2 3 4 5 6 7 8 Required return 4.3% (current risk-free rate) 4.8 5.3 5.8 6.3 6.8 (current IRR) 7.3 7.8 8.3 The NPV for project Pita is $ (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. 2 parts Clear All Check Answer remaining 2 3 4 5 6 7 8 9 10 5.3 5.8 6.3 6.8 (current IRR) 7.3 7.8 8.3 8.8 9.3 The firm is analyzing two projects based on their RADRs. Project Pita requires an initial investment of $13,400 and is assigned a risk index of 8. Project Grape Leaf requires an initial investment of $8,000 and is assigned a risk index of 10. The two projects have 7-year lives. Pita is projected to generate cash inflows of $5,300 per year. Grape Leaf is projected to generate cash inflows of $4,900 per year. Use each project's RADR to select the better project. The NPV for project Pita is $ (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. 2 parts Clear All Check Answer remainingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started