Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is Part B I am looking for help on. Here is the Question plus the information from part A. Thank you, On January 31,

It is Part B I am looking for help on. Here is the Question plus the information from part A. Thank you,

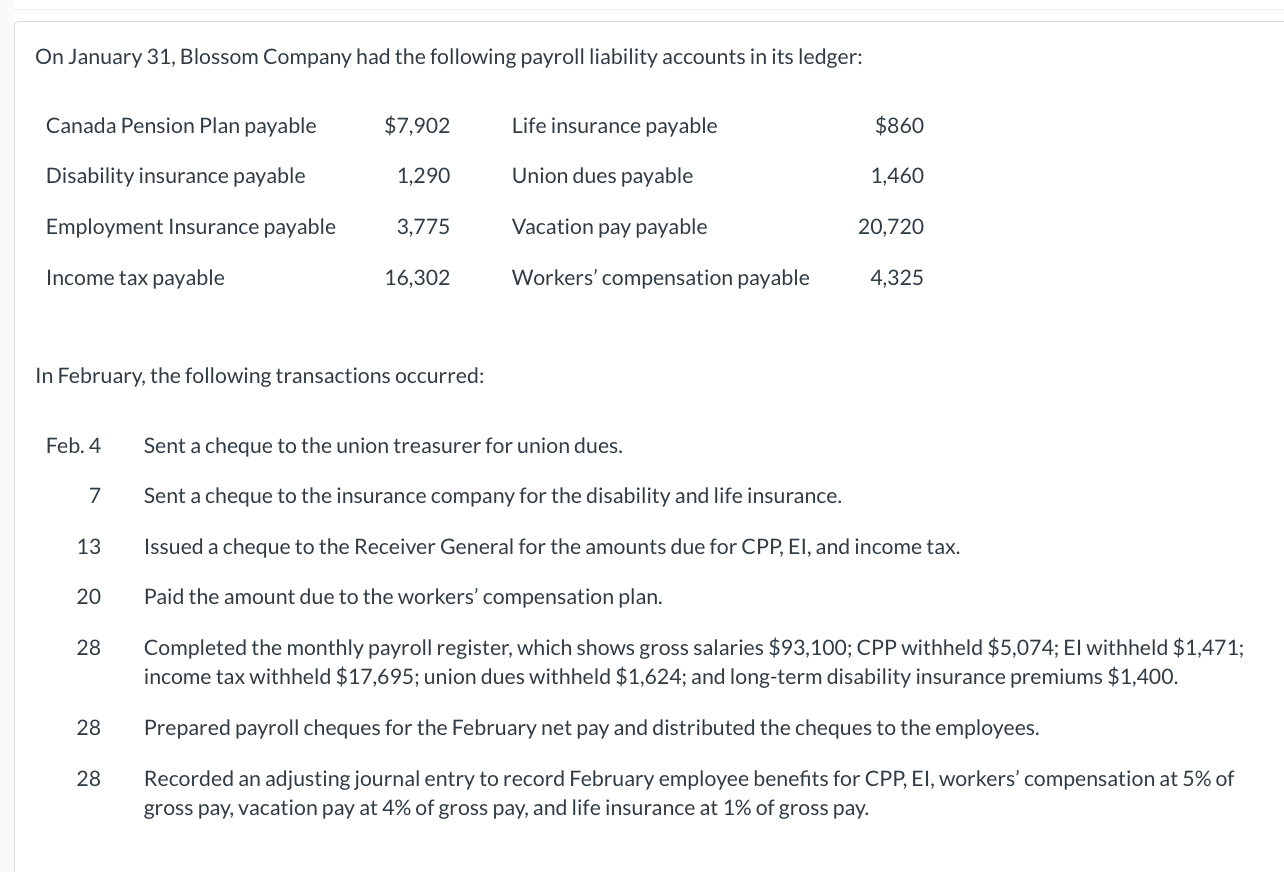

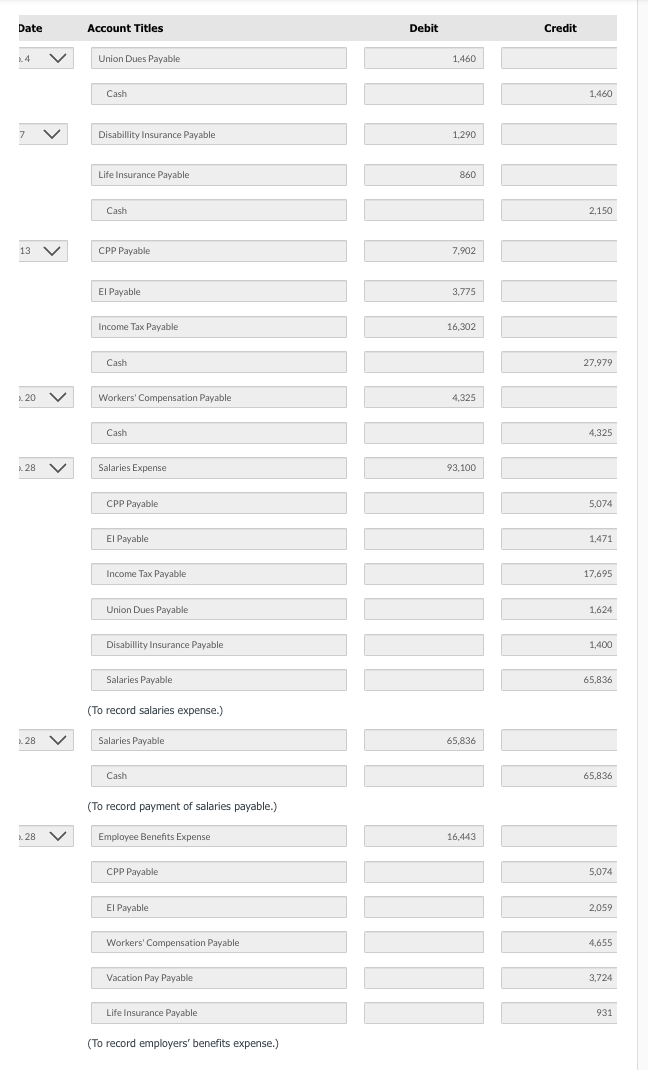

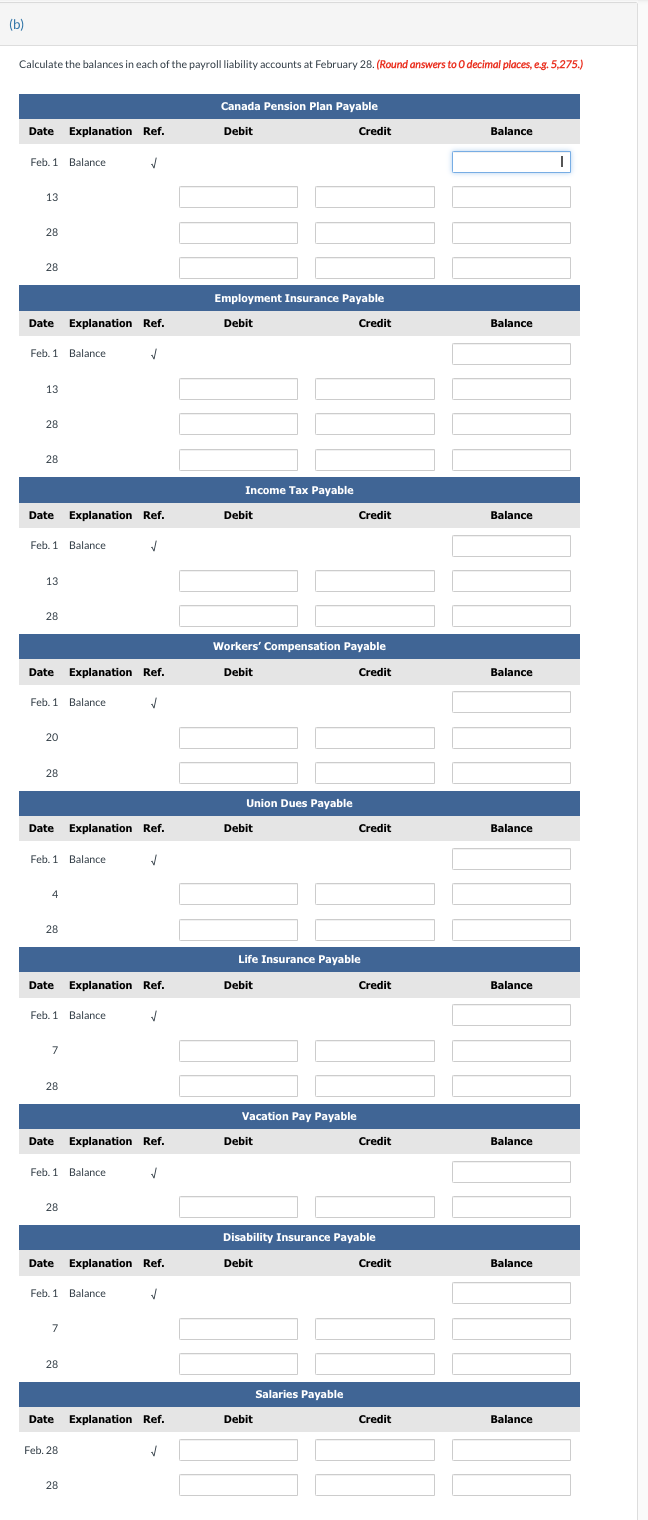

On January 31, Blossom Company had the following payroll liability accounts in its ledger: In February, the following transactions occurred: Feb. 4 Sent a cheque to the union treasurer for union dues. 7 Sent a cheque to the insurance company for the disability and life insurance. 13 Issued a cheque to the Receiver General for the amounts due for CPP, EI, and income tax. 20 Paid the amount due to the workers' compensation plan. 28 Completed the monthly payroll register, which shows gross salaries $93,100; CPP withheld $5,074; El withheld $1,471; income tax withheld $17,695; union dues withheld $1,624; and long-term disability insurance premiums $1,400. 28 Prepared payroll cheques for the February net pay and distributed the cheques to the employees. 28 Recorded an adjusting journal entry to record February employee benefits for CPP, EI, workers' compensation at 5% of gross pay, vacation pay at 4% of gross pay, and life insurance at 1% of gross pay. Date Account Titles 2. 4 2.4 7 7 13 4.20 28 u. 28 4.28 28 28 Union Dues Payable Cash Disabillity Insurance Payable Life Insurance Payable Cash CPP Payable El Payable Income Tax Payable Cash Workers' Compensation Payable Cash Salaries Expense CPP Payable El Payable Income Tax Payable Union Dues Payable Disabillity Insurance Payable Salaries Payable (To record salaries expense.) Salaries Payable Cash (To record payment of salaries payable.) Employee Benefits Expense CPP Payable El Payable Workers' Compensation Payable Vacation Pay Payable Life Insurance Payable Debit Credit 1,460 860 7,902 3,775 16,302 4,325 93,100 4,655 3,724 (To record employers' benefits expense.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started