Answered step by step

Verified Expert Solution

Question

1 Approved Answer

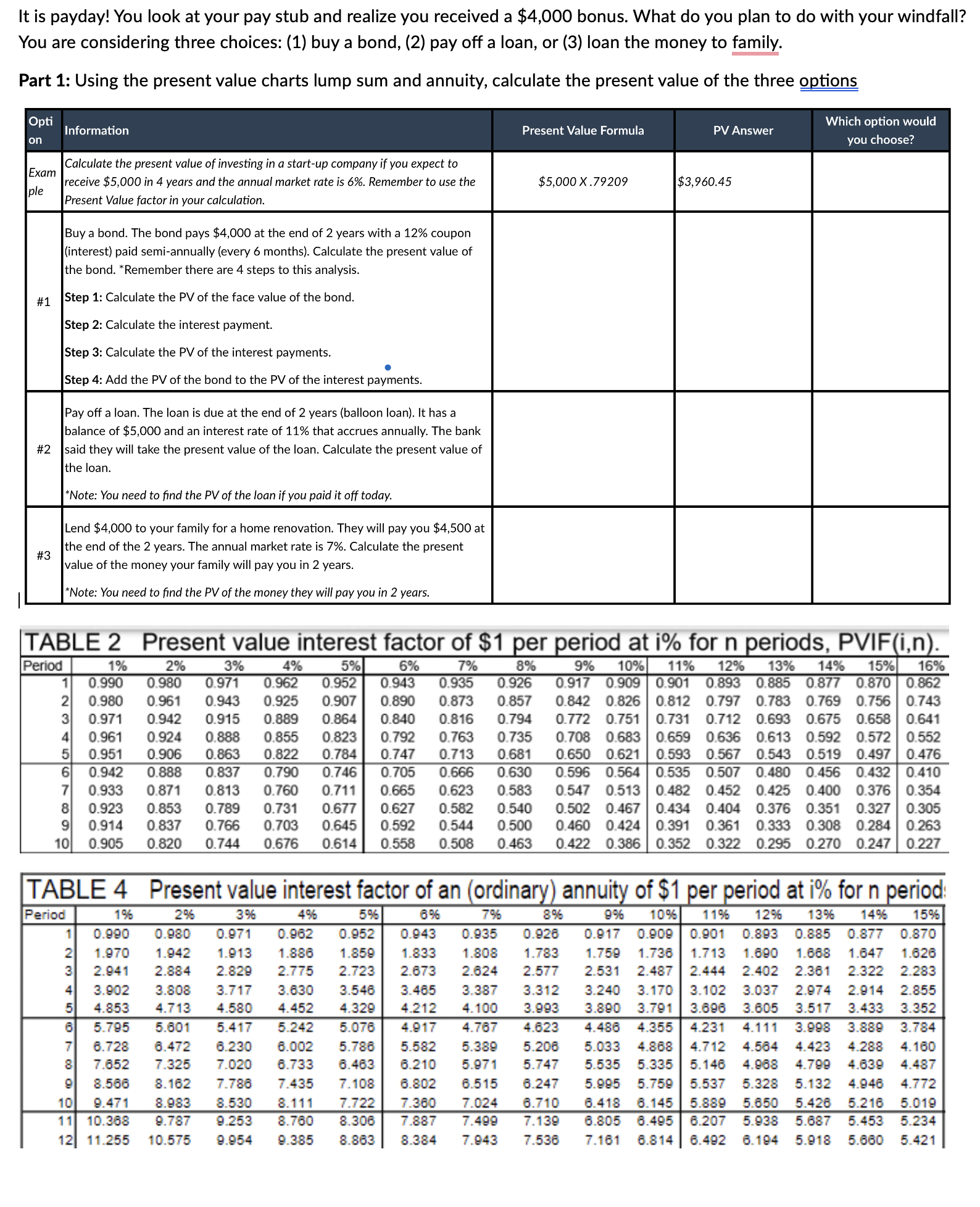

It is payday! You look at your pay stub and realize you received a $4,000 bonus. What do you plan to do with your

It is payday! You look at your pay stub and realize you received a $4,000 bonus. What do you plan to do with your windfall? You are considering three choices: (1) buy a bond, (2) pay off a loan, or (3) loan the money to family. Part 1: Using the present value charts lump sum and annuity, calculate the present value of the three options Which option would PV Answer you choose? Opti Information Present Value Formula on Exam ple Calculate the present value of investing in a start-up company if you expect to receive $5,000 in 4 years and the annual market rate is 6%. Remember to use the Present Value factor in your calculation. $5,000 X.79209 $3,960.45 Buy a bond. The bond pays $4,000 at the end of 2 years with a 12% coupon (interest) paid semi-annually (every 6 months). Calculate the present value of the bond. *Remember there are 4 steps to this analysis. #1 Step 1: Calculate the PV of the face value of the bond. Step 2: Calculate the interest payment. Step 3: Calculate the PV of the interest payments. Step 4: Add the PV of the bond to the PV of the interest payments. Pay off a loan. The loan is due at the end of 2 years (balloon loan). It has a balance of $5,000 and an interest rate of 11% that accrues annually. The bank #2 said they will take the present value of the loan. Calculate the present value of the loan. #3 *Note: You need to find the PV of the loan if you paid it off today. Lend $4,000 to your family for a home renovation. They will pay you $4,500 at the end of the 2 years. The annual market rate is 7%. Calculate the present value of the money your family will pay you in 2 years. *Note: You need to find the PV of the money they will pay you in 2 years. TABLE 2 Present value interest factor of $1 per period at i% for n periods, PVIF(i,n). Period 1% 1 0.990 2 0.980 3 4 0.961 5 0.951 6 0.942 7 4% 5% 6% 2% 3% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 TABLE 4 Present value interest factor of an (ordinary) annuity of $1 per period at i% for n period: Period 19 2% 39 4% 69 7% 1 0.990 0.980 0.971 0.962 0.935 2 1.970 4 5 1.913 3 2.941 2.884 2.829 3.902 4.853 4.713 1.942 3.808 3.717 3.630 4.580 4.452 6 5.795 5.601 5.417 5.242 7 8 7.652 9 8.566 5% 8% 99 10% 1196 129 139 14% 15% 0.952 0.943 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 1.886 1.859 1.833 1.808 1.783 1.759 1.738 1.713 1.690 1.668 1.647 1.626 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 3.546 3.485 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started