Answered step by step

Verified Expert Solution

Question

1 Approved Answer

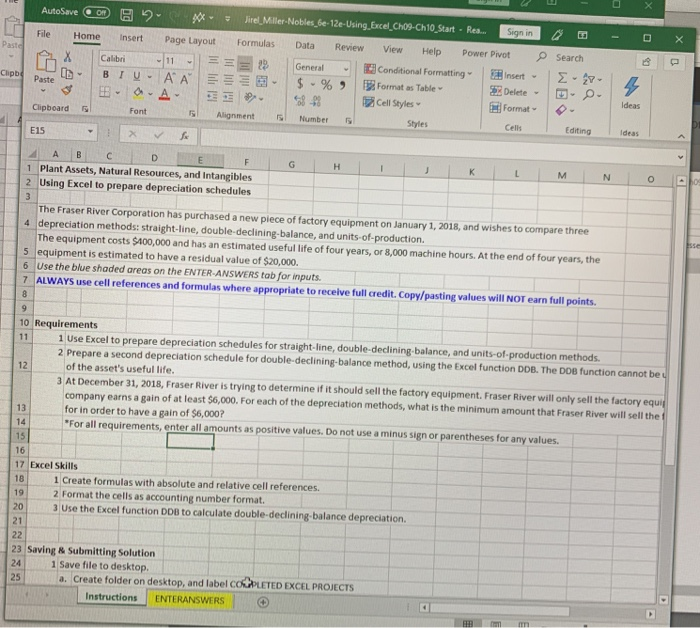

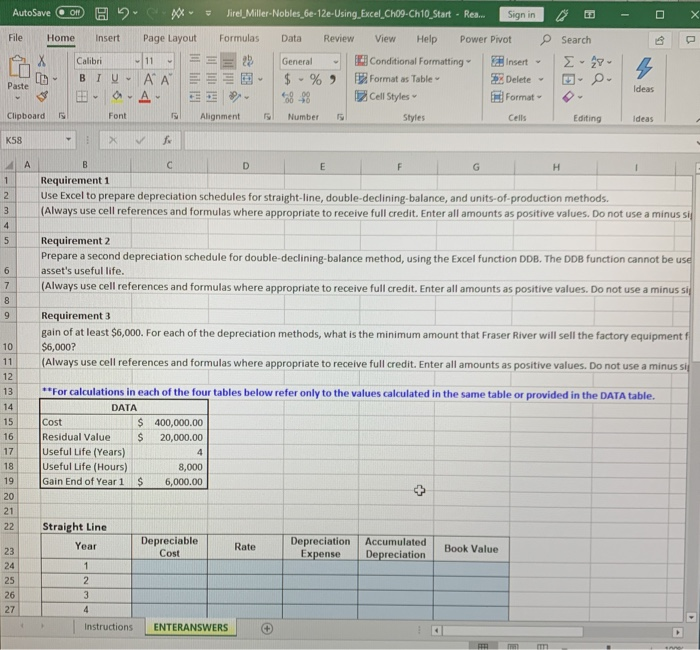

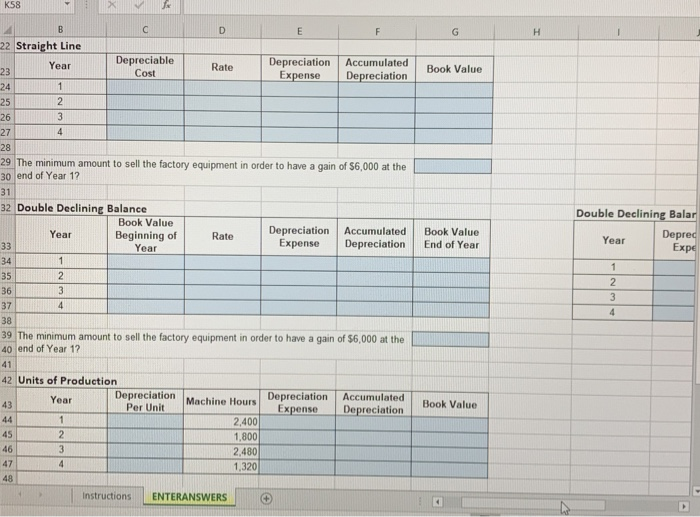

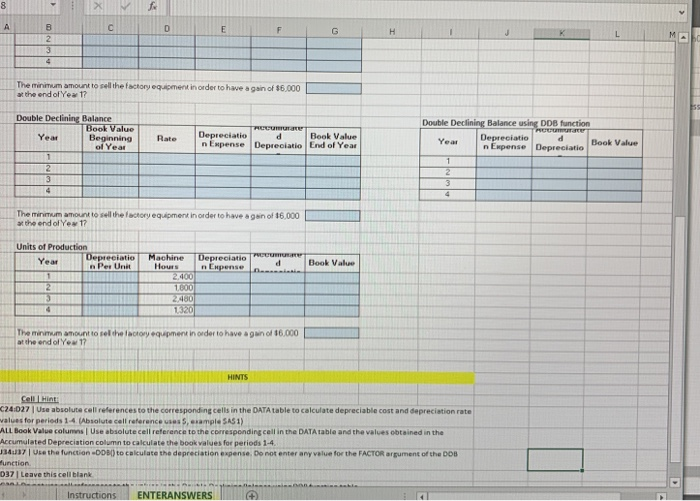

IT IS REQUIRED THAT I ENTER FORMULAS! that is what i need help with, not the numerical answers Jirel Miller-Nobles be-12e-Using Excel Ch09-Ch10 Start -

IT IS REQUIRED THAT I ENTER FORMULAS! that is what i need help with, not the numerical answers

Jirel Miller-Nobles be-12e-Using Excel Ch09-Ch10 Start - Rea. AutoSave Off Sign in X File Home Page Layout Formulas Insert Data View Review Help Power Pivot Search Paste Calibri - General Conditional Formatting 11 Insert 4 $ -% 6849 A A A Cipbe BIU BFormat as Table Delete Paste Ideas Cell Styles Format Font Clipboard Alignment Number Styles Cells Editing Ideas E15 B A F G H L K N O 1 Plant Assets, Natural Resources, and Intangibles 2 Using Excel to prepare depreciation schedules 3 The Fraser River Corporation has purchased a new piece of factory equipment on January 1, 2018, and wishes to compare three 4 depreciation methods: straight-line, double-declining-balance, and units-of-production. The equipment costs $400,000 and has an estimated useful life of four years, or 8,000 machine hours. At the end of four years, the 5 equipment is estimated to have a residual value of $20,000. 6 Use the blue shaded areas on the ENTER-ANSWERS tab for inputs. 7 ALWAYS use cell references and formulas where appropriate to receive full credit. Copy/pasting values will NOT earn full points. bse 8 9 10 Requirements 1 Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-production methods. 2 Prepare a second depreciation schedule for double-declining-balance method, using the Excel function DDB. The DDB function cannot be of the asset's useful life. 3 At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equi company earns a gain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the 11 12 for in order to have a gain of $6,000? 13 "For all requirements, enter all amounts as positive values. Do not use a minus sign or parentheses for any values. 14 15 16 17 Excel Skills 18 1 Create formulas with absolute and relative cell references. 2 Format the cells as accounting number format. 3 Use the Excel function DDB to calculate double-declining-balance depreciation, 19 20 21 22 23 Saving & Submitting Solution 1 Save file to desktop. a. Create folder on desktop, and label COLETED EXCEL PROJECTS 24 25 Instructions ENTERANSWERS the JirelMiller-Nobles Ge-12e-Using Excel_Ch09-Ch10 Start Rea.. AutoSave Off Sign in File Formulas Home Insert Page Layout Review Help Power Pivot Data View Search X Calibri 11 Conditional Formatting General Insert $ .% A A Format as Table 2Delete BIU Paste Ideas Cell Styles 8-43 Format Clipboard Font Alignment Number Styles Cells Editing Ideas K58 A C E F G H Requirement 1 Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-production methods. 1 2 (Always use cell references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not use a minus sij 4 5 Requirement 2 Prepare a second depreciation schedule for double-declining-balance method, using the Excel function DDB. The DDB function cannot be use asset's useful life (Always use cell references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not use a minus si 6 7 8 Requirement 3 gain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment $6,000? 10 (Always use cell references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not use a minus si 11 12 For calculations in each of the four tables below refer only to the values calculated in the same table or provided in the DATA table. 13 14 DATA Cost Residual Value Useful Life (Years) Useful Life (Hours) 15 $400,000.00 16 $ 20,000.00 17 4 18 8,000 Gain End of Year 1 19 $ 6,000.00 20 21 Straight Line 22 Depreciable Cost Depreciation Expense Accumulated Year Rate Book Value 23 Depreciation 24 2 25 26 3 27 Instructions ENTERANSWERS K58 C D F G H 22 Straight Line Depreciation Expense Depreciable Cost Accumulated Depreciation Year Rate Book Value 23 24 25 26 27 1 2 3 4 28 29 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the 30 end of Year 1? 31 32 Double Declining Balance Book Value Beginning of Year Double Declining Balar Depreciation Expense Accumulated Book Value Deprec Expe Year Rate Year Depreciation End of Year 33 34 1 2 35 3 36 3 4 37 38 39 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the 40 end of Year 1? 41 42 Units of Production Depreciation Expense Depreciation Per Unit Accumulated Year Machine Hours Book Value 43 Depreciation 44 1 2,400 45 1,800 46 3 2,480 1,320 47 48 Instructions ENTERANSWERS 8 A B E F G H L 2 3 4 The minimum amount to sell the factory equipment in order to have a gain of $6,000 at the end of Yea 1 Double Declining Balance Book Value Beginning of Year Double Declining Balance using DDB function RCCUmUrTe d n Expense Depreciatio End of Year Depreciatio Beok Value Year Depreciatio n Expense Depreciatio Rate Year Book Value 1 2 2 3 3 4 4 The minimum amount to sell the factory equipment in order to have a gan of 16.000 at the end of Yew 17 Units of Production re Machine Hours Depreciatio P n Expense Depreciatio n Per Unit Year Book Value di 2,400 1800 3 4 2480 1320 The minimum amount to sell thefactory equipment in order to have again of $6.000 at the end of Yew 17 HINTS Cell Hint c24:027 Use absolute cell references to the corresponding cells in the DATA table to calculate depreciable cost and depreciation rate values for periods 1-4 (Absolute cell reference uses 5,ample SAS 1) ALL Book Value columns | Use absolute cell reference to the corresponding cell in the DATA table and the values obtained in the Accumulated Deprecistion column to calculate the book values for periods 1-4 J3437 Use the function DD8) to calculate the depreciation expense. Do not enter any value for the FACTOR argument of the DDB unction 037 | Leave this cell blank nan mhin. Instructions ENTERANSWERS Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started