It is spring of 2020. Having successfully advised The Cheesecake Factory for the past several years, you are an even more trusted advisor than you

It is spring of 2020. Having successfully advised The Cheesecake Factory for the past several years, you are an even more trusted advisor than you were back in 2017. Unfortunately, 2020 is shaping up to be a particularly bad year for the world as the pandemic spreads. In a video meeting with the executive team, they again look to you for advice and direction. Sales are down dramatically. You must decide how to navigate the crisis, not knowing how severe it will be or how long it will last. The CFO asks you directly if there are other provisions in the recently enacted Coronavirus Aid, Relief, and Economic Security Act (the CARES Act) that can help the company.

In a previous meeting, you explained how the Employee Retention Credit (enacted as part of CARES) can help offset the costs of keeping the restaurant management teams on payroll despite the reduction in sales volume. In this meeting, you focus on the CARES act changes to the net operating loss rules. Specifically, you have learned that the CARES act temporarily changes the net operating loss rules to allow for net operating losses from 2018, 2019, or 2020 to be carried back up to 5 years, such that companies can get refunds of taxes paid in those years. A tax refund would provide the company with a vital cash infusion at a time when the company needs cash to pay the bills and make up for the loss of sales volume. While economic prospects for 2021 are highly uncertain in spring of 2020, you are by nature optimistic and believe that the world will adapt and prevail. If you can help the company navigate through the current crisis, you believe the odds are favorable that the company will return to profitability in 2021.

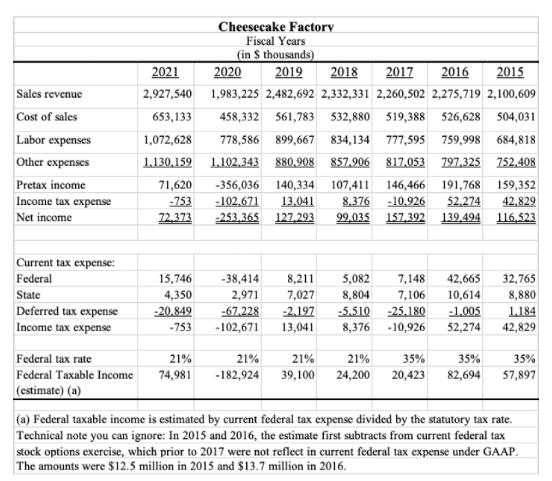

Below are key numbers from The Cheesecake Factory's financial statements from 2015 to 2021. But remember, in spring 2020, the full-year 2020 and 2021 numbers have not yet happened and depend, in part, on what you advise the company to do.

1. Is there any incentive for The Cheesecake Factory in 2020 to shift income? If so, what is the incentive?

2. How might The Cheesecake Factory shift income or expenses? Be as specific as possible.

3. What are tax benefits of the income shifting you consider?

4. What are the tax and nontax costs of the income shifting you consider?

Sales revenue Cost of sales Labor expenses Other expenses Pretax income Income tax expense Net income Current tax expense: Federal State Deferred tax expense Income tax expense Cheesecake Factory Fiscal Years (in S thousands) 2021 2020 2019 2018 2017 2016 2015 2,927,540 653,133 1,072,628 1,983,225 2,482,692 2,332,331 2,260,502 2,275,719 2,100,609 458,332 561,783 532,880 519,388 526,628 504,031 778,586 899,667 834,134 777,595 759,998 684,818 1.130,159 1.102.343 880.908 857,906 817,053 797,325 752,408 146,466 191,768 159,352 -356,036 140,334 107,411 -102,671 13,041 8,376 -10,926 52,274 -253.365 127,293 99,035 157,392 139,494 42,829 116.523 71,620 -753 72.373 15,746 4,350 -20.849 -753 Federal tax rate 21% Federal Taxable Income 74,981 (estimate) (a) 8,211 2,971 7,027 -38,414 -67,228 -102,671 5,082 7,148 7,106 8,804 -2.197 -5.510 -25.180 13,041 8,376 -10,926 21% 35% 21% 21% -182,924 39,100 24,200 20,423 42,665 32,765 10,614 8,880 -1.005 1,184 52,274 42,829 35% 82,694 35% 57,897 (a) Federal taxable income is estimated by current federal tax expense divided by the statutory tax rate. Technical note you can ignore: In 2015 and 2016, the estimate first subtracts from current federal tax stock options exercise, which prior to 2017 were not reflect in current federal tax expense under GAAP. The amounts were $12.5 million in 2015 and $13.7 million in 2016.

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 The Cheesecake Factory will have an incentive to change its revenue stream in 2020 The COVID19 pandemic is predicted to cause the business to experience a net operating loss NOL in 2020 The CARES Ac...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started