Answered step by step

Verified Expert Solution

Question

1 Approved Answer

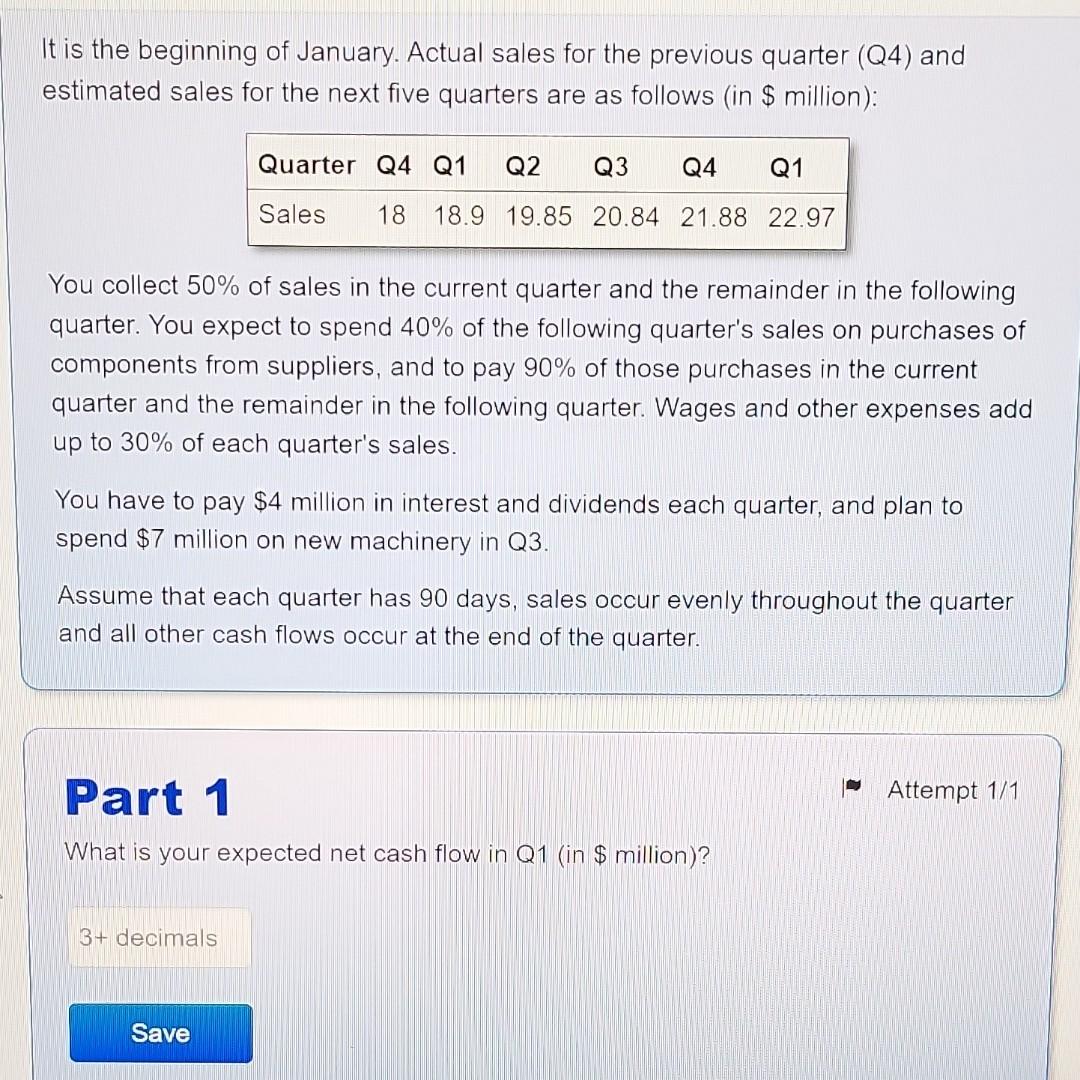

It is the beginning of January. Actual sales for the previous quarter (Q4) and estimated sales for the next five quarters are as follows (in

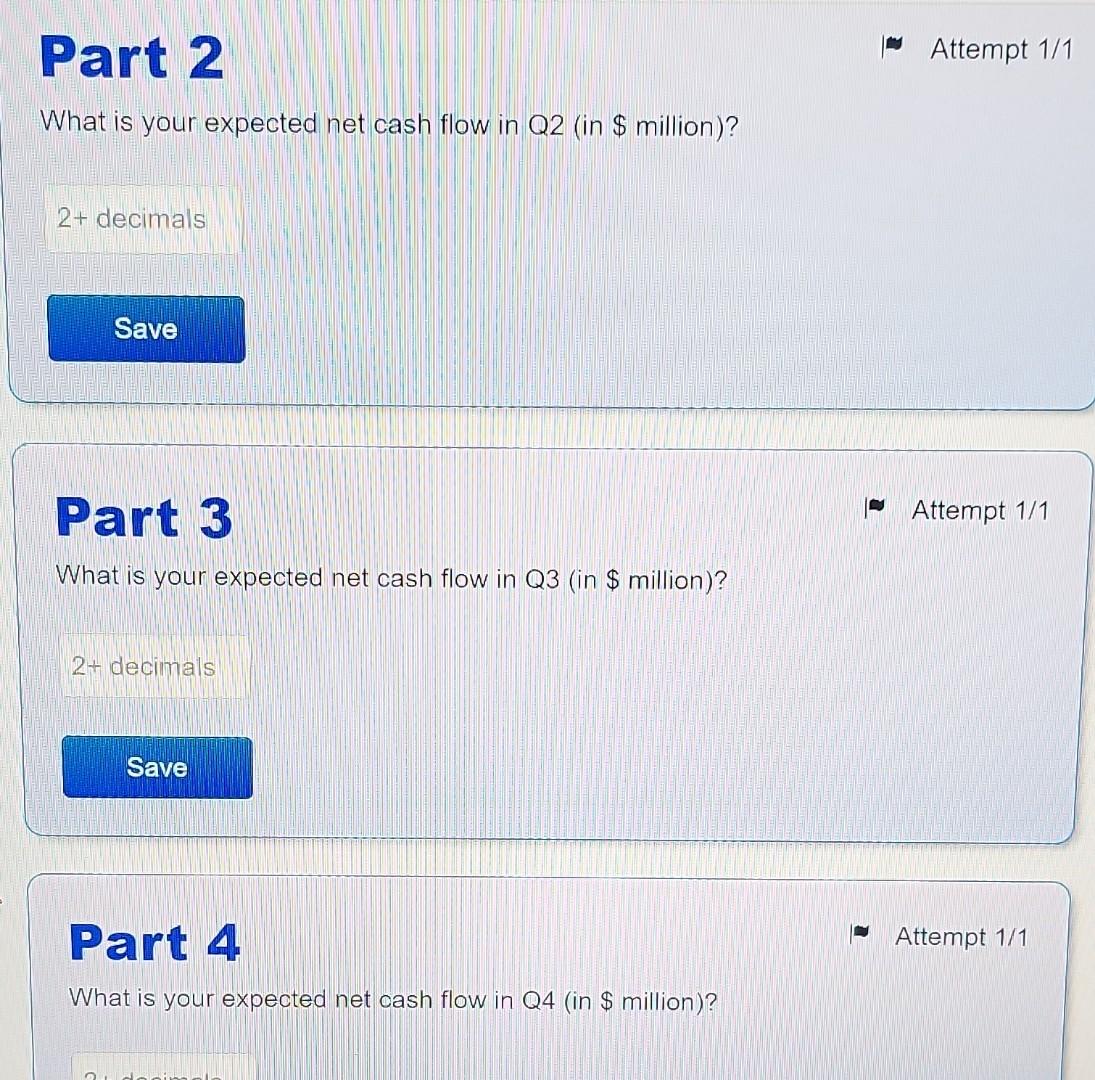

It is the beginning of January. Actual sales for the previous quarter (Q4) and estimated sales for the next five quarters are as follows (in $ million): You collect 50% of sales in the current quarter and the remainder in the following quarter. You expect to spend 40% of the following quarter's sales on purchases of components from suppliers, and to pay 90% of those purchases in the current quarter and the remainder in the following quarter. Wages and other expenses add up to 30% of each quarter's sales. You have to pay $4 million in interest and dividends each quarter, and plan to spend $7 million on new machinery in Q3. Assume that each quarter has 90 days, sales occur evenly throughout the quarter and all other cash flows occur at the end of the quarter. Part 1 Attempt 1/1 What is your expected net cash flow in Q1 (in \$ million)? 3+ decimals Part 2 Attempt 1/1 What is your expected net cash flow in Q2 (in \$ million)? Part 3 Attempt 1/1 What is your expected net cash flow in Q3 (in \$ million)? 2+decimals Part 4 Attempt 1/1 What is your expected net cash flow in Q4 (in \$ million)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started