Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is the continuation of the question before i want the solution shortly e. 1,587. f. 1,450. g 1,687. h. 2,000. Q6) Total long term

It is the continuation of the question before

i want the solution shortly

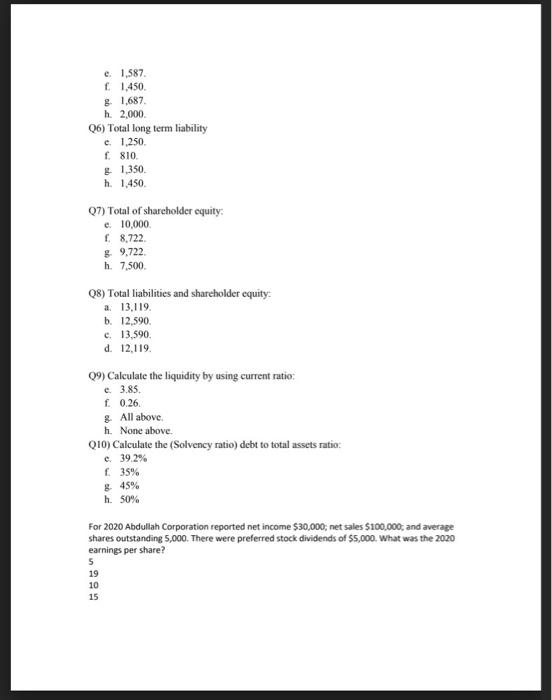

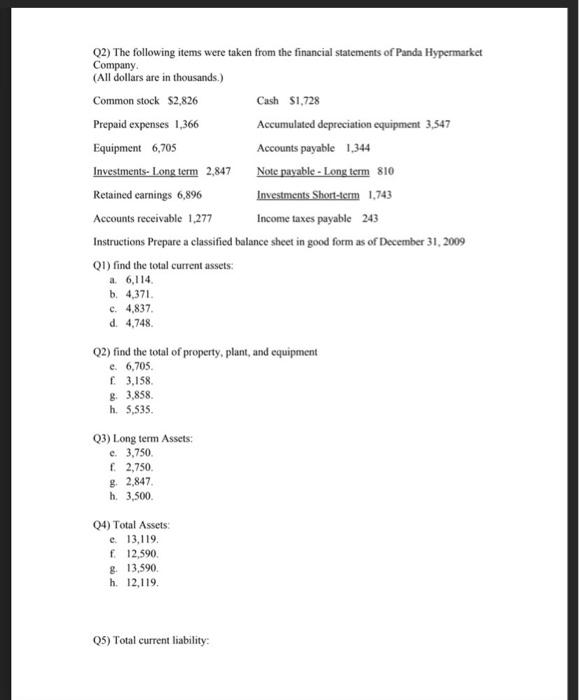

e. 1,587. f. 1,450. g 1,687. h. 2,000. Q6) Total long term liability c. 1,250. f. 810. g 1,350. h. 1,450. Q7) Total of shareholder equity: e. 10,000. f. 8,722. g. 9,722. h. 7,500. Q8) Total liabilities and shareholder equity: a. 13,119. b. 12,590. c. 13,590. d. 12,119. Q9) Calculate the liquidity by using current ratio: e. 3.85. f. 0.26. g. All above. h. None above. Q10) Calculate the (Solvency ratio) debt to total assets ratio: c. 39.2% f. 35% g. 45% h. 50% For 2020 Abdullah Corporation reported net income $30,000; net sales $100,000; and average shares outstanding 5,000. There were preferred stock dividends of $5,000. What was the 2 2020 earnings per share? 5 19 10 15 e. 1,587. f. 1,450. g 1,687. h. 2,000. Q6) Total long term liability c. 1,250. f. 810. g 1,350. h. 1,450. Q7) Total of shareholder equity: e. 10,000. f. 8,722. g. 9,722. h. 7,500. Q8) Total liabilities and shareholder equity: a. 13,119. b. 12,590. c. 13,590. d. 12,119. Q9) Calculate the liquidity by using current ratio: c. 3.85. f. 0.26. g. All above. h. None above. Q10) Calculate the (Solvency ratio) debt to total assets ratio: c. 39.2% f. 35% g 45% h. 50% For 2020 Abdullah Corporation reported net income $30,000; net sales $100,000; and average shares outstanding 5,000. There were preferred stock dividends of $5,000. What was the 2 2020 earnings per share? 5 19 10 15 Q2) The following items were taken from the financial statements of Panda Hypermarket Company. (All dollars are in thousands.) Common stock $2,826 Cash $1,728 Prepaid expenses 1,366 Accumulated depreciation equipment 3,547 Equipment 6,705 Accounts payable 1,344 Investments- Long term 2,847 Note payable - Long term 810 Retained earnings 6,896 Investments Short-term 1,743 Accounts receivable 1,277 Income taxes payable 243 Instructions Prepare a classified balance sheet in good form as of December 31, 2009 Q1) find the total current assets: a. 6,114. b. 4,371. c. 4,837. d. 4,748. Q2) find the total of property, plant, and equipment c. 6,705. 3,158. g. 3,858. h. 5,535. Q3) Long term Assets: c. 3,750. f. 2,750. 82,847. h. 3,500. Q4) Total Assets: e. 13,119. f. 12,590. g. 13,590. h. 12,119. Q5) Total current liability: Q5) Total current liability 1,587. 1,450 81,687 2,000 Q6) Total longtems liability e 1,250 $10. 1,350 h 1,450 Q7) Total of shareholder equity e. 10,000 18,722 #9,722 7,500 QS) Total liabilities and shareholder equity a 13,119 b.12.590 13,590 d. 12.119 Q9) Calculate the liquidity by using current ratio 3.85. 0.26 8. All above h Note above Q10) Calculate the (Solvency ratio) debt to total assets ratio: 39.2% 39% 30% For 2020 About Corporation reported net income $30,000, net als $100,000; and average shares outstanding 5,000. There were preferred stock dividends of 55,000. What was the 2020 eamings per share? 1 19 10 15 Q2) The following items were taken from the financial statements of Panda Hypermarket Company. (All dollars are in thousands) Common stock $2,826 Cash $1,728 Prepaid expenses 1,366 Accumulated depreciation equipment 3,547 Equipment 6,705 Accounts payable 1,344 Investments-Longterm 2,847 Note payable Leg $10Red earnings 6,196 Investments Short-term 1,743 Accounts receivable 1,277 Income taxes payable 243 Instructions Prepare a classified balance sheet in good form as of December 31, 2009 Q1) find the total current st a 6,114 b. 4,371 4,837 d. 4,748, Q2) find the total of property, plast, and equipment 6,705 3,158 3,858 h 5,535 Q3) Long term Assets 3,750 2,750 82,847 h. 3,500. Q4) Total Assets 13,119. 12,590 13,590 h. 12,119

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started