Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is the end of the third quarter, and Margaret is evaluating the performance of two key divisions in the company. Both divisions had

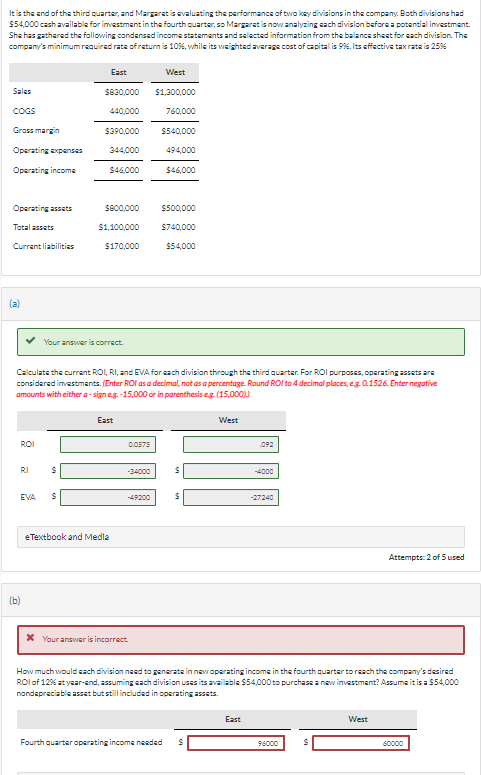

It is the end of the third quarter, and Margaret is evaluating the performance of two key divisions in the company. Both divisions had $54,000 cash available for investment in the fourth quarter, so Margaret is now analyzing each division before a potential investment. She has gathered the following condensed income statements and selected information from the balance sheet for each division. The company's minimum required rate of return is 10%, while its weighted average cost of capital is 9%. Its effective tax rate is 25% East West Sales COGS $830,000 $1,300,000 440,000 760,000 Gross margin $390,000 $540,000 Operating expenses 344,000 494,000 Operating income $46,000 $46,000 Operating assets $800,000 $500,000 Total assets $1,100,000 $740,000 Current liabilities $170,000 $54,000 (a) Your answer is correct. Calculate the current ROI, RI, and EVA for each division through the third quarter. For ROI purposes, operating assets are considered investments. (Enter ROI as a decimal, not as a percentage. Round ROI to 4 decimal places, e.g. 0.1526. Enter negative amounts with either a-sign eg.-15,000 or in parenthesis eg. (15,000)) (b) ROI East 0.0575 RI $ -34000 $ EVA $ eTextbook and Medla * Your answer is incorrect. -49200 West .092 -4000 -27240 Attempts: 2 of 5 used How much would each division need to generate in new operating income in the fourth quarter to reach the company's desired ROI of 12% at year-end, assuming each division uses its available $54,000 to purchase a new investment? Assume it is a $54,000 nondepreciable asset but still included in operating assets. East Fourth quarter operating income needed $ West 96000 S 60000

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Performance Analysis East and West Divisions I ROI RI and EVA Calculations A East Division ROI ROI Operating Income Operating Assets ROI 46000 800000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started